Foreign direct investment (FDI) flows to Latin America and the Caribbean fell by 14 per cent to $142 billion in 2016, their fifth straight year of decline, according to UNCTAD's World Investment Report 2017.

The difference in investment trends between the north and south of the region observed in 2015 disappeared in 2016, with all subregions registering declines. FDI inflows in South America retreated 14 per cent to $101 billion, reflecting the impact of economic recession, weak commodity prices and higher currency volatility.

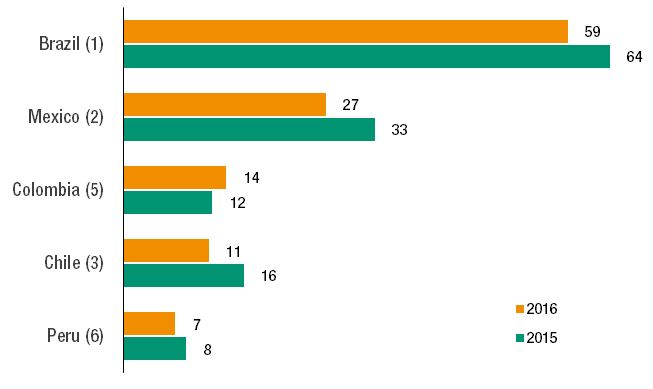

Flows to Brazil, the region’s principal recipient of FDI, fell by 9 per cent to $59 billion, weighed down by a sharp decline in the services sector. FDI also retreated in a number of South America’s exporters of non-renewable natural resources, including in Bolivia (Plurinational State of), Chile, Ecuador and Peru.

In Central America, inflows also fell by 14 per cent to $38 billion, as gross fixed capital formation and export trade volumes slowed down during the year. FDI flows to Mexico fell sharply, by 19 per cent to $27 billion, as investment in the services sector declined. Flows to most of Mexico’s manufacturing industry also retreated, especially in automotive manufacturing.

Flows to the Caribbean, excluding financial centres, likewise dipped by 9 per cent to $3 billion, though with significant variation at the country level. A rise in FDI flows to the Dominican Republic, up 9 per cent to $2 billion, was unable to offset declines in Jamaica and Trinidad and Tobago.

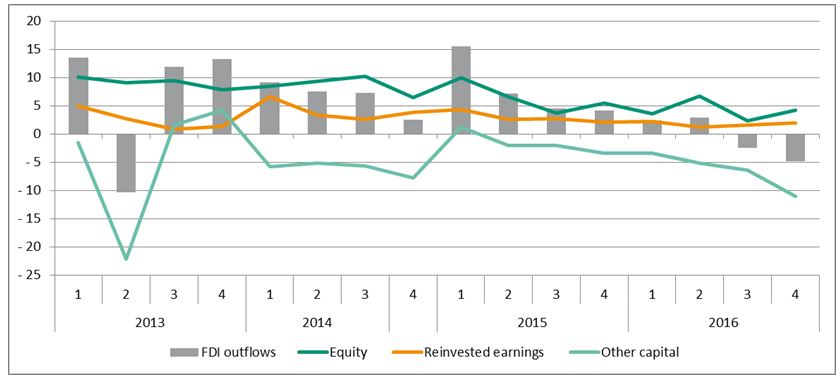

FDI outflows by the region’s multinational enterprises (MNEs) fell a staggering 98 per cent to reach just $751 million. This was due to strong changes in intra-company lending flows that pushed overall outward investment into net divestment of foreign assets in Brazil and Mexico. Intra-group financing flows were also strongly impacted by a large increase in reverse investment in debt instruments, as foreign affiliates funnelled capital raised in corporate debt markets back to their Latin American parents (figure 2).

FDI prospects for Latin America and the Caribbean in 2017 remain muted. Economic growth is projected to remain well below the rates that were associated with higher inflows in previous years. In particular, investment in the region’s extractive sector is likely to remain modest. Greenfield FDI project announcements for the sector in 2016 were only $4 billion, as operators continue to strengthen their balance sheets and restructure their capital expenditure plans. FDI to the region is also likely to be affected by uncertainties about economic policymaking in the United States.

Figure 1. Top 5 recipients of FDI flows in Latin America and the Caribbean, 2015 and 2016*

(Billions of dollars)

Source: UNCTAD, World Investment Report 2017.

* (X)= 2015 ranking

Figure 2. FDI outflows from Latin America and the Caribbean, by component, 2013 Q1-2016 Q4

(Billions of dollars)

Source: UNCTAD, World Investment Report 2017.