Eighty-five per cent of newly adopted investment policy measures in 2015 were addressed towards investment liberalization and promotion, the UNCTAD World Investment Report 2016 has found, with the remaining 15 per cent of new investment measures featuring restrictions or regulations, mainly reflecting concerns about foreign ownership in strategic industries or national security considerations.

The report, subtitled Investor Nationality – Policy Challenges, says that entry requirements for foreign investment were eased or eliminated in a broad range of industries such as aviation, financial services, mining and real estate. Some countries pursued privatization policies, improved business licensing procedures or provided other forms of investment incentives. Another noteworthy feature was the adoption or revision of investment laws, mainly in some African countries.

Where restrictions or regulations have been introduced for national security and related reasons, the report suggests finding a balance with the interests of investors, for transparent and predictable procedures.

Meanwhile, the international investment agreement universe grew to 3,304 agreements by the end of 2015, with the addition of 31 new ones, the report says. Treaty making included major mega-regional initiatives, such as the concluded Trans-Pacific Partnership and the Transatlantic Trade and Investment Partnership, which is still under negotiation.

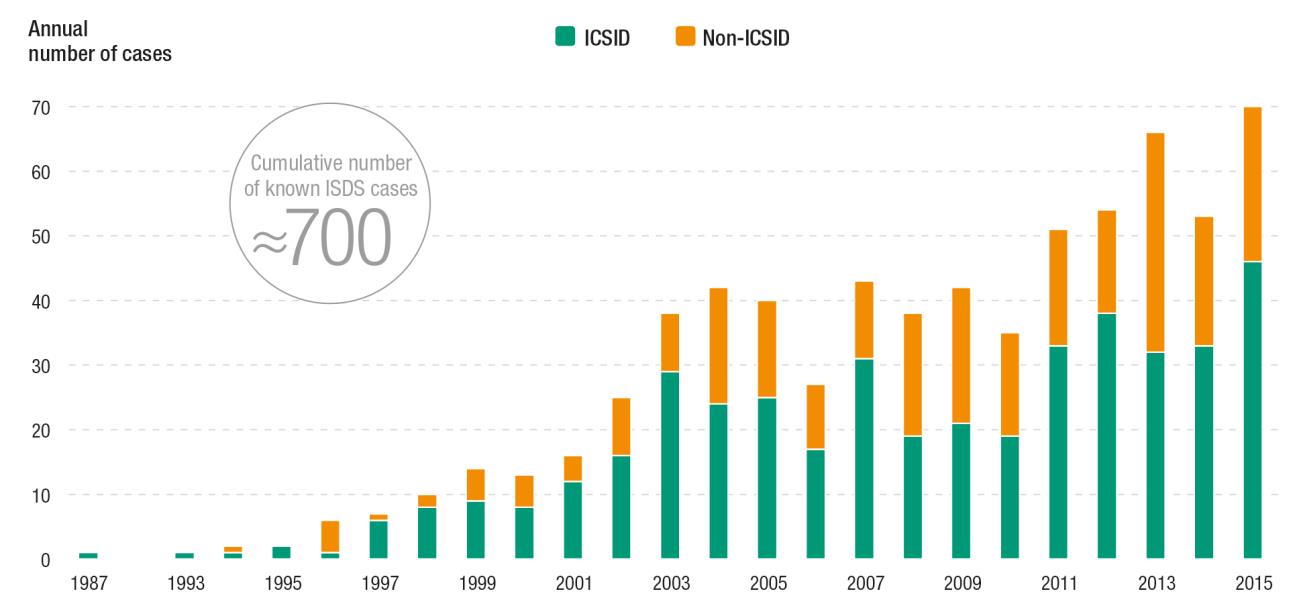

New investor–State dispute settlement cases amounted to 70 in 2015 – an all-time annual high. As of 1 January 2016, the total number of publicly known investor–State dispute settlement claims had reached almost 700, involving more than 100 countries, the report says.

Reform to bring the international investment agreement regime in line with today’s sustainable development imperative is gaining momentum at the national, bilateral, regional and multilateral level, as new treaty models are adopted and a set of new generation treaties, signed. The report says that international investment agreement reform will require countries to intensify collaboration and coordination. The UNCTAD World Investment Forum 2016, to be held in Nairobi from 17–21 July 2016, offers an opportunity to discuss how to carry that reform to the next phase.

The report also underlines that facilitating investment is crucial for the 2030 Agenda for Sustainable Development and calls for more proactive investment facilitation at the national and international level to fill a gap in the existing policy regime. The UNCTAD global action menu for investment facilitation and promotion provides specific guidance and more than 40 action lines, on how to make investment facilitation an integral part of the overall investment policy framework, aimed at maximizing the benefits of investment for sustainable development.

Trends in international investment agreements signed, 1980–2015

Source: UNCTAD, World Investment Report 2016.

Abbreviations: IIAs, international investment agreements; BITs, bilateral investment treaties; TIPs, treaties with investment provisions.

Known investor–State dispute settlement cases, annual and cumulative, 1987–2015

Source: UNCTAD, ISDS Navigator.

Abbreviations: ISDS, investor–State dispute settlement; ICSID, International Centre for Settlement of Investment Disputes.

Note: Information about 2015 claims has been compiled on the basis of public sources, including specialized reporting services. UNCTAD statistics do not cover investor–State cases that are based exclusively on investment contracts (State contracts) or national investment laws, or cases in which a party has signalled its intention to submit a claim to ISDS but has not commenced the arbitration. Annual and cumulative case numbers are continuously adjusted as a result of verification and may not exactly match case numbers reported in previous years.

Report: http://unctad.org/en/PublicationsLibrary/wir2016_en.pdf

Overview: http://unctad.org/en/PublicationsLibrary/wir2016_Overview_en.pdf

Country Factsheets: http://unctad.org/en/Pages/DIAE/World%20Investment%20Report/WIR-2016-Country-Factsheets.aspx