Written by

Christopher Garroway and Chantal Line Carpentier of UNCTAD

Progress on fulfilling the Financing for Sustainable Development Agenda is slower than ever. This article considers constraints to financing the Sustainable Development Goals (SDGs) and addresses key obstacles: heightened geopolitical tensions around trade and technology, growing external debt amidst unresolved systemic issues; unmet expectations about private-public collaboration for development finance.

Progress on fulfilling the Financing for Sustainable Development Agenda is slower than ever. This article considers constraints to financing the Sustainable Development Goals (SDGs) and addresses key obstacles: heightened geopolitical tensions around trade and technology, growing external debt amidst unresolved systemic issues; unmet expectations about private-public collaboration for development finance.

There are opportunities to galvanize joint efforts at the UN and beyond. The authors offer reflections on potential ways forward.

There are opportunities to galvanize joint efforts at the UN and beyond. The authors offer reflections on potential ways forward.

The September 2019 Dialogue on Financing for Development (FfD), held in the General Assembly back-to-back with the Political Forum Summit, marks four years since agreement on the Addis Ababa Action Agenda (AAAA) and nearly two decades since adoption of the Monterrey Consensus. For almost a generation, global cooperation on Financing for Development has had a unifying framework to guide the partnership and implementation efforts needed to achieve the Sustainable Development Goals (SDGs) and the Millennium Development Goals that preceded them. Yet, progress on fulfilling the Financing for Development commitments is slower today than it has ever been. As world leaders assess progress in the first four years of the SDGs and their implementation, there is an opportunity for a frank assessment of the lack of progress on financing for development, and to address the key obstacles in its way.

Since 2002, the Group of Friends of Monterrey has offered an informal space for dialogue and an exchange of ideas among governments, international organizations, business representatives and civil society on how to make progress on Financing for Development commitments. At the most recent meeting of the Group in Mexico City, three major obstacles stood out as key constraints on the action areas of the Addis Agenda, hampering the current global enabling environment:

-

Heightened geopolitical tensions around trade and technology.

-

Growing external debt amidst unresolved systemic issues.

-

Unmet expectations about public-private collaboration for development finance.

This article addresses these three obstacles in turn and offers potential ways forward.

With a "technological cold war" brewing, the trade agenda has moved away from development

First, discourse around international trade has moved further away from the financing for development agenda than it has been in a generation. In recent years, the world has witnessed a rise in unilateral actions, trade tensions and protectionist measures that largely circumvent multilateral processes. Despite existing commitments that international trade should play a central role – SDG targets 17.10-17.12 and Chapter 2D of AAAA – in achieving the SDGs, amidst persistent inequalities and a globalization that has left too many people and countries behind, today appeals to the mutually beneficial gains from trade ring increasingly hollow, replaced by the simpler notion that trade is a zero-sum game.

Consequently, transformative concepts that developing countries have long rallied around, such as industrial policy and technology transfer, are being stripped of their development connotation and increasingly weaponized in what many are calling a trade war, but which in many respects has the potential to become a much longer technological cold war. Indeed, discussion about harnessing benefits of international trade and international cooperation in science, technology and innovation to finance development is currently farther away than it was two decades ago at Monterrey.

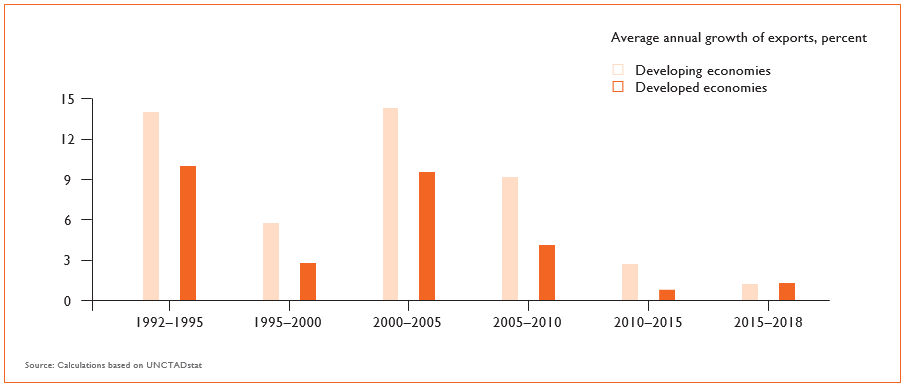

In particular, trade tensions between the United States and China and the potential departure of the United Kingdom from the European Union (BREXIT) have negative implications for a number of developing countries. Trade tensions between the world’s two largest economies have had a negative impact on global trade growth, compounding the longer-term downward trend of export growth post-crisis, which is already far below the averages of previous decades (Figure 1).

Figure 1: Trade has slowed in developing and developed economies

Rising US-China tariffs could divert some bilateral trade to countries that are close competitors of Chinese and American companies, and it is feared that this could significantly hurt some industries in developing countries, especially those tightly integrated into Chinese or American supply chains, as those of many ASEAN countries are. Continued escalation could generate further knock-on effects, reducing global import demand and weakening long-term growth prospects, including for developing countries and vulnerable LDCs, LLDCs and SIDS.

BREXIT could change access to the United Kingdom’s market for a number of countries, and uncertainty around the United Kingdom’s trade policy could noticeably impact the global economy and the economies of a number of LDCs. According to UNCTAD estimates, a no-deal BREXIT could push the UK into recession and reduce EU exports by 35 billion US dollars per year if Europe loses preferential access to UK markets. It would also harm the competitiveness of many non-EU countries, especially LDCs, e.g. Cambodia (- 12 percent), Madagascar (- 14 percent), Mozambique (- 32 percent), Myanmar (12 percent) and Nepal (- 20 per- cent). 1 Even if these LDCs retain duty free access to UK markets, their exports will decline, as they can no longer compete with foreign competitors who benefit from the UK‘s most-favoured nation tariffs post-BREXIT.

Mindful of many of these challenges, a number of countries have sought to pursue reforms of the multilateral trading system, including modernizing and reforming rule-making, transparency and dispute-settlement functions at the World Trade Organization (WTO). One of the central issues in these discussions is how to promote development in the WTO through special and differential treatment (SDT), which is a mechanism that has allowed developing countries to opt out of many of the most constraining WTO rules that prevent poor countries from participating fairly in international trade.

In the reform discussion there is little consensus among WTO members on whether current SDT provisions provide a disproportionate level of flexibilities to large developing economies. One group of WTO members is highly critical of the principle that allows Member States to »self-declare« as developing countries, arguing that this principle allows them to unfairly exploit SDT provisions to protect their markets, while reaping benefits from global trade. Conversely, another WTO group supports the principle of self-declaration, contending that development cannot be measured solely by economic indicators. A potential resolution of this sensitive issue might be offered by the principle of »common but differentiated responsibilities«, whereby countries agree voluntarily to assume additional commitments according to their capacities instead of being obligated to do so statutorily.2 Whichever way this debate goes, it is crucial that any reform of the multilateral trading system move development and sustainable development issues back to its core.

Discussions at the WTO about adopting rules for electronic commerce have also failed to find a consensus, despite increased interest in the digital economy as a potential source of trade growth. Global electronic commerce sales grew 13 percent in 2017 to an estimated 29 trillion US dollars. business-to-business (b2b) e-commerce continues to dominate – accounting for 88 percent of all online sales – but the fastest-growing segment is business-to-consumer (b2C), increasing by 22 percent to 3.9 trillion US dollars in 2017. Indeed, cross-border b2C sales reached an estimated 412 billion US dollars in 2017, accounting for almost 11 percent of total b2C e-commerce.

Countries remain divided over whether to pursue e-commerce discussions at the WTO through the recently launched plurilateral Joint Statement Initiative on electronic commerce, or under the existing 1998 Work Programme on electronic commerce at the WTO, which was agreed multilaterally more than two decades ago. The majority of developing countries and LDCs have declined to participate in this recent plurilateral dialogue. In this case as well, which-ever way the debate goes, it is highly important from a financing for development perspective that any negotiations on electronic commerce put development issues and ways of addressing the widening digital divide between countries at the centre of discussions.

The crisis of the multilateral trading regime opens the door to reform that could make trade deliver on its promises while addressing inequalities and environmental consequences, thus making it a true engine for sustainable development as called for by Agenda 2030. It could build on the increasing number of regional trade agreements (RTAs) containing chapters addressing sustainable development and gender mainstreaming in trade policy and the modernization of the International Investment Agreements that contain actions to make these treaties more sustainable development-friendly.

Rising external debt in developing countries is putting SDG achievement at risk

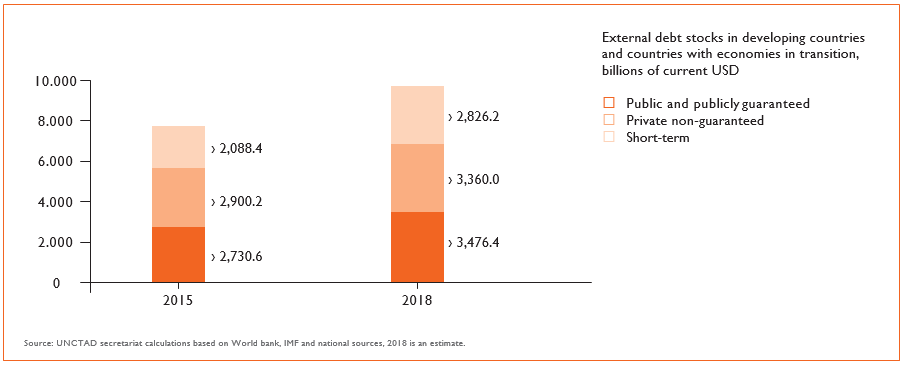

The second key reason we are further behind on SDG finance is the mounting debt crisis in developing countries. Global debt levels have continued to set new records and grew to 247 trillion US dollars in July 2019, up from 168 trillion US dollars in 2008 at the start of financial crisis.3 Levels of external indebtedness are at an all-time high in developing countries, which have seen both their public and private debt burdens grow by one third over the last decade. External debt stocks in developing countries now amount to approximately 10 trillion US dollars (Figure 2). Amidst the uncertain global conditions described above, many developing countries are experiencing default, distress or rapidly growing vulnerabilities.

Figure 2: External debt in developing countries is at an all-time high

Some 40 percent of low-income countries are already in debt distress. Crucially, the major implication is higher debt-service burdens, which prevent countries from investing in SDG-specific sectors. UNCTAD calculates that if developing countries are to achieve both their SDGs and long-term debt sustainability, their average fiscal gap equals 10 percent of GDP.

Trade tensions, volatile commodity prices and the growing incidence of natural and climate change related disasters will only further aggravate debt vulnerabilities in developing countries, especially in small island developing states (SIDS). With the devastating recent hurricane seasons in the Caribbean and the damage wreaked by Cyclone Idai on Mozambique, Malawi and Zimbabwe, addressing the confluence of climate and financial vulnerability is more urgent than ever before. Innovative approaches to climate debt swap facilities, such as proposed by ECLAC in this year’s Report of the Inter-Agency Task Force on Financing for Development, offer an encouraging way forward, but given the stakes, further concrete proposals to tackle these problems at an international level are needed.

Promotion of soft law principles such as the UNCTAD Principles for Responsible Sovereign Lending and borrowing is another fruitful avenue to pursue, but the international community should also consider revisiting discussions of statutory approaches to a Sovereign Debt Restructuring Mechanism for countries in default and creating a well-endowed global climate disaster fund. Going forward it is also critical that the analysis of the issue of debt sustainability start with the massive investments needed to achieve the SDGs.4

Given the global nature of many of the determinants of developing country debt sustainability, the Financing for Development follow-up process also needs to re-initiate discussions of policy reform at the level of international monetary and financial governance. Developing countries are currently facing an asymmetric international monetary system which exposes them to the risk of balance of payments crises and volatile exchange rates, which adversely impacts their trade and investment decisions. Therefore, it should remain a paramount objective of the Financing for Development follow-up process to work towards a more development-friendly financial system, which would be focused on proactive facilitation of structural transformation in developing countries.

Private sector SDG finance is focused on advocacy, rather than action, especially for the furthest behind

The sizable SDG investment gap, which UNCTAD calculates at approximately 2.5 trillion US dollars annually, underpins the third major obstacle slowing progress on the Financing for Development commitments: the uneven and unrealistic expectations that many policymakers place on the private sector’s role in SDG financing.

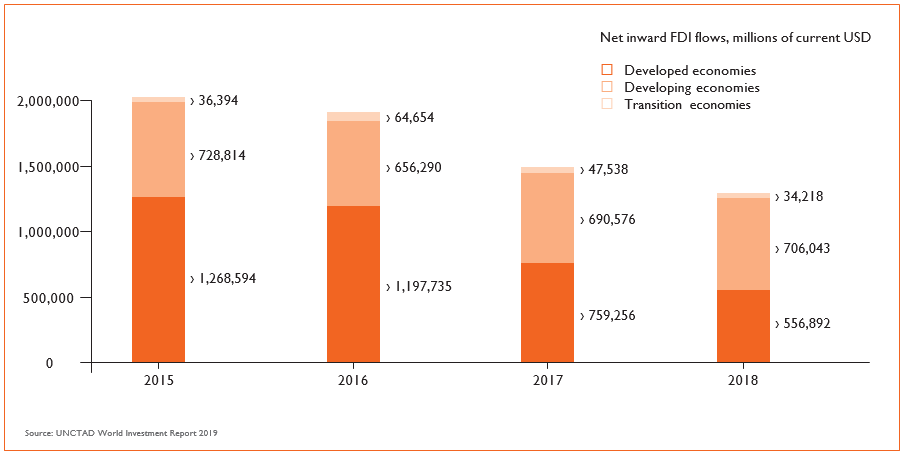

Over the past four years too much time and ink has been spent extolling the virtues of the private sector’s role in SDG financing, with too few concrete results to show for it, as statistics clearly suggest. Foreign Direct Investment (FDI) inflows were down another 13 percent this past year to 1.3 trillion US dollars (Figure 3), reaching their lowest level since 2004.

Figure 3: Global foreign direct investment is in steady decline

In particular investments in LDCs and in Africa have been insufficient to meet their SDG financing needs. Only seven percent of the 81 billion US dollars in private finance mobilized for development between 2012–2015 goes to LDCs.5 Even in the public sector, new facilities to help raise private investment remain in many cases untapped, or far below the scale needed. For example, the World bank‘s IDA18 Private Sector Window‘s one billion US dollars risk mitigation facility for low-income countries is barely on track to spend half that amount.6 Similarly, recent studies of blended finance, which has been highly touted as a key instrument for unlocking private sector financing in the SDGs, have shown that the amounts that blending efforts generate from additional sources of financing are substantially below the scale needed to go from »billions to trillions«. For example, a recent ODI study finds that for every one US dollars of multilateral development bank and development finance institution investment in developing counties, on average only 0.75 US dollars of private finance is mobilized. This amount falls to 0.37 US dollars in low-income country contexts.7

The barriers holding back meaningful private sector investment are both systemic in nature and closely related to national capacities, especially in the poorest countries. SDG investment policies at the national level are hard won and require both willing domestic and foreign private sectors, but also a dynamic public sector. Many developing countries simply do not have the basic capacity to seek financing for their SDG priorities. The dramatic increase in requests for technical assistance to build capacity in this area, including national financing frameworks, which many members of the UN System have received from developing countries since agreement on the Addis Ababa Action Agenda, testifies to this fact.

With limited new sources of development finance, including from private sector actors, the demand from policymakers and government remains palpable. Just last October, UNCTAD’s World Investment Forum brought together a record 11 heads of state and government, over 50 ministers, 50 CEOs and more than 6000 participants all looking for new ways to spur private sector investment in developing countries in pursuit of the SDGs. but much greater efforts are needed, especially along the sectoral and regional dimensions, indeed even along municipal dimensions.

A potential way forward

Meeting this demand must become an overarching objective not just of the UN system, but also of its member states and their private sector and civil society actors. From the UN Secretary-General’s SDG Financing Strategy to the upcoming high-Level Dialogue on FfD, there are ample opportunities to re-galvanize joint efforts. Adequate political will, however, is required.

The 15th session of UNCTAD, which will take place in Barbados in October 2020, as well as the next World Investment Forum, which will be held in 2020 in the United Arab Emirates, will also offer important opportunities to assess and adopt new approaches to scaling up our collective efforts to overcome these obstacles. but if there is to be a decisive change in course, the biggest players and deepest pockets need to treat the lack of progress in the last four years more seriously and more urgently.

Steps forward:

-

To put TRADE back on track, we need to put sustainable development at the heart of the multilateral trade regime, building on existing experience from the investment regime and regional trade agreements.

-

To deal with rising debt vulnerabilities while still making the large investments needed to achieve the SDGs, we need to promote the UNCTAD Principles for Responsible Sovereign Lending and borrowing, explore Sovereign Debt Restructuring Mechanisms for countries in default, and create a well-endowed global climate disaster fund and decarbonization bank.

-

To address unmet expectations about public-private collaboration for development finance, we need increased knowledge-sharing and evidence to improve blended finance practices and to speed up documentation of the type of financing/ funding, whether private/ public or blended, that is best suited by sector and type of country so as to ensure that the countries that need it the most are not completely left behind.

Why are we behind on SDG finance and what can we do about it?

To put TRADE back on track, we need to put sustainable development at the heart of the multilateral trade regime, building on existing experience from the investment regime and regional trade agreements.

To put TRADE back on track, we need to put sustainable development at the heart of the multilateral trade regime, building on existing experience from the investment regime and regional trade agreements.

To deal with rising debt vulnerabilities while still making the large investments needed to achieve the SDGs, we need to promote the UNCTAD Principles for Responsible Sovereign Lending and borrowing, explore Sovereign Debt Restructuring Mechanisms for countries in default, and create a well-endowed global climate disaster fund and decarbonization bank.

To deal with rising debt vulnerabilities while still making the large investments needed to achieve the SDGs, we need to promote the UNCTAD Principles for Responsible Sovereign Lending and borrowing, explore Sovereign Debt Restructuring Mechanisms for countries in default, and create a well-endowed global climate disaster fund and decarbonization bank.

To address unmet expectations about public-private collaboration for development finance, we need increased knowledge-sharing and evidence to improve blended finance practices and to speed up documentation of the type of financing/ funding, whether private/ public or blended, that is best suited by sector and type of country, so as to ensure that the countries that need it the most are not completely left behind.

To address unmet expectations about public-private collaboration for development finance, we need increased knowledge-sharing and evidence to improve blended finance practices and to speed up documentation of the type of financing/ funding, whether private/ public or blended, that is best suited by sector and type of country, so as to ensure that the countries that need it the most are not completely left behind.

- UNCTAD, BREXIT. Implications for Developing Countries. 2019.

- Dr. Mukhisa Kituyi, "Revitalizing Trade" in UNA-UK publication SDGs: Transforming our world, 19 June 2019.

- Institute of International Finance, "Global Debt Monitor: July 2019", 2019.

- Inter-Agency Taskforce on FFD, UN. "Financing for Sustainable Development Report 2019" 2019.

- UNCDF, "Blended Finance in the LDCs", 2018.

- International Development Association: World bank, "WB IDA18 PSW Statistics", 2018.

- Samantha Attridge and Lars Engen, "Blended finance in the poorest countries: the need for a better approach", ODI, London, April 2019.

Read the original article on Friedrich-Ebert-Stiftung