To foster prosperity for all, the world urgently needs to strategically align international investment and finance to where development needs are the greatest.

© Shutterstock/noomcpk

As the world grapples with rising debt and falling investment, it’s often people paying the price.

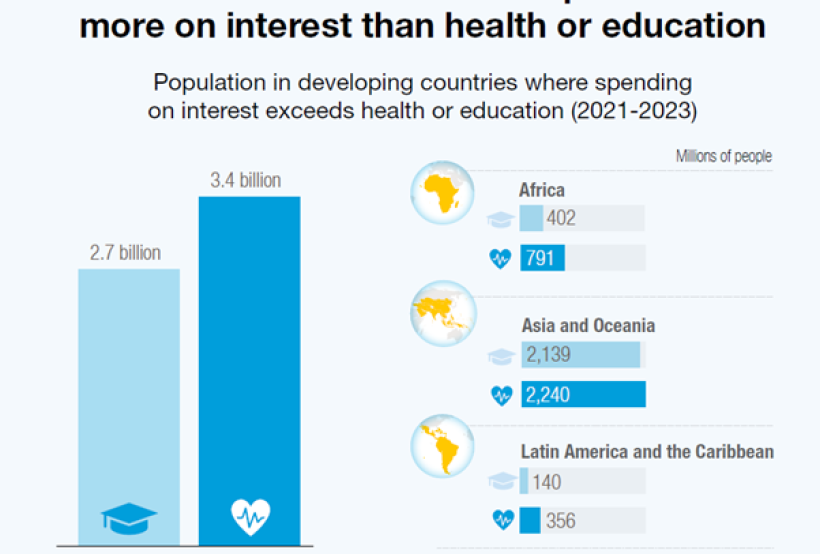

Developing countries paid a record $921 billion in interest in 2024. To put the debt burden into perspective, 3.4 billion people live in countries that spend more on debt interest payments than on health or education.

Another example: In 2024, global foreign direct investment fell for the second consecutive year. The drop was especially steep in sectors crucial to achieving the Sustainable Development Goals: Renewable energy (-31%), transport (-32%) and water and sanitation (-30%).

In this context, it’s all the more pressing to strategically align international investment and finance to where development needs are the greatest – an issue atop the agenda of the 16th United Nations Conference on Trade and Development (UNCTAD16).

UNCTAD, an organization at the intersection of finance and development, has long been influencing global policies around debt, the cost of capital, as well as investment for growth and stability.

Topical focus at UNCTAD16

UNCTAD16 aims to shore up finance for sustainable development, addressing the urgent need to reform the international financial architecture, end the debt trap and unlock long-term investment and finance.

Investment is a catalyst turning development ambition into action. Directing capital into sectors that matter the most — from renewable energy to digital networks — will accelerate sustainable economic growth and create opportunities for the next generation.

Public debt can be a powerful tool to finance development. But when debt grows too large or becomes too costly, it turns into a heavy burden. Developing countries must not be forced to choose between servicing their debt or serving their people. Measures including faster debt workouts, fairer restructuring and lower borrowing costs will be key to moving from debt servicing to financing development and investing in people.

More broadly, what UNCTAD is doing to help

To build a more predictable and conducive investment climate, UNCTAD supports countries to enhance transparency, streamline investment procedures and leverage digital tools – such as single windows – to lower transaction costs.

UCNTAD’s Debt Management and Financial Analysis System (DMFAS) Programme bolsters technical cooperation in debt management. For over 40 years, the programme has helped more than 115 institutions – such as finance ministries and central banks – in 75 countries enhance transparency and governance to manage their debt effectively and sustainably.

It’s committed to supporting the implementation of key elements of the Sevilla Commitment that came out of the 4th International Conference on Financing for Development, including a new “Sevilla Forum on Debt” aimed at providing a new space for countries to coordinate debt management and restructuring strategies. A UN entity is expected to serve as the forum’s secretariat.

Key reports

For more data and analysis on the digital economy, sustainability and inclusive development, see:

- World Investment Report 2025: International investment in the digital economy

- A World of Debt Report 2025

UNCTAD16 programme and registration

The full programme is available. All participants, including members of the press, are required to register online for the Conference.