How did it start? The origins of the DMFAS Programme

The late 70’s and early 80’s were a time when debt issues were already being intensively discussed within UNCTAD. Before the debt difficulties of the developing countries came to world-wide attention through the Mexican default in 1982, UNCTAD had already raised the alert on the impact of the debt burden on the development process and had called for its alleviation.

The UNCTAD Secretariat started to attend Paris Club meetings as an observer in 1978 on the basis of Resolution 165 S-IX of the UNCTAD Trade and Development Board on the identification of specific features for multilateral negotiations of bilateral debt. It also started to provide assistance to debtor countries in preparing their case for submission to the Paris Club, upon their request. It is in this context that UNCTAD identified the need for a computer-based debt recording and management system and initiated the development of such a system.

As a result of its participation in the Paris Club meetings and accumulated experience on debt issues, UNCTAD economists came to know first-hand the strengths and weaknesses of debt management systems in a large number of developing countries.

As a result of its participation in the Paris Club meetings and accumulated experience on debt issues, UNCTAD economists came to know first-hand the strengths and weaknesses of debt management systems in a large number of developing countries. How was the idea of creating a debt management system born?

In 1979, UNCTAD started its first technical assistance project on external debt. The first difficulty faced by UNCTAD officials was the lack of information on external debt. How much did the country owe? To which creditors? In which currencies? When were the payments falling due? Who were the national debtors besides the central Government? The participation of an UNCTAD representative in the Paris Club meetings in the early 1980s confirmed that this lack of information applied generally to developing countries. Consequently, the idea of creating a computer-based debt management system emerged, aimed at helping debtor countries record, project and analyze public debt loans.

The Debt Management & Financial Analysis System (DMFAS) Programme was established in 1981 with a small team. Its initial focus was on the development of a computer-based debt management information system. Originally focusing on central government and government guaranteed external debt, over time the DMFAS software expanded its scope to incorporate domestic debt instruments, following the evolution of borrowings practices of developing countries.

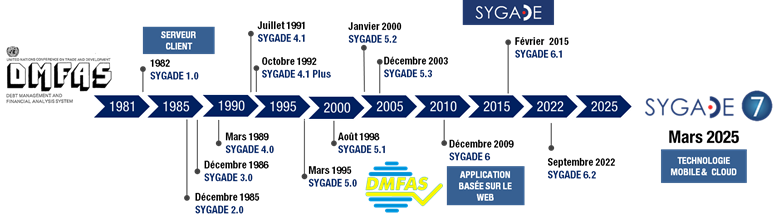

Evolution of DMFAS products and services.

The creation of DMFAS was a step forward for countries in improving their public debt management, external debt in particular. Since its inception, the DMFAS Programme has offered countries solutions for improving their capacity to handle the day-to-day management of public liabilities and produce reliable debt data for policy-making purposes.

The DMFAS software

DMFAS 1 to DMFAS 4: The first version of the DMFAS software was released in 1982 in Bolivia and later in Costa Rica and Madagascar. Developed originally in a mix of COBOL, Dbase and Lotus 1-2-3, the system was updated on a regular basis in accordance with developments in debt management and changes in technology. For example, new modules were added to support debt reorganization and debt analysis, and the system continuously evolved to respond to new reporting requirements and to include new amortization and payment methods. This period also saw the replacement of all DBase functions by COBOL.

DMFAS 1 to DMFAS 4: The first version of the DMFAS software was released in 1982 in Bolivia and later in Costa Rica and Madagascar. Developed originally in a mix of COBOL, Dbase and Lotus 1-2-3, the system was updated on a regular basis in accordance with developments in debt management and changes in technology. For example, new modules were added to support debt reorganization and debt analysis, and the system continuously evolved to respond to new reporting requirements and to include new amortization and payment methods. This period also saw the replacement of all DBase functions by COBOL.- DMFAS 5: 1st Client-server and relational database (Oracle): At the end of the 1980’s DMFAS version 4 was a stable and fully-fledged computer-based debt management system but the computer and software techniques needed to technologically evolve. DMFAS 5 was developed with a relational database system (Oracle), bringing the benefits of improved data integrity, accessibility and flexibility. This was also the first client-server version of the system.

- DMFAS 6: 1st web-based version including a dedicated module for domestic debt instruments: With the changes in technology and in debt management practices, including new organizational structures for debt offices (front-back-middle office functions), DMFAS 6, was released in 2009 and is the first Web-based version of the software. In addition to improvements on existing functionalities, DMFAS 6 included for the 1st time a module dedicated to the recording of domestic debt instruments. In addition, the scope of instruments was expanded to record non-guaranteed external debt, short-term external debt and the software included new analytical features.

- DMFAS 7: 1st version to cover non-traditional debt instruments, contingent liabilities, financial derivatives and be IPSAS compatible: With 40 years of debt management experience, the DMFAS Programme is currently developing its 7th major version. It is designed to meet the evolving needs of debt management offices, including expended debt instruments coverage, new transparency requirements, management of more complex debt instruments, data quality issues and operational risk management. The new version will include a broader debt coverage to cover non-traditional debt instruments, contingent liabilities and financial derivatives. It will be compatible with latest international standards, including IPSAS standards. Responding to the evolution in technology, the new version will also be compliant with the latest standards for Web applications (Cloud technology), strengthened security, faster connectivity, processing, accessibility and improved portability.

Moving from capacity building to capacity development

Capacity-building is the second pillar of the Programme’s technical assistance. The Programme in its early days started the process of building capacities that did not exist. In the late 1980’S, a group of independent experts identified that a contributing factor to the debt crisis had been the neglect by many developing countries of the basic functions of debt management. As a result, a Joint Programme was established in 1991 between UNDP, UNCTAD and the World Bank to provide training in various areas of debt, such as interpretation of loan agreements, debt management procedures and data analysis. To maximize the usefulness of DMFAS, the Programme also provided assistance in the analysis of the legal, institutional and technical environment in which the software would have to operate. Over time, as countries’ debt management capacity improved, the programme evolved its approach to include strengthening existing capacities in debt management.

Capacity-building is the second pillar of the Programme’s technical assistance. The Programme in its early days started the process of building capacities that did not exist. In the late 1980’S, a group of independent experts identified that a contributing factor to the debt crisis had been the neglect by many developing countries of the basic functions of debt management. As a result, a Joint Programme was established in 1991 between UNDP, UNCTAD and the World Bank to provide training in various areas of debt, such as interpretation of loan agreements, debt management procedures and data analysis. To maximize the usefulness of DMFAS, the Programme also provided assistance in the analysis of the legal, institutional and technical environment in which the software would have to operate. Over time, as countries’ debt management capacity improved, the programme evolved its approach to include strengthening existing capacities in debt management.

Taking a holistic approach to downstream debt management (data recording, monitoring, reporting, analysis and operational risk), the Programme offers today a full range of capacity-development activities. These activities aim at strengthening countries’ capacities to generate validated debt information, produce reliable statistical and analytical reports on public debt and ensure effective operational risk. Additionally, the Programme offers support in establishing appropriate communication and information flows and procedures, and in linking the debt database to different information systems such as payment, budgeting, treasury and accounting systems or to an integrated financial management information system.

Focusing on downstream debt management capacity development, DMFAS activities complements the work of other organisations such as the World Bank, IMF and regional bodies whose primary focus is on strategy and debt sustainability analysis (upstream debt management). In 2021, the DMFAS Programme celebrated 40 years of assisting developing countries in strengthening their public debt management capacities.

DMFAS, a key player in technical assistance in public debt management

Since its establishment in 1981, the Programme has supported 118 institutions in 77 countries. Today, 85 institutions in 63 countries actively use the DMFAS software.

After 45 years, in collaboration with international and regional partners, the Programme remains fully committed to providing the highest level of technical assistance in debt management taking into account advancements in information technology, international financial techniques and best practices.

________________________________________

For more details on UNCTAD's work on debt, see Chapter V,C. The debt crisis of the developing countries, UNCTAD at 50 - A short history, UNCTAD/OSG/2014/1.