Written by

Miho Shirotori and Bruno Antunes, UNCTAD

Managing the COVID-19 health crisis and the economic recovery ahead requires substantial financial resources.

In addition to dealing with financial concerns at the macro level, such as debt management, policymakers need to consider that the economic fallout from COVID-19 is most severely felt by those who have little or limited access to financial resources.

Financial inclusion, in terms of providing access to financial services at an affordable and sustainable cost, must be a key part of governments’ policy response to the current crisis.

The current slowdown of economic activity, while necessary to address the health crisis, has led to mass unemployment and tumbling incomes for many, particularly for those in the informal sector.

This will be aggravated by the disruption of value chains supplying intermediate and final products and by demand lowered by budgetary pressures on households, firms and governments.

Backstop measures

Governments are providing liquidity backstop measures to both businesses and households, but the challenge goes beyond envisaging Marshall-like plans and sound financial systems.

The most vulnerable and hardest hit by the COVID-19 crisis will also be the ones more likely to have higher barriers to benefiting from this support.

These include not having a bank account or having poor access to payment, credit and other financial services. It is these people who need to quickly become beneficiaries of financial inclusion measures.

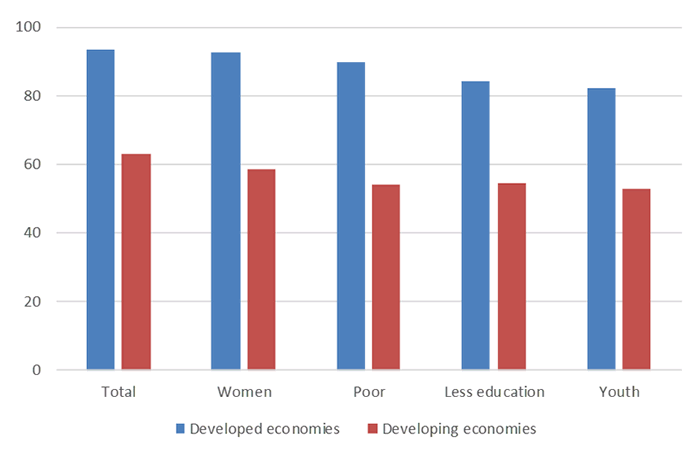

Even prior to the pandemic, financial inclusion was a key development concern. In 2017, only 63%of adults in developing economies had an account at a bank or another type of financial institution, well below the 93% in developed economies. The poor, less educated, youth and women suffer even lower levels of financial inclusion (figure 1).

Figure 1. Share of people with a bank account or similar (Percentage)

Source: UNCTAD calculation based on the Global financial inclusion database, World Bank.

As noted by UNCTAD, sectors severely affected by the COVID-19 crisis, such as tourism, rely intensively on low-skilled, part-time workers, many of whom are women.

Many migrant workers from developing countries are also concentrated in these sectors and are thus most affected by unemployment and reduced income – impacts often compounded by informality.

Their lower cash flows affect remittance transfer to their home countries, which had prior to the pandemic been forecast to reach $574 billion in 2020.

This underscores the importance of financial inclusion policies that facilitate access to speedy, safe and affordable remittance transfer services.

Diaspora funds and diaspora associations can not only provide useful development financing and information, but they may also be critical in bridging household income gaps in home countries during the forthcoming global recession.

What measures should be included in a coherent policy mix?

In the face of the economic and financial anomaly created by the pandemic, securing access to financial services of all, particularly the most vulnerable and disadvantaged people, must be an integral part of a government’s policy response.

First, governments and financial regulators need to help reduce the cost of access to credit services, via, for example reducing intermediation costs and documentation requirements.

Governments and regulators can also allow for different account levels with different limits and risks, and subsequent lower costs and conditions.

This was the case in Mexico in 2010-2011, in the aftermath of the global financial crisis, where the government established four levels of accounts that provided proportional solutions, ranging from a basic account with no opening requirements and a $388 balance limit, to the traditional account with thorough opening requirements and no balance limit.

Second, governments and financial regulators should enhance consumer protection in financial services.

The revised United Nations Guidelines for Consumer Protection present concrete policy guidelines to address the legitimate need of protecting vulnerable and disadvantaged consumers of financial services.

Governments may adopt measures elaborated in the guidelines, with a view to reinforcing and integrating consumer policies concerning financial inclusion and the protection of consumers in accessing and using financial services.[1]

In particular, governments and financial regulators should put in place a regulatory framework that promotes cost efficiency and transparency for remittances.

It should ensure consumers are provided with clear information on the price and delivery of the funds to be transferred, exchange rates, all fees and any other costs associated with the money transfers offered, as well as remedies if transfers fail.

Third, governments may facilitate increased policy coordination among financial services providers, including post offices.

With more than 670,000 outlets globally, post offices have been facilitating small-scale financial transfers from migrant workers to recipients, particularly in rural and remote areas in home countries.

The “Fast PACE” initiative by the UK Post Office that allows quicker and easier cash access to self-isolating customers during the COVID-19 crisis may be adapted for migrant workers needing quick transfers.

Governments may also provide temporary policy flexibility, if appropriate, in relation to digital financial services (DFS), via for example mobile phones.

DFS, whose importance is also recognized by the G20, can significantly enhance financial inclusion and ensure services are gender neutral and youth friendly.

Fourth, regulators need to promote real risk-based approaches and minimize de-risking, where financial services providers end or restrict business relationships to avoid, rather than manage, risk.

Effective risk management allows for correspondent banking, critical for several developing regions such as the Caribbean, and may benefit from South-South cooperation as outlined by the Prime Minister of Barbados.

UNCTAD, as the focal point in the United Nations on the services economy, consumer protection and trade, continues to support countries in their efforts to achieve stable and inclusive financial services for all, including in extraordinary circumstances like now.

This article draws from UNCTAD’s forthcoming publication entitled Access to financial services and digital economy for sustainable development.

[1] Chapter V, section J, guidelines 66 to 68.