Regulatory and policy shortcomings stifle Africa’s capacity to capitalize on the potential of its services sector, the UNCTAD Economic Development in Africa Report 20151 argues.

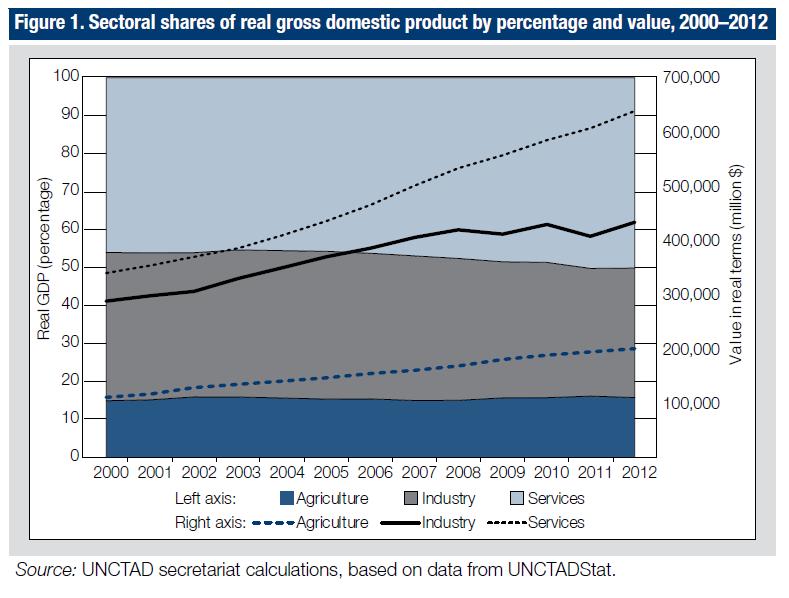

The report, subtitled “Unlocking the Potential of Africa’s Services Trade for Growth and Development”, argues that because Africa’s infrastructure provision remains suboptimal and costly, the services sector, though a dynamic driver of growth in Africa in recent years (see figure 1), has not been able to deliver the kind of structural transformation required to address the continent’s development needs.

Infrastructure services are critical to achieving the sustainable development goals being set by the United Nations for 2016–2030 and creating a platform for broad-based growth in Africa, the report argues, adding that some infrastructure services such as water and sanitation are directly linked to sustainable development goals targets central to achieving social development outcomes. In addition, while services such as electricity, telecommunications and transport contribute to productivity, they also determine the competitiveness of African firms.

“Africa accounts for 15 per cent of the world’s population but only 2.2 per cent of global services exports, indicating tremendous untapped potential for the sector,” UNCTAD Secretary-General Mukhisa Kituyi said. “The Economic Development in Africa Report 2015 underscores the need for African countries to tackle various regulatory and policy shortcomings, which explain these inefficiencies and impede Africa’s capacity to fully capitalize on the potential of its services sector.”

The report notes that during 2009–2012 the services sector in Africa grew at a rate of 4.6 per cent, compared to 5.4 per cent in the developing world. The fastest growing services subsectors were transport, storage and communications. Africa’s services sector propelled gross domestic product growth in 30 out of 54 countries during 2009–2012. Of the 45 countries where the share of services in output rose, 30 experienced a contraction in manufacturing from the period 2001–2004 to the period 2009–2012.

Some African economies have developed their services industries with relative success and are even sourcing services to African markets, the report notes. Examples include the financial and banking services industries of countries such as Mauritius and Nigeria, the commercial and cargo air transport industry in Ethiopia, Kenya and South Africa, the educational services industries of Uganda, the telecommunications services of Egypt, as well as the port services industries of Djibouti and Kenya.

Illustrative is the case of Ethiopian Airlines, the fastest growing, largest and most profitable airline in Africa, growing by an average rate of 20 to 25 per cent per year since 2005. The company is a $2.3 billion African powerhouse, with a reported net income of $228 million in 2013/14, making it the most profitable carrier in Africa.

However, African countries continue to grapple with building the necessary infrastructure to enable industrialization and economic growth. It is necessary to put in place clear and consistent regulatory and compliance frameworks to achieve efficient services. Infrastructure services regulation is also critical as a guarantor of interconnected factors such as access, affordability, investment requirements and quality control. The latter is significant in Africa, where networks are often quite limited in range and poorly maintained, but private providers may be reluctant to expand and upgrade.

However, with the trend towards greater regional liberalization of trade in services and deeper economic integration in Africa, it may become easier to prioritize the service sector and necessary policies to enhance its contribution to growth.

The report argues that the need for effective infrastructure services regulation is critical for three reasons:

• First, to achieve post-2015 sustainable development goals related to social welfare, water and sanitation and health-related indicators, greater emphasis is placed on regulation that protects consumers, attracts investors and enables Governments to achieve policy objectives.

• Second, Africa’s infrastructure services, in particular road freight, are more expensive and of lower quality than in any other region of the world. UNCTAD has estimated that African users in 2012 faced transport costs at 7.7 per cent of the delivered value of exports, more than twice as high as the world average of 3.7 per cent. Transaction costs are higher for intra-African trade than for trade with the rest of the world. Not only have high transport costs raised the cost of doing business, impeding private investment, but they serve as an additional barrier to African countries’ benefiting from the rapid growth in world trade.

• Third, access to reliable sources of energy is low across Africa and the amount of electricity being generated, reliably and consistently, is too low to meet rising demand. For example, securing investment and delivering large capital projects will be a key challenge for Africa’s energy utilities as the infrastructure investment needs of the sector are unprecedented; 74 per cent of the continent’s population is without access to electricity, and closing the existing energy gap by 2030 would cost an estimated $93 billion per year.

Most African States rank low in regulatory independence across all sectors and standard international models of infrastructure regulation are not regularly employed in Africa. Most African regulatory bodies are at an early stage of development, have modest budgets and often lack qualified staff members. In Africa the high cost and lack of access to capital, aging networks, a weak public sector and few independent regulatory institutions represent serious challenges to possible entrants into infrastructure service markets.

Although the State remains a major player in the provision of infrastructure services in Africa, regulatory independence is an important element of effective infrastructure services provision. The type of ownership – whether State, private, public–private partnership or joint venture – may vary, as long as it contributes to a Government’s development objectives.

“For African firms to effectively exploit growing opportunities for expanded trade through global services value chains, major investments in transport, logistics and energy infrastructure are required,” Dr. Kituyi said. “Also, as the utilities sector transforms, so too must its regulation and traditional business model of supply and operation move towards being capable of adapting to new technological and consumer demands.”

Full report (English): http://unctad.org/en/PublicationsLibrary/aldcafrica2015_en.pdf

Full report (French): http://unctad.org/fr/PublicationsLibrary/aldcafrica2015_fr.pdf