Foreign direct investment (FDI) flows to the transition economies of South-East Europe, the Commonwealth of Independent States (CIS) and Georgia surged by 81 per cent to $68 billion in 2016, reveals data from UNCTAD's World Investment Report 2017.

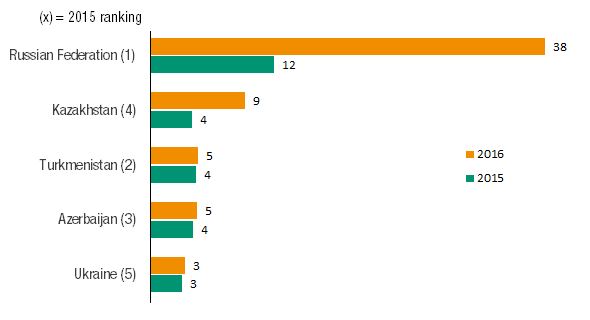

The performance of the two transition subgroups differed substantially. Flows to the CIS and Georgia almost doubled to $63 billion, supported by strong rises to Kazakhstan and the Russian Federation, while FDI in South-East Europe fell by 5 per cent to $4.6 billion. The top recipients of foreign direct investment were the Russian Federation, followed by Kazakhstan, Turkmenistan, Azerbaijan and Ukraine (figure 1).

In the Russian Federation, FDI tripled to $38 billion, as the economy outperformed expectations, partly due to firmer oil prices. Equity investment recovered from a negative $400 million in 2015 to a positive $19 billion. A surge of reinvested earnings by established investors, from $11 billion to $18 billion in 2016, also supported the rise of FDI. Despite the surge, inflows to the country were still only half of the 2008 record of $76 billion. The doubling of FDI flows to Kazakhstan was associated with a strong increase in mining exploration activities and interest by new investors.

Some South-East European countries avoided the general downward trend. Flows to Albania, Bosnia and Herzegovina and the former Yugoslav Republic of Macedonia all rose. In Albania and Serbia, Chinese investors emerged as new sources of foreign investment.

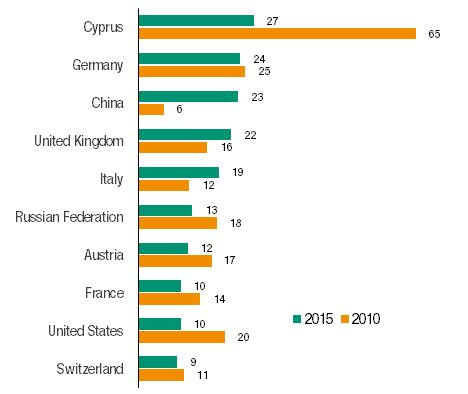

There is a shift in the geographical sources of FDI in transition economies, with Chinese investors gaining prominence. Between 2010 and 2015, the FDI stock of Chinese multinationals in the region increased almost four times, from $6 billion to $23 billion, establishing China as the third most important home country for FDI (figure 2). The FDI stock of all other source countries, except the United Kingdom, declined. Cyprus, the traditionally dominant hub for both inward and outward FDI of transition economies, saw a fall of close to 60 per cent in its FDI stock in the region (from $65 to $27 billion).

FDI outflows from the transition economies declined by 22 per cent to $25 billion, their lowest level since 2005. They increased by 1 per cent in the Russian Federation, the group's dominant outward investor, from $27.1 to $27.3 billion, but turned largely negative in Kazakhstan, due to reverse intra-company loans.

The prospects for foreign direct investment in the region are moderately optimistic. In 2016, large greenfield projects were announced in manufacturing and services, signalling a revival of investors' interest. However, the prospects for FDI in the Russian Federation remain subdued. Import substitution strategies in the country could offer possibilities for new players, but those strategies are benefitting more locally owned producers, and less foreign direct investment. Privatization could also unlock foreign direct investment opportunities in some economies, such as the Russian Federation, Ukraine and the countries of South-East Europe. Regional cooperation plans aimed at attracting investment to South-East Europe were initiated under the umbrella of the Central European Free Trade Area and are expected to support FDI in the region.

Figure 1. Top 5 recipients of FDI inflows in Transition economies, 2015 and 2016

(Billions of dollars)

Source: UNCTAD, World Investment Report 2017.

Figure 2. Top 10 investor economies in transition economies, 2010 and 2015

(Billions of dollars)

Source: UNCTAD, World Investment Report 2017.

Note: Numbers presented in this figure are based on the FDI stock data of partner countries

Press Release

For use of information media - Not an official record

UNCTAD/PRESS/PR/2017/016 Foreign Direct Investment To Transition Economies Surged By 81 Per Cent In 2016, Says UN Report

Geneva, Switzerland, 7 June 2017