Global Investment Trends Monitor, No. 49

Industry and infrastructure project announcements are 15% lower. Deal pace is accelerating in the third quarter.

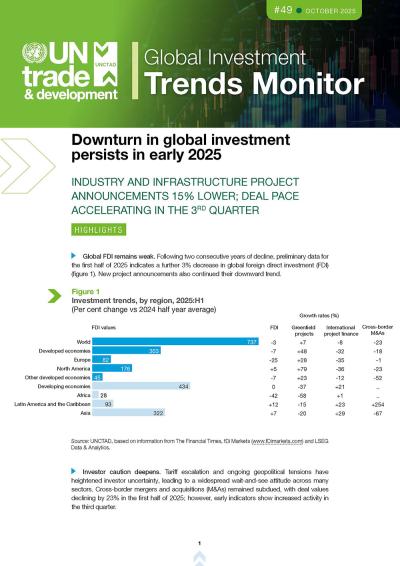

Following two consecutive years of decline, preliminary data for the first half of 2025 indicates a further 3% decrease in global foreign direct investment (FDI).

New project announcements also continued their downward trend.

Infrastructure and manufacturing take a hit

The value of international project finance deals – primarily concentrated in infrastructure sectors – fell by 8%.

Greenfield investment project announcements, mostly in industrial sectors, also declined, dropping by 17% in number. Supply chain-intensive manufacturing sectors were especially affected.

Bright spots in the digital and AI sectors

Despite fewer projects, the total value of greenfield announcements rose by 7%.

Announced greenfield project values in the first half of 2025 were significantly lifted by continued investment growth and major projects in the digital economy and AI-related sectors.

SDG investment faces mounting challenges

The global investment climate remains tough for sectors critical to the Sustainable Development Goals (SDGs).

Following a sharp decline in 2024, preliminary data from the first four months of 2025 shows a further 10% drop in the number of SDG-related investment projects.

Projects in least developed countries are on track to fall by another 5% in 2025, possibly reaching their lowest level since 2015.

Outlook: persistent headwinds

Looking ahead, the international investment environment is expected to remain challenging throughout the remainder of 2025.

Geopolitical tensions, regional conflicts, economic fragmentation, evolving industrial policies, and multinational efforts to de-risk supply chains are likely to continue weighing on FDI flows.

Nevertheless, easing financial conditions, rising merger and acquisition (M&A) activity in the third quarter, and higher overseas spending by sovereign wealth funds could support a modest rebound by year-end.