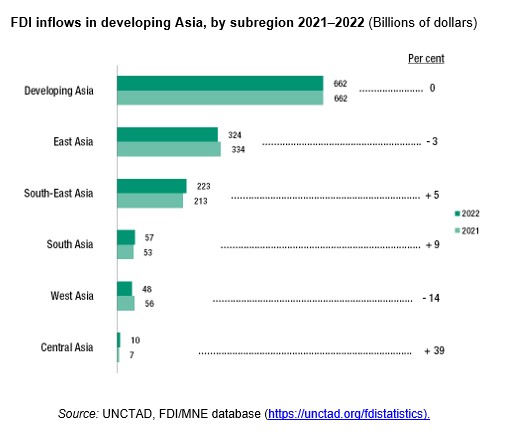

Foreign direct investment (FDI) in developing countries in Asia remained flat at $662 billion in 2022, about half of global inflows, according to UNCTAD’s World Investment Report 2023 published on 5 July.

Inflows were highly concentrated. Five economies (China, Singapore, Hong Kong (China), India and the United Arab Emirates, in that order) accounted for almost 80% of FDI to the region.

In East Asia, inflows to China rose by 5% to $189 billion, mainly in manufacturing and high-tech industries and mostly from European multinational enterprises (MNEs). Flows to Hong Kong (China) fell by 16% to $118 billion.

In South-East Asia, Singapore, the largest recipient, registered another record, up 8% to $141 billion. Flows to Malaysia grew by 39% to $17 billion – a new record for the country.

FDI to Viet Nam and Indonesia rose by 14% and 4%, to $18 billion and $22 billion, respectively. FDI to the Philippines fell by 23% as a result of several divestments.

In West Asia, flows to Saudi Arabia fell by 59% to $7.9 billion. FDI to the United Arab Emirates increased by 10% to $23 billion – the highest amount ever recorded. The country attracted the fourth-highest number of greenfield projects in the world. Flows to Türkiye rose by 9% to $13 billion.

In South Asia, FDI flows to India rose by 10% to $49 billion as the country became the third-largest host country for greenfield project announcements and the second-largest for international project finance deals. FDI in Bangladesh grew by 20% to $3.5 billion.

In Central Asia, flows to Kazakhstan almost doubled to $6.1 billion, mainly in extractive industries. FDI also rose in Uzbekistan, by 11%, to $3 billion.

Flows rise in all major regional economic groupings

Over the past five years, FDI flows increased in all major regional economic groupings in developing Asia. FDI in in the member States of the Association of Southeast Asian Nations grew by 41%, to $222 billion.

Flows increased also in the Regional Comprehensive Economic Partnership (up 42%, to $580 billion), among the countries of the Gulf Cooperation Council (where they more than doubled, to $37 billion) and in member States of the South Asian Association for Regional Cooperation (up 20%, to $56 billion).

In 2022, the share of intraregional greenfield project announcements rose to 24% of all projects announced in developing Asia (30% in terms of value), compared with 21% in 2017. Looking at projects of Asian MNEs only, 47% were in the region, up from 40% in 2017.

Across developing Asia, investment in sectors relevant for the achievement of the Sustainable Development Goals rose.

The number of announced greenfield project numbers in these sectors grew by 32%, to 921, primarily because of strong interest in renewables, transport services and telecommunication. The number of international project finance deals rose moderately, by 6%.

China and Hong Kong (China) continue to be the largest investors in the region, followed by the United States, Japan and Singapore.

-----------------------------------------------

About UNCTAD

The United Nations Conference on Trade and Development (UNCTAD) promotes inclusive and sustainable development through trade, investment, finance, and technology.

UNCTAD's World Investment Report is a leading publication that provides analysis and insights into global investment trends and policies.

World Investment Forum

The key findings of the World Investment Report 2023 will inform discussions at UNCTAD’s 8th World Investment Forum to be held in Abu Dhabi from 16 to 20 October 2023 under the theme "Investing in sustainable development".

The forum will bring together government leaders, global CEOs, policymakers and other stakeholders to find solutions and reach consensus on priority issues. Its outcomes will feed into negotiations at the annual climate summit COP28, which will also be held in the United Arab Emirates.

-----------------------------------------------