Version française - Versión española

In August, the DMFAS Programme released version 6.2 of the DMFAS software to all its user countries. This is the last major release of DMFAS 6 and contains the following new functionalities.

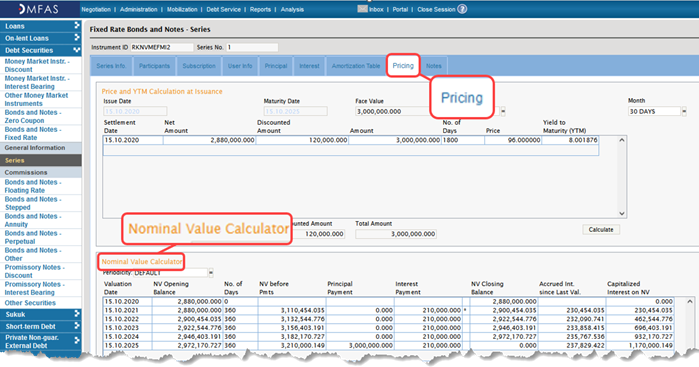

Nominal value calculations

The new version includes the calculation of Nominal Value for 4 types of Debt Securities (Money Market Instrument-Discount, Money Market instrument- Interest bearing, Bond- Zero coupon, Bond- Fixed Rates). The Pricing tab calculates the Price and Yield as well as the price and the yield to maturity (YTM) of the instrument in addition to its nominal value using a default periodicity, which can also be changed by users. A standard report on nominal value calculation can be generated from the Tools menu of the module. Reports can be produced for a set of instruments with nominal value for a defined period and the corresponding accrued interest. For more information, please visit the online help.

Medium-Term Debt Strategy (MTDS) Interface

Medium-Term Debt Strategy (MTDS) Interface

This new module in DMFAS 6.2 aims at facilitating the preparation of the debt data required as an input in the MTDS analytical tool. The final output is an Excel file that is imported into the MTDS tool. This Excel file contains the stylized debt instruments needed to define different borrowing strategies. It also includes the following aggregates, calculated until the last maturity of the debt portfolio:

- Projected principal payments based on outstanding

- Projected interest payments based on outstanding

- Actual and projected debt outstanding.

The module is for the moment only available in English and countries need to follow specific instructions for its installation.

Enhancements in Administration module: DSSI terms and reference rates

Handling of the Debt Service Suspension Initiative (DSSI) in the system is facilitated by the addition of a new code for “DSSI TERMS” under the Reorganization Terms filed in Tranches to classify loans treated under a DSSI agreement.

New reference rates (SOFR, €STR, SONIA, TONAR/TONA, SARON, SORA) are available in the Interest tab under Tranches to replace the LIBOR reference rates. Instructions on how to add a new reference rate for an existing tranche are annexed to the release note.

Technical enhancements

This release also contains an update on the Application’s architecture and support tools. With the use of Open Java version 11 (OpenJDK 11) and Apache Tomcat 9, security and performance concerns raised by institutions on previous DMFAS 6 releases have been resolved. Additionally, other internal security enhancements such as Password Encryption, integration of Secured Socket Layer configuration, among others, have been implemented.

Other enhancements

The release also contains improvements in the debt service module, enhancements to export of reports in Excel format and to the Data export module. The online help has been updated in the 3 languages to integrate the new functionalities.

Finally, this release integrates some corrections. The release note together with the installation instructions containing detailed information are available in the client area of the DMFAS website here: https://unctad.org/dmfas/client/page/DMFAS6releases