Written by Alexander Karavaytsev and Boris Turkin

Article No. 51 [UNCTAD Transport and Trade Facilitation Newsletter N°86 - Second Quarter 2020]

The new marine fuel requirements of the International Maritime Organisation (IMO), implemented on 1 January 2020 (IMO 2020), introduced a lower cap on marine fuel sulphur emissions. This objective could be achieved via switching to lower sulphur fuels (LSFO) or through the installation of the Exhaust Gas Cleaning System (so called “scrubber”). As the regulation came into force, only about 10%-15% of the global fleet was estimated to be equipped with scrubbers (S&P Global Platts, Clarkson Research), which implies that most owners of bulk carriers had to switch to more expensive low-sulphur fuels as a way to comply.

IMO 2020 was expected to increase significantly freight costs because of the price differential between low and high-sulphur marine fuels and of the cost involved in installing scrubbers. Yet, fears about a widespread disruption due to the new regulation have not materialised for the dry bulk freight market, at least so far, in part owing to narrowing spreads between high sulphur and low sulphur fuels and seemingly enough supply of the latter.

This article aims to take stock of some observable changes, particularly in freight costs of grains and oilseeds, as a result of the implementation of this regulation. While these commodities constitute key staples from the perspective of food security, the cost of transportation can be a significant decisive factor for poorer importing countries, which tend to be relatively more sensitive to changes in purchase prices. Increased delivery costs could also contribute to higher domestic food prices, including bread and meat, with grains and oilseeds being a feedstock for food and feed sectors.

Higher fuel costs as at 1 January…

In efforts to assess the implications of the IMO 2020 regulation for the grains and oilseeds sector, the International Grains Council (IGC) has performed model-based analysis of voyage freight rates on relevant routes. Voyage rates represent total freight costs for a route (expressed in US$ per ton of cargo) and include vessel hire (timecharter costs), fuel (bunker) costs, port, canal and other charges. The scope of the review spanned around 300 routes carrying heavy grains (wheat, durum), soybeans, sorghum, maize and barley from 7 key origins (Argentina, Australia, Brazil, Black Sea (Russia, Ukraine), Canada, Europe, USA (Gulf and Pacific Northwest) to more than 50 destinations globally.

Based on the analysis, the switch to IMO compliant LSFO prices as of 1 January resulted in a nearly two-fold increase in assessed fuel costs across covered routes, equivalent to an average rise in nominal voyage freight rates of 20%, or US$5 per ton, to around US$30 per ton. The increase ranged from US$3 for routes out of the Black Sea and Europe (featuring short-haul deliveries to North Africa) to a US$7 rise for Brazil (where grains and oilseeds shipments are dominated by long-haul journeys to Far East Asia, most notably China -soybeans- and Vietnam -maize-). The rise for the US was estimated at around US$4 per ton. While Asia is likewise a key destination for US grains and oilseeds exports, deliveries are split between long-haul trips from the Gulf and relatively shorter journeys from the Pacific Northwest.

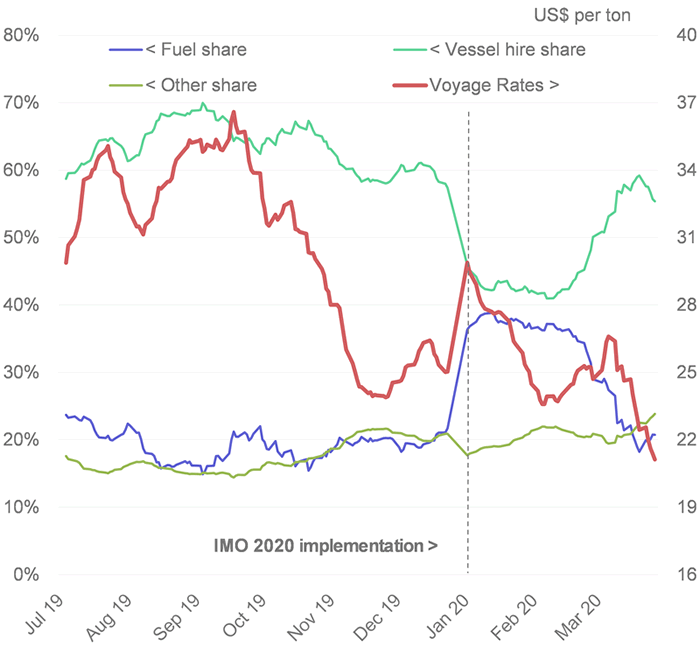

In terms of the composition of total freight costs, the IMO 2020-related adjustment meant that the share of fuel in total journey costs, which hovered around 20% during the prior six months, rose to 36% for underlying routes (Figure 1).

Figure 1. Composition of voyage freight rates on key grains and oilseeds routes

Source: IGC analysis.

Note: Average trade weighted nominal voyage rates.

… But a subsequent drop amid declining crude oil prices

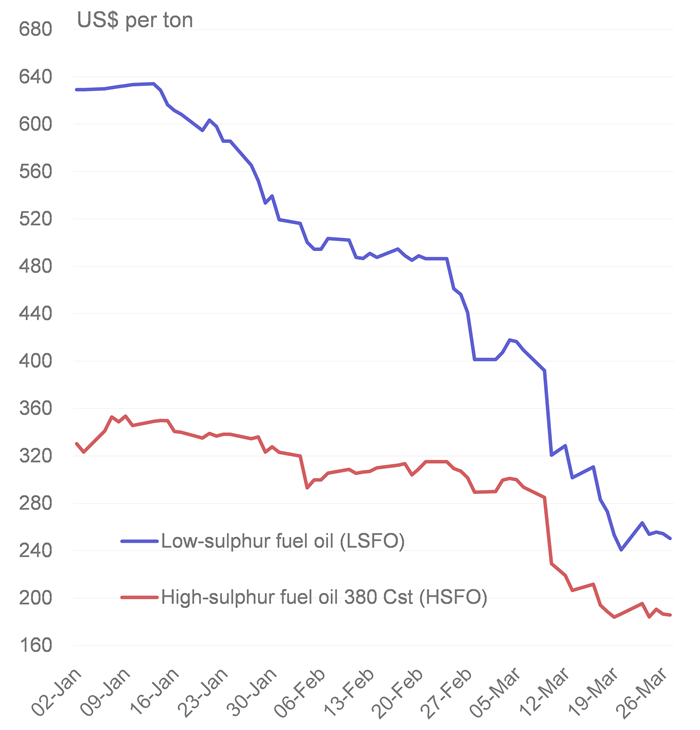

Fuel cost component: Against the backdrop of plunging crude oil markets, average LSFO prices dropped by 60% in the period from the turn of the year to late-March, while the spread between low-sulphur and high-sulphur fuel oils contracted nearly five-fold, from around US$300 to US$65 (ClearLynx, Reuters, IGC calculations). More importantly, average LSFO values dropped below levels at which HSFO prices were quoted in early January, largely reversing the effect of the IMO 2020-related switch in fuels (Figure 2).

Figure 2. High-sulphur and low –sulphur fuel oil prices

Sources: ClearLynx, Reuters.

Note: Average price across 13 major fuelling destinations globally.

Timecharter component: In late 2019, daily hire rates for ocean-going carriers of dry bulk cargoes (including grains, oilseeds, coal, sugar, cement and ores) were weighed by worries about ongoing trade disputes and a slowing world economy. That pressure was subsequently amplified by seasonal factors, including a downturn in grains and oilseeds dispatches by some southern hemisphere exporters and the Lunar New Year holidays in Asia. Although recent China’s purchases of US wheat, soybeans and maize under the Phase One trade deal were termed positive, sentiment across all dry bulk market segments came under pressure from the spread of coronavirus and related containment measures, which appear to impact trade volumes and cause disruption to supply chains.

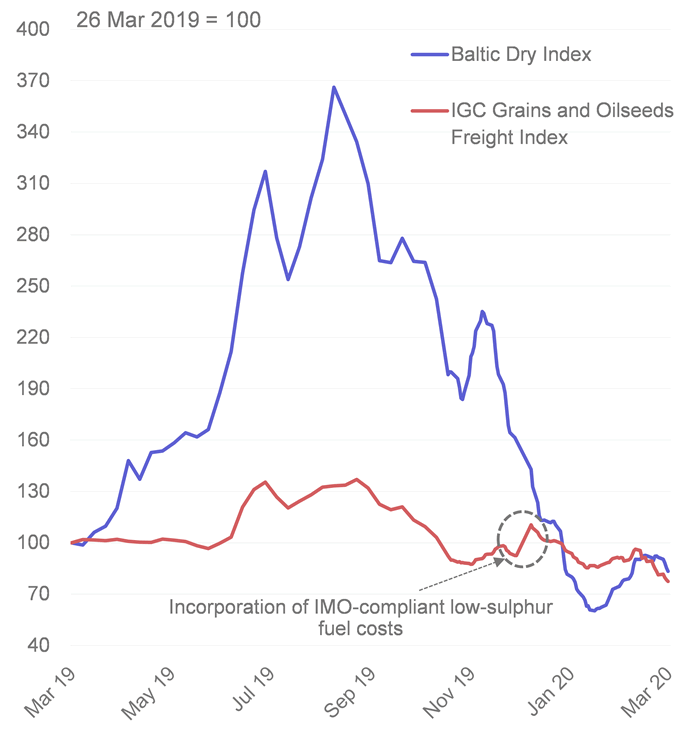

Reflecting this, the Baltic Dry Index (BDI), a composite indicator for timecharter (vessel hire) costs across bulk carriers’ main size categories (Capesize, Panamax and Supramax), plunged to its lowest in almost four years by mid-February, while the loss since 1 January stood at 42% as at 27 March. (Figure 3).

Figure 3. Baltic Dry Index and IGC Grains and Oilseeds Freight Index

Sources: Baltic Exchange, IGC.

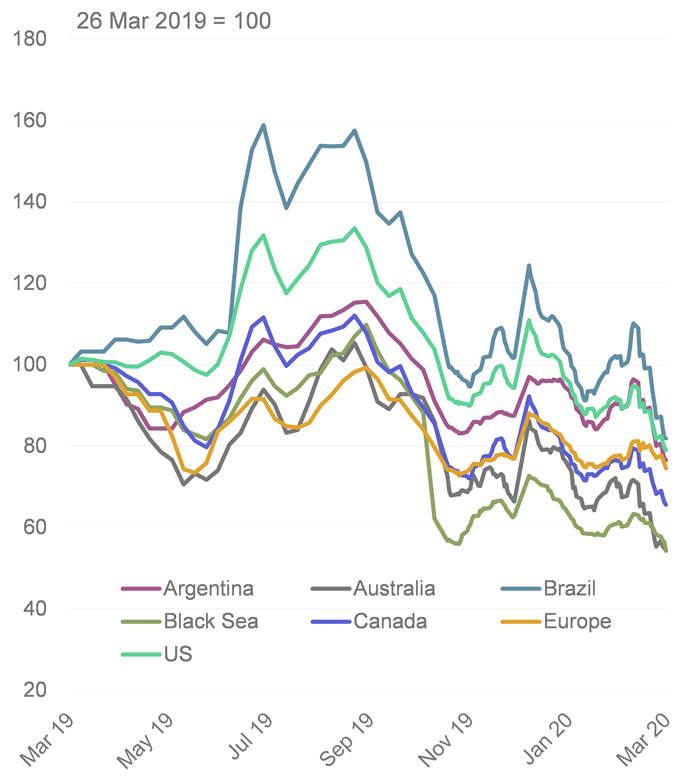

Total voyage costs (timecharter + fuel + other): Resulting from steep falls in the two main underlying components – timecharter values and fuel costs - voyage freight rates posted steep losses in recent months. This is evidenced by the International Grains Council’s Grains and Oilseeds Freight Index (IGC GOFI) which offers a measure of movements in nominal voyage rates across key grains and oilseeds routes. The indicator is focused on deliveries in Panamax, Supramax and Handysize segments, often referred to as “grains and oilseeds carrying”, and does not cover Capesize vessels, mainly involved in the transportation of iron ore and heavy raw materials. Amid declines across all constituent origin-based sub-Indices, the Index receded by 30% since the start of the year by late-March, to its lowest since October 2016. (Figure 4).

Figure 4. IGC GOFI origin-based sub-Indices

Source: IGC

Conclusion

Vessel owners initially faced a steep increase in fuel costs as a result of the new regulation, but subsequent developments in the freight market against a deteriorating economic background have erased that effect. Shipping prices on most routes have fallen well below pre-IMO 2020 levels, while the share of fuel in voyage costs is broadly like late-December values, which suggests a limited overall impact for the grains sector to date.

The implications of the regulation for freight prices may be more pronounced, should cargo flows pick up and increase demand for vessels and marine fuel. However, given the uncertainty surrounding the coronavirus epidemic and its impact on the global economy, the outlook for seaborne trade remains hazy at this stage. At the same time, the importance of fuel-related issues has seemingly faded for the time being, not least owing to heavy falls in crude oil prices.

Alexander Karavaytsev ¦ Economist ¦ International Grains Council ¦ akaravaytsev@igc.int

Boris Turkin ¦ Analyst ¦ International Grains Council ¦ bturkin@igc.int