UNCTAD estimates show that in the third quarter of 2021 world trade continued its strong recovery from the COVID-19 pandemic – albeit unevenly across countries and sectors.

© aerial-drone

The value of world imports and exports of goods hit $5.6 trillion in the third quarter of 2021, setting a new quarterly record, according to an UNCTAD report published on 30 November.

New projections in the November edition of the organization’s Global Trade Update show trade in goods and services reaching $28 trillion for the year – an increase of 23% on 2020 and 11% compared with pre-COVID-19 levels.

But trade’s overall strong performance masks that the recovery has been uneven across countries and sectors, the report says.

“The positive trend for international trade in 2021 is largely the result of the strong recovery in demand due to subsiding pandemic restrictions, economic stimulus packages, and increases in commodity prices,” it says.

It also warns that the forecast for 2022 remains very uncertain.

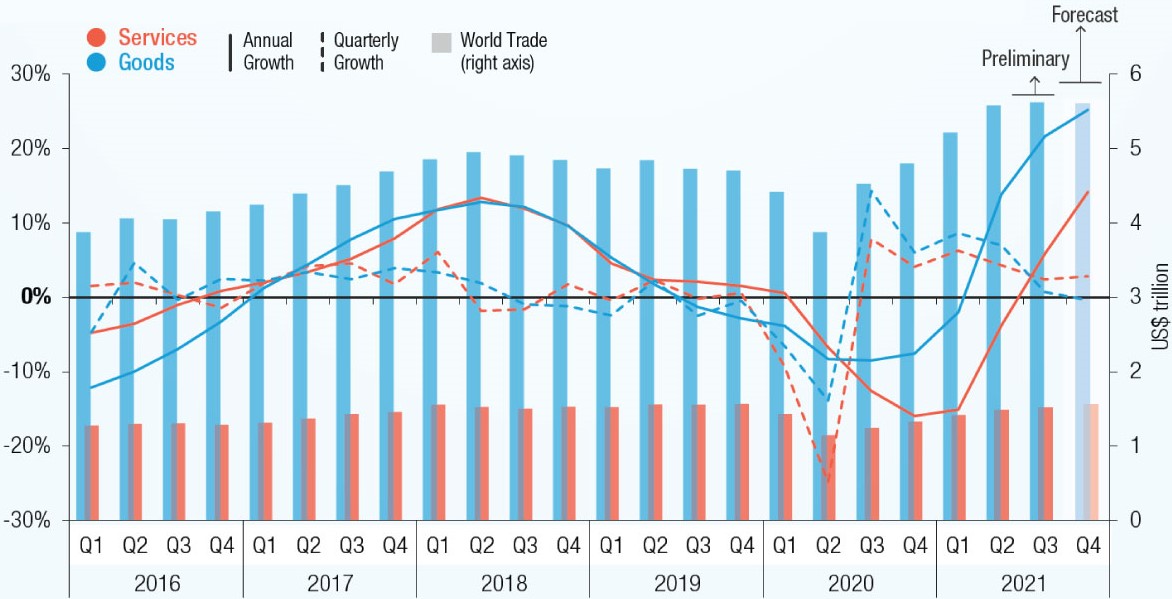

Figure: World trade to continue recovering during 2021

Source: UNCTAD calculations based on national statistics.

Note: Quarterly growth is the quarter over quarter growth rate of seasonally adjusted values. Annual growth refers to the last four quarters. Figures for Q3 2021 are preliminary. Q4 is a nowcast.

Remarkable yet uneven

Although the services sector picked up in line with the overall growth, trade in services, such as tourism, will remain slightly below pre-pandemic levels at $6 trillion in 2021.

Among the manufacturing sectors, trade in energy-related products grew the most, buoyed by high demand for and increases in the price of fossil fuels. Meanwhile, trade was more muted during the third quarter of 2021 in some sectors affected by the global shortage of semiconductors, such as the automotive industry and electronics.

From a regional perspective, trade growth also remained uneven in the third quarter of the 2021, even if the regional differences were less pronounced than in the first half of the year.

Trade flows continued to increase more strongly for developing countries in comparison to developed economies, the report says, highlighting that this trend had become more general.

“While this trend was driven by strong trade growth in East Asian developing economies in previous quarters, it has become broader across developing countries in Q3 2021,” it says. “Furthermore, in Q3 2021 trade growth has been relatively lower for East Asian economies than for other developing countries.”

The report noted that, for example, India’s trade growth had accelerated in third quarter for both in goods and services, while China’s remained relatively constant, “albeit at already high levels.”

Uncertainty ahead

Among the factors contributing to uncertainty about next year, the report cites China’s “below expectations” growth in the third quarter of 2021.

“Lower-than-expected economic growth rates are generally reflected in more downcast global trade trends,” it says, while pointing to “inflationary pressures” that may also negatively impact national economies and international trade flows.

The UNCTAD Global Trade Outlook also noted that “many economies, including those in the European Union”, continue to face COVID-19-related disruptions that could affect consumer demand next year.

In addition, the report warns that the large and unpredictable swings in demand that marked 2021 and led to increased stress on supply chains and spiralling shipping costs could continue into the next year.

“In particular,” it says, “the backlogs across major supply chain hubs that have characterized most of 2021 could continue into 2022 and therefore negatively affect trade and reshape trade flows across the world.”

Geopolitical factors could play a role in changing trade patterns, as regional trade within Africa and within the Asia-Pacific area increase, “diverting trade away from other routes”.

The report also highlights the risk of a continued shortage of semiconductors.

“Since the onset of the COVID-19 pandemic, the semiconductor industry has been facing headwinds due to unanticipated surges in demand and persisting supply constraints...If persistent, this shortage could continue to negatively affect production and trade in many manufacturing sectors.”