Simply increasing the quantity of investment in Africa will not be sufficient to achieve transformational growth, UNCTAD’s Economic Development in Africa Report 20141 argues. Increasing the productivity or quality of investment and ensuring that it goes to strategic and priority sectors of an economy – such as infrastructure, agriculture and manufacturing – are key.

Subtitled Catalysing Investment for Transformative Growth in Africa, the report says that Africa cannot achieve sustained economic growth and transformation without diversifying the sources of its economic growth both on the demand and supply sides of its economies.

The report says that Africa has experienced relatively high growth during the past decade but the nature and pattern of this growth has not resulted in more jobs and poverty reduction because consumption has been the dominant driver. Instead, the report says, a consumption-based growth strategy must go hand-in-hand with an increase in investment, particularly that which increases the capacity to produce tradable goods, to reduce the likelihood of current account imbalances in the future.

On the demand side, the report recommends balancing the relative contributions of consumption and investment to the growth process since it is evident that a consumption-based growth strategy cannot be sustained in the medium to long term. This is because it often results in economic challenges such as overdependence on imports that in turn affects the development and survival of local industries, the building of productive capacities and job creation.

In order to reverse the current account imbalances associated with high consumption, countries often require drastic reductions in consumption that then have a severe negative impact on growth, the report notes.

The role of investment in the growth process needs to be enhanced, particularly given the very low investment rates observed in Africa relative to investment requirements, the report asserts. This is because recent evidence suggests that investment is a major driver of long-run growth in Africa and that current-account deficit reversals that are caused by investment booms which increase the production capacity for tradable goods are associated with better growth performance than those driven by consumption booms.

On the supply side, the report recommends that sources of growth also be diversified, requiring a shift from low- to high-productivity activities, both across and within sectors.

The report shows that structural problems exist with Africa’s recent growth from a supply or sectoral perspective, with many countries yet to go through the normal process of structural transformation, characterized by a shift from low- to high-productivity activities, and a declining share of agriculture in output and employment, as well as an increasing share of manufacturing and modern services in output.

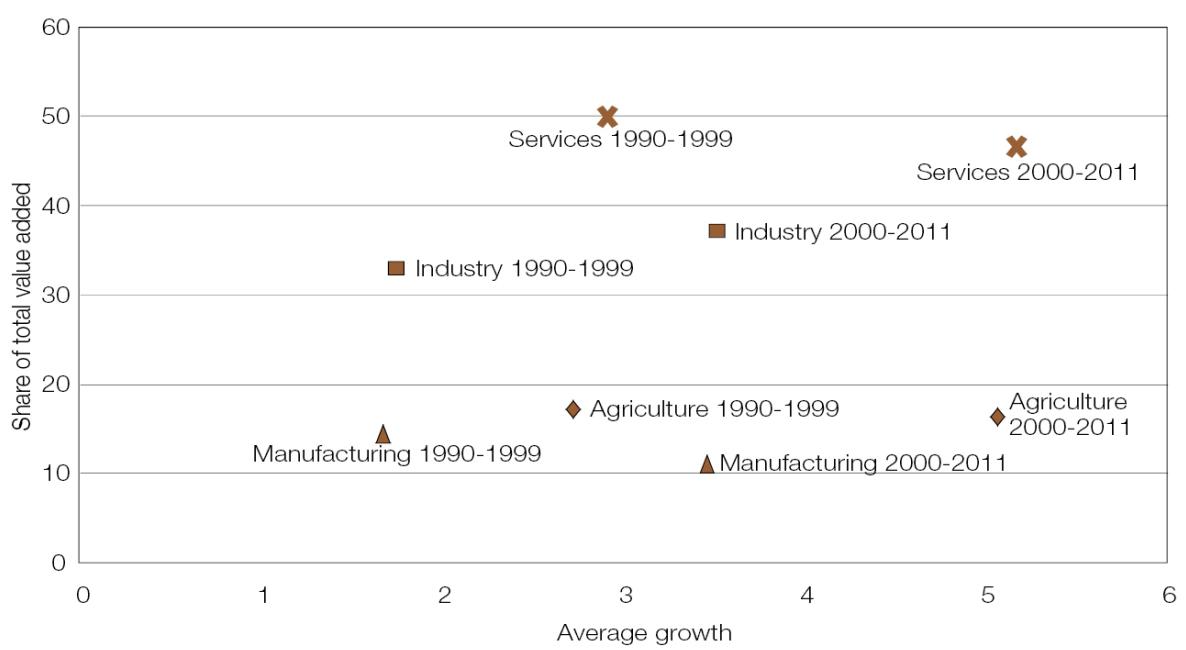

Available data indicate the share of manufacturing in total value added has declined over the past two decades, showing an average fall from 14 per cent in 1990–1999 to 11 per cent in 2000–2011.

Furthermore, the services sector is now dominant in Africa’s economies. Its share of total value added in 2000–2011 was about 47 per cent, compared to 37 per cent for industry and 16 per cent for agriculture. In terms of dynamics, over the same period the services sector had an average growth rate of 5.2 per cent while agriculture had 5.1 per cent and industry, 3.5 per cent (see figure).

This pattern of structural change in Africa is unexpected given that the continent remains at an early stage of development, the report contends. It is unusual for the services sector to play such a dominant role in an economy in the early stages of its development.

The dominance of the services sector should be of concern, the report says, because it is driven mostly by low-productivity activities such as informal and non-tradable services. This suggests that Africa’s recent growth is fragile and is unlikely to be sustained in the medium to long term.

While the national development plans, visions or frameworks of most African countries identify infrastructure, agriculture and manufacturing sectors as strategic and/or give them priority, commercial banks and financial institutions in Africa are generally reluctant to finance projects in them, preferring to lend to the non-production sectors. Indeed, one of the challenges facing Governments in Africa is how to promote investment in strategic or priority sectors by redirecting financial resources to them.

The report argues that industrial policy has an important role to play in achieving this goal and suggests that central banks can encourage lending to strategic sectors through adopting financing policies that favour lending to these sectors.

One way to redirect investment to strategic sectors, particularly in the case of small and medium-sized enterprises, is to encourage financial institutions to use the flow of remittances as collateral for small and medium-sized enterprises seeking finance for productive investments.

The establishment of partial credit guarantee schemes can also increase the flow of funds to strategic sectors and groups such as small and medium-sized enterprises. There are also non-financial measures that Governments can take to promote investment in the strategic sectors, one of which is the provision of market information and investment opportunities available in those sectors, the report concludes.

Growth rates and shares of sectors in Africa’s total value added, 1990–2011

Source: UNCTAD.

Full report:http://unctad.org/en/PublicationsLibrary/aldcafrica2014_en.pdf