Unregulated finance remains at the heart of today’s hyperglobalized world, and the failure to tame it and address the deep-seated inequalities it has generated threatens efforts to build inclusive economies, a United Nations report says.

The UNCTAD Trade and Development Report 2017: Beyond Austerity – Towards a Global New Deal underlines that, despite all the talk of the urgency of reform at the time of the financial crisis, and recent claims that the financial system is safer, simpler and fairer, regulatory actions have so far done little more than clip the wings of high-flying finance, with lending now somewhat backed by capital and a bit less trading in the shadows.

“The public purse was used generously to prevent the financial sector going under in 2007/08, but the root causes of financial instability have not been addressed by national Governments or on a global scale,” said UNCTAD Secretary-General Mukhisa Kituyi.

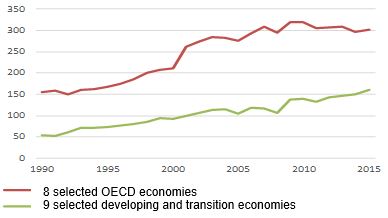

Looking back over the past decades, the grip of finance over entire economies has intensified, as shown by multiple indicators. Total banking sector assets since the 1990s have more than doubled in most countries, with peaks at over 300 per cent of gross domestic product (GDP) in some Organization for Economic Cooperation and Development (OECD) economies (figure 1). The Trade and Development Report 2017 estimates that banking in developed countries is a $100 trillion sector, which now exceeds global income. Similarly, trends for developing and transition economies are showing peaks above 200 per cent of GDP in some cases.

A shaky global financial system

The degree of bank concentration remains alarmingly high, a theme highlighted across this year’s report. In many countries, the globally consolidated balance sheets of the top five banks are greater than national income. For many economies, the external asset and liability positions of their domestic sectors are also greater than their GDP. “This is a shaky state for the global financial system,” Dr. Kituyi said.

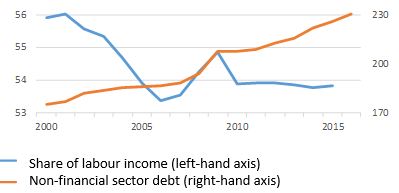

Financialization has been accompanied by the rise of indebtedness across the non-financial sector, increasing to 188 per cent of global GDP prior to the crisis. Despite the debt-driven growth model ending disastrously in 2008, this trend reached a record 230 per cent of GDP in 2016. With household debt rising and the wage share moving in the opposite direction (figure 2), the links between indebtedness and insecurity are increasingly difficult to ignore.

Income inequality widens still further

The report discusses how these trends are closely related, with inequality worsening. It shows that the income gap between the top 10 per cent and the bottom 40 per cent has widened in the run up to four out of five financial crises across the world since the late 1970s. And in their aftermath, inequality continued to rise in two thirds of the cases. The mechanisms are complex and vary from country to country, but put succinctly, the story is: the “great escape” of top incomes breeds underconsumption, private debt and speculative investment in a context of enhanced capture of regulatory agendas, making the financial system more vulnerable, hence the crises. And in the recovery process, the poor bear the consequences of adjustment as they lose income and employment amid austerity policies.

Figure 1: Financialization: Total banking assets

(Percentage of GDP)

Source: UNCTAD secretariat.

Note: Selected OECD economies include France, Germany, Italy, Japan, the Republic of Korea, Spain, the United Kingdom and the United States of America. Selected developing and transition economies include Brazil, Chile, China, India, Mexico, the Russian Federation, South Africa, Thailand and Turkey.

Figure 2: Non-financial sector debt versus labour income share

(Percentage of GDP)

Source: UNCTAD secretariat.

Note: See figure 1 for list of selected economies.

Press Release

For use of information media - Not an official record

UNCTAD/PRESS/PR/2017/031

Geneva, Switzerland, 14 September 2017