Having avoided a deep depression, stabilized financial markets and recovered the ground lost during the crisis years, there is a growing belief in some policy circles that the global economy is back to normal. The suggestion is that by maintaining tight fiscal policy, making labour markets even more flexible and using active monetary policies to address shocks and cyclical problems, steady growth and stable prices will prevail. The approach relies on buoyant asset prices, trade competitiveness and declining wage shares to maintain growth – but the UNCTAD Trade and Development Report, 20141 : Global governance and policy space for development suggests that it can’t bring the world economy back to robust health.

Sluggish growth, weak employment conditions, high household indebtedness and persistently high levels of inequality are neither new nor normal. Rather, the report insists that the main problems in the post-crisis period are insufficient aggregate demand and continuing financial instability, and that both of these issues reflect policy choice.

To offer a credible policy alternative, UNCTAD economists have used their own global model to consider the potential impact of a coordinated package of fiscal, monetary, industrial and trade policies described in this year’s report. The model divides up the world economy into 25 countries and groups and evaluates growth patterns, trade, employment and financial performance in the public and private sectors and also allows a role for international financial flows.

The alternative policy scenario entails growth-enhancing fiscal policies, including public investment, income policies to support demand growth on a sustainable basis and industrial policies to promote investment. It also includes development-oriented trade agreements that would support these policies in developing countries, as well as regulation of finance and capital controls to limit the likelihood of financial shocks.

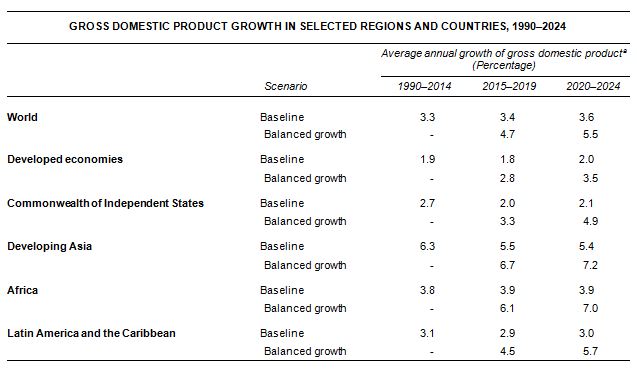

The growth outcomes from the baseline, “business-as-usual” scenario and the alternative scenario are compared for the world economy and the main regions in the table below. The alternative scenario shows considerable improvements, in part thanks to strong feedback and synergies from coordination of pro-growth policies. Also, the report notes that global imbalances would be more effectively corrected against an expansionary backdrop in the alternative scenario. Thus, the growth performance of the baseline itself is increasingly vulnerable to the threat of future financial shocks, which are known to be triggered by rising macrofinancial imbalances and overindebtedness.

Expanding policy space: A common agenda

The report recognizes that making the alternative scenario a reality requires a careful examination of the policy space available to developed and developing countries alike. The instruments available to policymakers and the room to use them reflect a complex mixture of rules, restraints and norms at the national and international levels. However, in recent years concerns have been raised that various legal obligations emerging from multilateral, regional and bilateral agreements have unduly restricted policy space, particularly for developing countries. These have also compounded tightening constraints on policy resulting from the reach and strength of global firms and markets.

The report insists that there is always give and take on policy space in an interdependent world economy made up of sovereign States of unequal economic and political strength. But the governance arrangements that have evolved under finance-led globalization have given too much leeway to private corporations and taken too much from the space for government action. It was initially hoped that the global financial crisis would provide the political motivation to correct this, but reforms have been stymied. In light of the big policy challenges facing advanced and emerging economies, it is important that policy space be made a central issue on the global development agenda.

a Data refer to purchasing power parity in constant 2005 international dollars.

Better coordination of policies is essential

The simulation results from UNCTAD’s modelling exercise underscore the need for policy consistency and macroeconomic coherence. In an increasingly interconnected global economy, policies have to be reasonably consistent for the world as one whole. More specifically, when considering policy options, a seemingly good policy for one country in isolation may turn out to be a bad choice after “fallacy of composition” effects are properly estimated.

Examples abound: one country’s wage cuts to boost competitiveness is another country’s dwindling export opportunities, a trade surplus for one economy means sucking demand out of another, a liquidity injection by one central bank to boost employment can mean an emerging bubble for another to manage, and so on.

It is therefore essential, the report insists, that efforts to devise a more effective set of globally inclusive institutions to regulate markets help correct unsustainable imbalances when they emerge and give better support for global prosperity with a willing bias to help countries that are lower down the development ladder.

Full report: http://unctad.org/en/PublicationsLibrary/tdr2014_en.pdf