Written by Jan Hoffmann and Julian Hoffmann,

Article No. 57 [UNCTAD Transport and Trade Facilitation Newsletter N°87 - Third Quarter 2020]

In the 2nd quarter of 2020, there were 939 container ports in the world that received regular liner shipping services. If all ports had direct services between each-other, there would be 440,391 direct port-to-port liner shipping connections.[i] In reality, however, only 12,748 port pairs have such direct connections, i.e. 2.9 per cent of the theoretical total. For trade between the remaining 97.1 per cent of port pairs, containers need to be transhipped in other ports. The least connected port pairs require up to 6 transhipments, with 7 direct port-to-port services and 14 port moves for one trade transaction.[ii]

To examine the characteristics of the liner shipping network, we use data provided to UNCTAD by MDS Transmodal. The idea for this analysis was inspired by a recent article by Kenza Bouhaj on the most connected economists.

Ports as nodes in the shipping network

We describe a port’s position in the shipping network by the following two metrics:

-

The node degree: The number of other ports with which the port has a direct connection.

-

The node betweenness: How important is a port for trade between other ports that connect with each-other via transshipment.

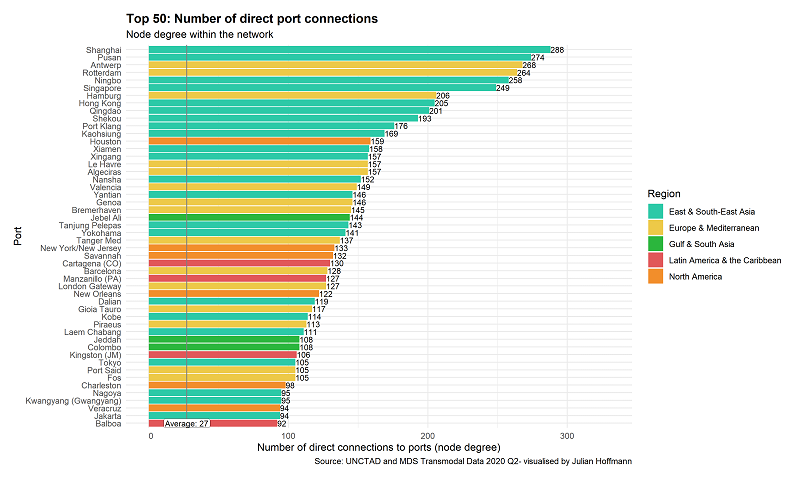

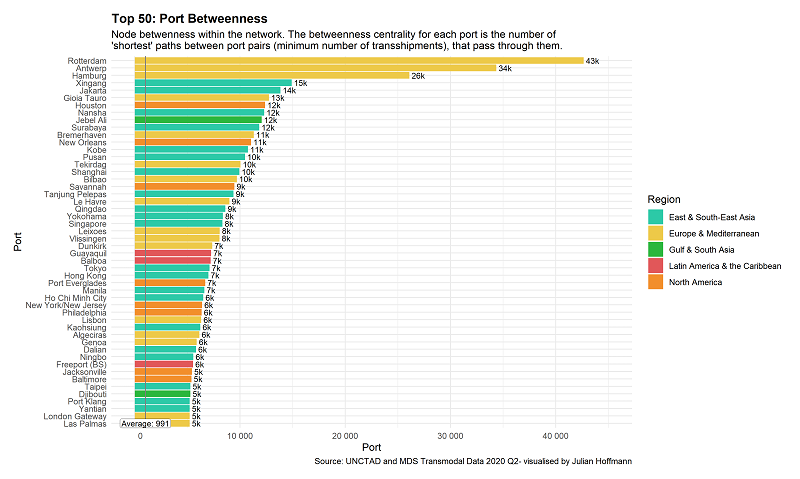

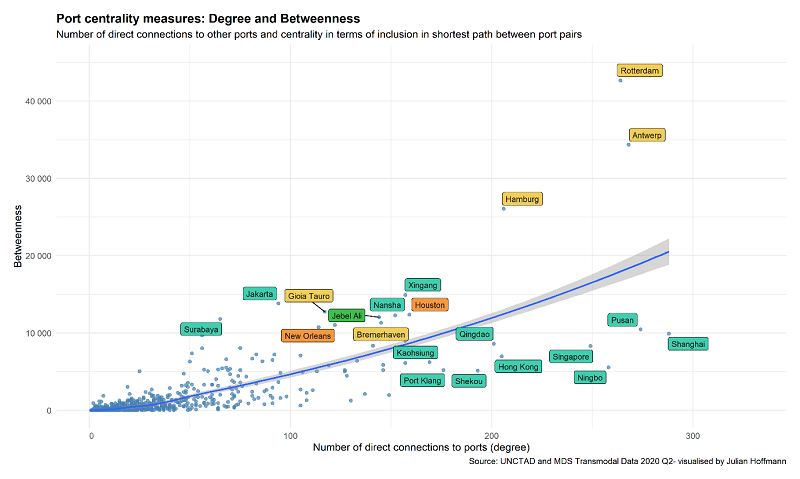

Figure 1 depicts the top 50 ports ranked by “degree” (all data is for the second quarters of each year) and Figure 2 shows the top 50 ports ranked by their “betweenness”. Figure 3 illustrates the correlation between the two measures “degree” and “betweenness”.

The best-connected ports in 2020

Under the measure “degree”, Shanghai is the best-connected port in 2020 with 288 direct connections, followed by Busan (274 direct connections), Antwerp (268) and Rotterdam (264). In Africa, Tanger Med has the highest degree (137 direct connections), and in South America, Cartagena is the best-connected port under this criterion (130 direct connections) (Figure 1).

Figure 2 shows the “betweenness”, i.e. for how many port-to-port connections a port is among the best options in terms of minimizing the number of necessary transhipments. For the case of Rotterdam, the port with the highest betweenness in 2020, there are 42,656 port-to-port connections that include Rotterdam on their optimal routes. Put differently, among the global total of 440,391 port-to-port connections, for 9.7 per cent of optimal routes, Rotterdam is included as a transshipment port. The second and third highest betweenness is calculated for Antwerp and Hamburg.

Under the criteria “betweenness”, the major European ports are better connected than the major Asian ports, while under the criteria “degree” Asian ports are better connected. Some of the ports with a high betweenness do not have a high number of direct connections. However, they are centrally located in their region and can be the ports best located to connect other ports through them (Figure 3).

How much choice do shippers have?

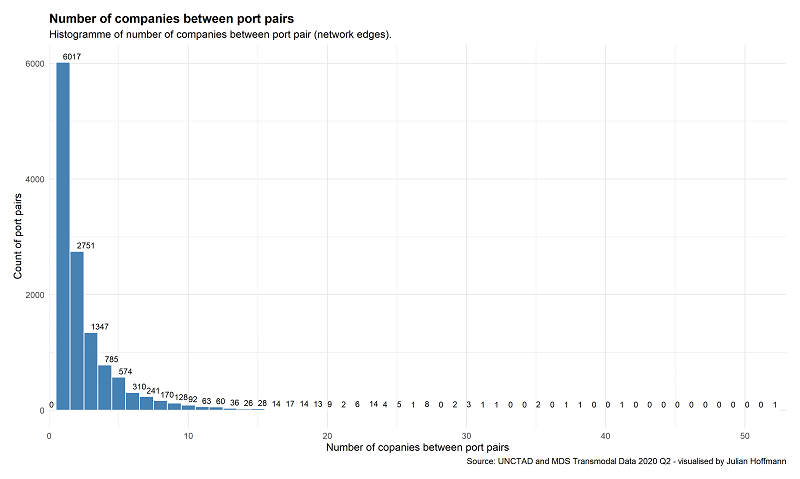

Apart from the route choices for port-to-port connections discussed above, shippers may also have different carriers to choose from. Among the 12,748 direct port-to-port connections that do not require a transhipment in 2020, on 6,017 of them (47.2 per cent) services are provided by only one single company, while on 2,751 routes (21.6 per cent) there is competition among two providers, and on the remaining 3,980 port pairs (31.2 per cent) there are three or more carriers offering their container shipping services (Figure 4).

The port pair that is best connected through direct services is Ningbo-Shanghai, with 52 liner shipping companies providing direct services between the two ports. It is followed by Port Klang – Singapore (41 companies), Busan – Shanghai (38), and Shanghai – Quingdao (37).

All top 50 best connected port pairs are on intra-regional routes, almost exclusively intra-Asian, except for two intra-European connections, which are Antwerp – Rotterdam with 24 companies and Hamburg – Rotterdam with 23 companies. In other regions, too, it is mostly neighbouring ports that are best connected with each-other. These intra-regional connections do not carry much trade between the neighbouring ports, but the high connectivity is the result of being connected to the same overseas routes, combined with feedering and transhipment services.

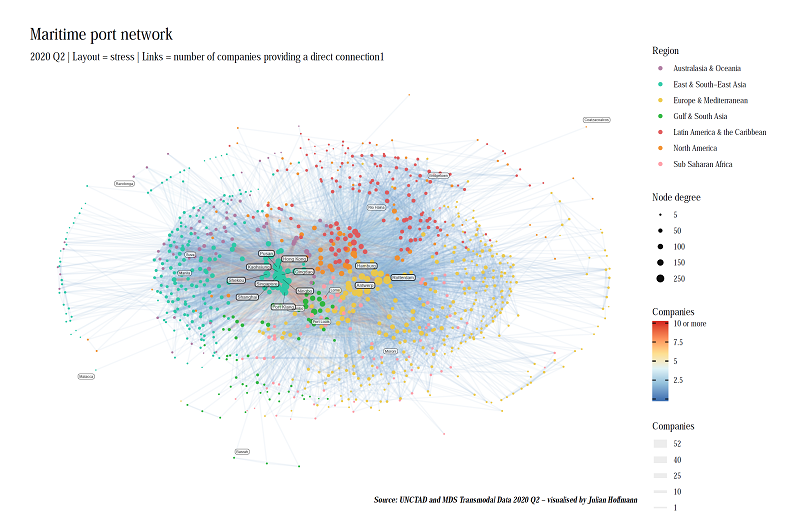

A map of the global shipping network

Figure 5 illustrates the world shipping network in 2020, with the following four dimensions.

-

The colour of each port represents its geographical region.

-

The size of each port represents the degree (as per Figure 1).

-

The thickness and colour of the connecting lines represents the number of companies that provide direct services on that port pair (as per Figure 4). Note that 97.9 per cent of port pairs are not connected through any direct line.

-

The distance between ports and their location on the chart represents its centrality within the network. Ports that are closer to each-other are better connected with each-other, and ports that are more in the middle of the chart are more central to the network.[iii]

The top twelve ports by degree (Figure 1) as well as ten other ports are labelled for illustration purposes. The major East Asian and European ports are clearly positioned at the centre of the network, and within each region close to each-other. Coatzacoalcos in Mexico and Malacca in Malaysia, on the other hand, are on opposite sides of the network and examples of port-to-port connections that would require a high number of transhipments.

Ports in the same geographical region are often also closely connected in the network, but by far not always; many ports from different regions (i.e. with different colours) may also be well connected with each-other through direct services and many common direct connections, which then places them close to each-other in the chart of the network.

Figure 5: The global liner shipping network, 2nd quarter 2020

What has changed in the last 14 years?

Between the 2nd quarter of 2006 and the 2nd quarter of 2020 the following changes in the network can be observed:

-

The number of container ports in the network has increased by 13 per cent, from 834 to 939. The average node betweenness increased by 27 per cent during the same period, reflecting the growth of the overall network, and the reduction of direct port-to-port services.

-

The centre of the network in terms of the largest nodes and the position within the network has shifted from Europe to Asia. The three ports that most improved their degree are located in China (Nansha, Ningbo, and Shekou), while the three ports that saw the largest decline of their degree are in the United Kingdom (Tilbury and Felixstowe) and Venezuela (Puerto Cabello).

-

The share of port pairs that count on direct services decreased from 3.7 per cent in 2006 to 2.9 per cent in 2020, reflecting a trend towards more connections that make use of transhipment services. The average degree decreased by 10 per cent during the same period.

-

The average number of companies providing services per port pair remained constant at 2.7 companies.

Measuring connectivity

In order to capture the position of a country or port in the global liner shipping network, UNCTAD in 2004 developed the Liner Shipping Connectivity Index (LSCI). The LSCI is today generated jointly by UNCTAD and MDS Transmodal, applying an updated methodology with six components.[i]

The six components from which the LSCI is generated include the number of companies that provide direct services, as well as the number of port or country pairs with direct connections, both of which we have also analysed in the present article.

The LSCI incorporates four further variables, notably 1) the size of the largest container ship, 2) the number of services, 3) the total deployed carrying capacity, and 4) the number of services, which we have not covered in the present article. For each one of these additional components, similar network analysis as presented in this article could be undertaken. However, most of the core metrics, such as the node degree and the node betweenness, or the overall structure of the network in terms of directly connected ports or the number of necessary transhipments, will not change if instead of the number of companies we incorporate any of the other four components of the LSCI.

Jan Hoffmann, Trade Logistics Branch, UNCTAD, Geneva (Jan.Hoffmann@UN.org); and Julian Hoffmann, data analyst, London (Julian.Hoffmann.Anton@gmail.com)

---------------------------

[i] The network is considered symmetric, so the total number of bilateral connections is 939 x (939-1) / 2 = 440,391.

[ii] When speaking about a “direct” service between two ports A and B, we mean that no transhipment of the container is necessary; it does not mean that the ship may not stop in other ports on its journey from A to B. For example, a container exported from Antofagasta to Bremerhaven may be put on a ship that provides a direct service, even though it stops in Callao on its way, or the container may be transhipped for example in Cartagena, to connect two different shipping services. In the former case, we speak about a direct service; in the letter case, we speak about a service that requires a transhipment. To be able to undertake this type of analysis, it is necessary to look at the complete shipping schedules; it would not be enough to look at port-to-port ship movements alone as provided for example by AIS data.

[iii] The chart and all metrics in this article are generated applying the packages in R iGraph (https://igraph.org/r/), ggraph (https://cran.r-project.org/web/packages/ggraph/index.html) and ggplot (https://ggplot2.tidyverse.org/reference/ggplot.html).

[iv] UNCTAD publishes the country level LSCI and the port level LSCI, as well as the bilateral country-to-country Liner Shipping Bilateral Connectivity Index (LSBCI) on-line (http://stats.unctad.org/maritime). MDS Transmodal also publishes the components of the LSCI for the top 100 ports (www.portlsci.com). A special chapter in the Review of Maritime Transport 2017 provides additional analysis of the LSCI and the LSBCI.

----------------------