Debt and development finance

Public debt can be a powerful tool for development, allowing governments to invest in their people and economies. But when debt grows too large or becomes too costly, it turns into a heavy burden.

This is especially for developing countries, whose public debt has grown twice as fast as that of advanced economies since 2010. They have also been borrowing at higher average rates than many advanced economies, making it harder to invest in schools, hospitals, infrastructure and other sectors critical for sustainable development.

Developing countries must not be forced to choose between servicing their debt or serving their people. There’s a pressing need to reform the international financial architecture to end the debt trap and unlock long-term investment and finance. We support countries in managing their public debt effectively.

Debt and development finance

Public debt can be a powerful tool for development, allowing governments to invest in their people and economies. But when debt grows too large or becomes too costly, it turns into a heavy burden.

This is especially for developing countries, whose public debt has grown twice as fast as that of advanced economies since 2010. They have also been borrowing at higher average rates than many advanced economies, making it harder to invest in schools, hospitals, infrastructure and other sectors critical for sustainable development.

Developing countries must not be forced to choose between servicing their debt or serving their people. There’s a pressing need to reform the international financial architecture to end the debt trap and unlock long-term investment and finance. We support countries in managing their public debt effectively.

Innovación digital para la transparencia de la deuda: Ayudar a los países a fortalecer las finanzas públicas

Los datos de deuda transparentes y fiables son un pilar fundamental de una política económica sólida…

News

Latest publications

Featured Series

External debt sustainability and development

Videos and podcasts

Related

Areas of work

- Debt and Debt Sustainability

- Responsible Sovereign Lending and Borrowing

- Sovereign Debt Restructuring

- Debt Management and Financial Analysis System

Projects

- Climate Finance for Development

- Financing green and sustainable development in small island developing States

- Mobilising financial resources for development in the time of Covid-19

Programmes

Meetings

7 – 9 diciembre 2026

Conferencia Internacional sobre la Gestión de la Deuda, 15ª sesión

Ginebra, Suiza

1 – 3 diciembre 2025

Grupo Intergubernamental de Expertos en Financiación para el Desarrollo, 9º período de sesiones

Ginebra, Suiza

30 junio – 3 julio 2025

ONU Comercio y Desarrollo en la 4ª Conferencia Internacional sobre Financiación para el Desarrollo

Sevilla, España

20 – 21 marzo 2025

Grupo Consultivo del Programa del Sistema de Gestión y Análisis de la Deuda (SIGADE), 14ª reunión

Ginebra, Suiza

17 – 19 marzo 2025

Conferencia Internacional sobre la Gestión de la Deuda, 14ª sesión

Ginebra, Suiza

Documents

30 Jan 2026

Report of the Intergovernmental Group of Experts on Financing for Development on its ninth session [ADVANCE COPY]

English05 Jan 2026

All roads lead to reform: A financial system fit to mobilize $1.3 trillion for climate finance

English02 Dec 2025

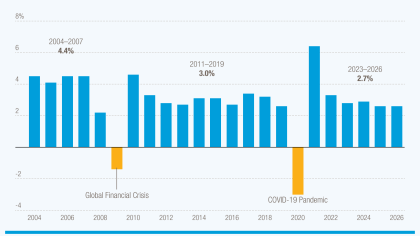

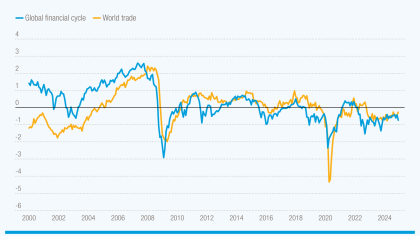

Trade and Development Report 2025: On the brink - trade, finance and the reshaping of the global economy

EnglishSecretary-General Statements

Contact

For further information on this topic, please contact us.