Foreign direct investment (FDI) flows to structurally weak, vulnerable and small economies declined in 2016, according to UNCTAD’s World Investment Report 2017, although some groups were less affected than others. Flows to least developed countries (LDCs) retreated strongly, by 13 per cent, to $38 billion, flows to landlocked developing countries (LLDCs) slipped by 2 per cent, to $24 billion, while small island developing States (SIDS) saw inflows shrink by 6 per cent, to $3.5 billion.

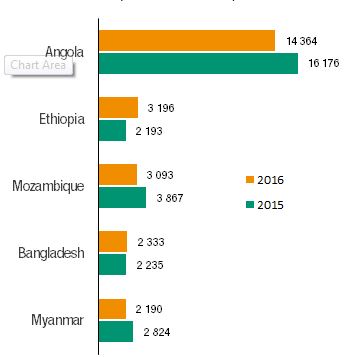

FDI flows to the 48 least developed countries1 fell to a seven-year low. FDI to commodity-rich LDCs in Africa, notably Angola, Mozambique and Zambia, continued to decline, and flows to Asian LDCs slowed after a record year in 2015. The five largest FDI recipients were Angola (attracting nearly 40 per cent of the total in LDCs), then Ethiopia, Mozambique, Bangladesh and Myanmar (figure 1).

Investors from developing economies, led by China, continue to actively expand into LDCs.

Foreign direct investment to LDCs is expected to recover in 2017. Although LDCs have the potential to attract more investment in manufacturing and services, investments related to oil and gas will continue to drive overall FDI inflows in the future.

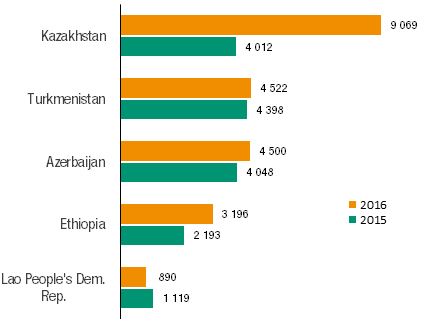

After a sharp fall in 2015, FDI flows to the 32 landlocked developing countries (LLDCs)2 declined marginally in 2016. The five largest recipients were Kazakhstan, followed by Turkmenistan, Azerbaijan, Ethiopia and the Lao People's Democratic Republic and accounted for more than 90 per cent of the group's total (figure 2). LLDCs remain marginal in the global foreign direct investment scene, accounting for less than two per cent of the world’s inflows. The dynamics of inflows varied across regions and host economies. FDI grew in transition economies, especially in Kazakhstan, as well as in Ethiopia, where inflows rose for a fourth consecutive year; by contrast, flows to Mongolia fell.

In LLDCs, investment is shifting towards activities such as infrastructure and manufacturing, helping to mitigate these countries’ geographical disadvantage. Investors from developing economies, particularly China, account for a growing share of the foreign direct investment to the group.

“There is a cautious optimism for the prospects for future flows to these countries. A continued recovery hinges very much on the evolution of both commodity prices and political issues,” said UNCTAD Secretary-General Mukhisa Kituyi.

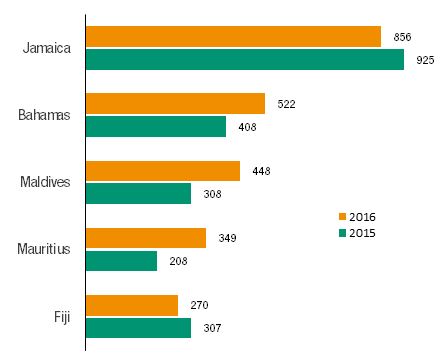

The already fragile FDI flows to small island developing States3 fell further in 2016, representing merely 0.2 per cent of global flows. Although FDI bounced back in some leading host economies, most economies saw a continued decline. The five largest recipients, Jamaica, followed by the Bahamas, Maldives, Mauritius and Fiji, accounted for 70 per cent of the group’s total (figure 3). Developing economies accounted for seven of the top 10 investors in SIDS, although the developed economies of Canada and the United States were the top investors by a wide margin.

In the absence of any new large-scale projects in the extractive industries, the prospects for attracting more foreign direct investment to SIDS remains dim. There is a growing importance to FDI between developing countries, and South-South FDI and non-equity modes of investment are both rising in the small island developing States.

Figure 1. LDCs: Top 5 recipients of FDI inflows, 2015 and 2016

(Millions of dollars)

Source: UNCTAD, World Investment Report 2017.

Figure 2. LLDCs: Top 5 recipients of FDI inflows, 2015 and 2016

(Millions of dollars)

Source: UNCTAD, World Investment Report 2017.

Figure 3. SIDS: Top 5 recipients of FDI flows, 2015 and 2016

(Millions of dollars)

Source: UNCTAD, World Investment Report 2017.