The 14th International Debt Management Conference renewed urgent calls to reform the global financial system so debt can support – not hinder – development.

It brought together:

- Over 600 participants from 107 countries, including senior debt managers, government officials, academics, and representatives from international organizations, civil society and the private sector.

- 20 United Nations entities working together to advance solutions.

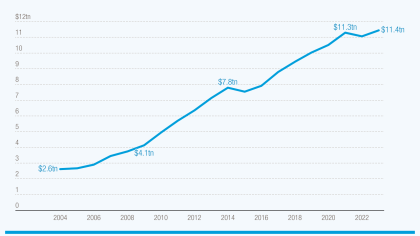

In 2023, developing countries’ external debt hit a record $11.4 trillion – equal to 99% of their export earnings. Rising debt burdens are forcing governments into tough trade-offs.

In her opening remarks, UN Trade and Development (UNCTAD) Secretary-General Rebeca Grynspan warned that too many countries are forced to “default on their development to avoid defaulting on their debt.”

Today, 3.3 billion people live in countries that spend more on debt payments than on health or education. In most developing nations, interest payments outweigh climate investments.

The conference featured nine expert panels examining the root causes of today’s debt-driven development crisis.

The message was clear: As debt challenges grow in scale and complexity, existing tools are falling short. Stronger global cooperation and more innovative debt management solutions are needed to break the cycle of unsustainable debt and build a more resilient, inclusive future.

DMFAS 7 software gives debt management a boost

A key focus of the conference was UNCTAD’s Debt Management and Financial Analysis System (DMFAS), which has helped more than 80 institutions across 60 countries improve transparency, governance and economic stability.

The event marked the launch of DMFAS 7, an upgraded version of the software that improves debt recording, monitoring and reporting.

After the conference, the DMFAS advisory group met to review capacity-building efforts and set future priorities.

Setting the stage for global action

As the world heads toward the 4th International Conference on Financing for Development (FfD4) later this year, the UNCTAD Debt Management Conference set the stage for concrete solutions to reduce debt distress while protecting sustainable development.

News

Featured Remote Videos

Many developing countries are sinking into a debt-driven development crisis, with their external debt hitting a record $11.4 trillion in 2023 – 99% of their export earnings.

Public debt itself is not a problem. It can be an essential tool for financing sustainable development. But debt can become a problem when debt servicing costs increase more than a country’s capacity to pay.

This is now the reality for two thirds of developing countries. Their public sector debt sustainability deteriorated between 2017 and 2023 as interest payments outpaced government revenues.

Cascading global crises – COVID-19, a worsening climate crisis, a cost-of-living crisis and geopolitical tensions – have aggravated developing countries’ challenges and eroded their fiscal space. Over half of the 68 countries eligible for the International Monetary Fund’s Poverty Reduction and Growth Trust now face debt distress – more than double the 2015 level.

Yet this figure understates the scale of the crisis. Many other developing countries also face mounting difficulties. But most governments are reluctant to default because existing debt workout mechanisms are inefficient and costly. Instead, they prioritize their public debt commitments over development goals and climate action

As a result, countries may not be defaulting on their debt, but they are defaulting on their development. Surging debt-service costs already crowd out vital investments. Today, 3.3 billion people live in countries that spend more on debt payments than on health or education, including three billion in middle-income countries.

A conference to drive debt solutions

Held every two years, the UN Trade and Development (UNCTAD) International Debt Management Conference brings together senior debt managers, government officials and delegates, academics, and representatives of international organizations, civil society and the private sector.

It provides a platform to discuss and share experiences on critical developments and challenges in the debt landscape of developing countries, and debt management issues in the broader global economic context.

The 14th session of the conference will explore the drivers and possible solutions to the current debt-driven development crisis, as well as innovative debt management strategies, focusing on building resilience, managing risks and navigating the complexities of global crises.

With the 4th International Conference on Financing for Development (FfD4) fast approaching, the 14th UNCTAD Debt Management Conference will contribute to setting the tone for the financing for development agenda, of which debt is a critical element.

Programme

- Panel 1: Searching for solutions: Breaking out of the debt morass?

In the context of massive financing gaps to achieve the SDGs and debt servicing costs draining resources available for development there are several UN processes underway to address the debt and development crisis. The UNSG recently appointed an Expert group to provide practical solutions to break out of the development morass and galvanize support for action on debt.

This Panel will provide insights from current international initiatives working for solutions including, the G20, the Pact for the Future and the Fourth International Conference on Financing for Development.

- Panel 2: Liquidity vs Solvency: Debates around debt sustainability and development

Since the Debt Service Suspension Initiative and the Common Framework of the COVID-19 period, there has been much debate as to whether developing countries are experiencing liquidity or solvency problems, and how the solutions can be best framed to ensure that development is not compromised by privileging costly debt servicing.

This panel considers aspects of this debate and ongoing changes in diagnostics including debt sustainability analyses.

- Panel 3: Legal tools: Consensus building and rulemaking in a fragmented debt landscape

Rule-making initiatives, whether soft or hard law, are crucial to building consensus tackling unsustainable debt. Soft law instruments such as the UNCTAD Principles on Promoting Responsible Sovereign Lending and Borrowing identify overarching rules in response to the problems in sovereign debt practices. While not legally binding, they are critical in fostering country consensus on guiding norms. Contractual innovations and domestic legislation can assist where international norms are absent.

This panel will discuss legislative efforts, contractual tools, and soft law.

- Panel 4: Governance, accountability and transparency in a world of fiscal constraints

Public debt accountability is vital during both prosperous and challenging times. Regular and transparent debt data dissemination, along with robust parliamentary oversight and comprehensive audits, are essential components of good governance in debt management. Accountability in the fiscal realm is key to ensure effective management of public finances as well as long term debt sustainability.

This panel will explore how governments have adopted measures to strengthen public debt governance and accountability through transparent reporting, parliamentary oversight, comprehensive audits, and well-designed fiscal rules.

- Panel 5: Debt-climate nexus: Innovative debt instruments to manage fiscal risk

Developing countries with high debt and climate vulnerabilities face a vicious cycle where disaster recovery and climate-resilient structural transformation require investment, leading to costly borrowing increase and deteriorated debt sustainability, perpetuating underinvestment in climate actions. Novel financial instruments are needed to enhance flexibility and resilience in public debt management amid shifting economic challenges.

This panel will delve into innovative debt instruments that can equip policymakers and practitioners to effectively navigate complex debt landscapes and break out the debt-climate vicious cycle.

- Panel 6: Elevating debt transparency: Rethinking reporting and ensuring quality standards

In today's interconnected financial landscape, the accuracy and reliability of debt data are essential for fostering trust and facilitating sound policymaking.

This session explores the significance of robust debt statistics and data quality, highlighting best practices and international standards that drive transparency and ensure effective debt management. It explores the methodologies for collecting, compiling, disseminating, and interpreting debt statistics, covering the evolving global requirements aimed at fostering transparency in debt reporting.

- Panel 7: Strategies for managing institutional challenges for a sustainable debt management office

A skilled and sustainable debt management office is essential to producing quality debt data and statistics. Addressing capacity- building needs and managing staff turnover are key priorities to achieve this. The specialized and technical nature of debt management results in the difficulties to recruit and retain staff. High staff turnover creates substantial disruptions, compounded by factors such as unplanned reassignments, low incentives, and private sector competition for human resources.

This panel explores strategies for managing institutional challenges for sustainable debt management offices.

- Panel 8: Making connections: Public debt and IFMIS challenges

Integrating public debt management with other core components of public financial management - such as treasury, budgeting and accounting - enhances financial oversight, reduces risk and supports better fiscal governance. But how does a government connect the distinctive features of a debt management system to other components of a public financial management system? What are the factors to consider? What are the challenges? And what is best practice?

This panel will include country case studies as well as Integrated Financial Management Information System (IFMIS) experts.

- Panel 9: New requirements for debt management systems: How are they measuring up?

Debt trends and advancements in information technology are evolving rapidly, adding new layers of complexity to effective debt management. This growing complexity necessitates updated requirements for debt management systems.

This panel explores these emerging requirements and examines the current and planned support from the international community aimed at assisting governments to strengthen their debt management capacities in a sustainable way. It delves into areas such as system enhancements, capacity development, and technical assistance, while also identifying additional measures needed to address future challenges effectively.

Conference participation and registration

The 14th Debt Management Conference will be held in person in Room XIX at the Palais des Nations in Geneva, Switzerland. Registration is required.

Only eligible participants may attend in person. Others can follow the discussions online (audio only). Registered participants unable to attend in person will receive a link to access the live audio stream in the six official UN languages one day before the session begins.

Who can attend in person?

In-person participation is open to:

- Government officials and delegates from UNCTAD member states

- Representatives of other organizations, including specialized agencies, intergovernmental bodies and accredited non-governmental organizations (general and special categories) as observers

- Academics and private sector representatives as observers

- Experts with proven expertise in the subject matter

Related meeting: Debt Management and Financial Analysis System (DMFAS) Advisory Group

Following the Debt Management Conference, the DMFAS Advisory Group will convene donors, beneficiaries and partners to examine the programme’s capacity-building activities and discuss future priorities and strategic direction.

Who can participate in the advisory group?

Participation is limited to countries using UNCTAD’s debt management software. Register for the DMFAS meeting.

In September 2021, Rebeca Grynspan was appointed Secretary-General of the United Nations Conference on Trade and Development (UNCTAD), becoming the first woman to lead the organization in its 60-year history.

Rebeca Grynspan, an economist and former Vice President of Costa Rica, is an experienced leader of international institutions with a substantive track record in government, UN diplomacy, economic policy and multilateral cooperation at the global level.

Prior to joining the United Nations, she was Vice President of Costa Rica and held cabinet positions as Minister of Housing, Minister Coordinator of Economic and Social Affairs and Deputy Finance Minister.

Previously, she served as Secretary-General of the Ibero-American Conference (2014–2021), chairing regional summits of Heads of State and Government; United Nations Under-Secretary-General and Associate Administrator of the United Nations Development Programme (UNDP); and UNDP Regional Director for Latin America and the Caribbean. She was a member of the UN Commission for the Reconstruction of Haiti, representing the UN Secretary-General.

At UNCTAD, Grynspan has been at the centre of critical negotiations to address global trade and development challenges. She played a decisive role in the successful Black Sea Grain Initiative brokered between the UN, Türkiye, the Russian Federation and Ukraine, which enabled the safe export of over 32 million tons of grain, lowered global food prices by 22% and prevented millions from falling into food insecurity. She also leads the UN Global Crisis Response Group on food, energy and finance, and has represented the UN in G20 summits.

Her leadership has been recognized widely. In 2024, she received the Doha Negotiator of the Year Award for spearheading UN efforts to restore Black Sea trade routes. In 2025, Spain’s Ministry of Foreign Affairs, European Union and Cooperation awarded her the inaugural Isabel Oyarzábal Women in Multilateralism International Prize for her contribution to multilateralism.

Ms. Grynspan holds degrees in economics from the University of Costa Rica and the University of Sussex, and honorary doctorates from several European universities.

The Honourable Mia Amor Mottley, Q.C., M.P., became Barbados' eighth and first female Prime Minister on 25 May 2018.

Ms. Mottley was elected to the Parliament of Barbados in September 1994 as part of the new Barbados Labour Party Government.

Prior to that, she served as one of two Opposition Senators between 1991 and 1994. One of the youngest persons ever to be assigned a ministerial portfolio, Ms. Mottley was appointed Minister of Education, Youth Affairs and Culture from 1994 to 2001.

She later served as Attorney General and Deputy Prime Minister of Barbados from 2001 to 2008 and was the first female to hold that position.

Ms. Mottley is an Attorney-at-law with a degree from the London School of Economics, specialising in advocacy. She is also a Barrister of the Bar of England and Wales.

In 2002, she became a member of the Local Privy Council. She was also admitted to the Inner Bar, becoming the youngest ever Queens Counsel in Barbados.

The Secretary of State in the Office of Finance, Licenciado Christian David Duarte Chávez, has a distinguished academic and professional career focused on public finance, the tax system, and economic policy. His primary objective as head of the Secretariat of Finance is to uphold the Constitution of the Republic, the laws, and the Government Plan of President Xiomara Castro.

In 2022 and 2023, he served as Vice Minister of the Revenue Administration Service (Servicio de Administración de Rentas, SAR). Starting in 2023, he assumed the role of Minister-Director of the institution, a position he held until September 2024. During his tenure, he spearheaded the restructuring of Honduras' tax system through both administrative reforms and structural measures, such as the Ley de Justicia Tributaria (Tax Justice Law), negotiations for a Free Trade Agreement with China, and audits of energy-generating companies under the framework of the Ley de Rescate de la ENEE (ENEE Rescue Law).

Between 2017 and 2020, Duarte held leadership positions in the Tribunal Superior de Cuentas (Supreme Court of Auditors).

Christian Duarte holds a degree in Economics (Licenciado en Economía) from the Universidad Nacional Autónoma de Honduras (UNAH) and a Master’s in Government and Public Affairs from the Facultad Latinoamericana de Ciencias Sociales (FLACSO), Mexico.

H.E. Pen Thirong is a Secretary of State of the Ministry of Economy and Finance (MEF), and a Deputy Secretary General of the Steering Committee of Public Financial Management Reform, who leads the preparation of draft rules and regulations for managing public investment projects. He is also a member of the Supreme National Economic Council (SNEC), Director for Cambodia to the ASEAN Infrastructure Fund (AIF) Board of Directors, and Alternate Director of the Asian Infrastructure Investment Bank (AIIB) for Cambodia, Indonesia, Lao People's Democratic Republic, Sri Lanka, and Timor-Leste.

He holds responsibilities for overall work in relation to public investment financed by external and domestic borrowing and grants, and management of public debt. He leads the technical team in the preparation of rules, regulations, and policy frameworks for managing public investment projects and public debt management including the development of government securities.

He was an Under Secretary of State of the Ministry of Economy and Finance (MEF) for four years from June 2020 to September 2024. Previously, he served as a Director General of the General Department of International Cooperation and Debt Management, MEF; an Advisor to ADB's Board of Directors, Manila, Philippines; a Deputy Director of the Department of Investment and Cooperation, Chief of ADB Unit; and a Financial Officer of the MEF.

H.E. PEN Thirong holds a Master in Business Administration from the Ateneo De Manila University, Graduate School of Business, Manila, Philippines; and a Master in Financial Economics from the University of London, England.

Paolo Gentiloni served as European Commissioner for Economy from 2019 to 2024.

In December 2024, the United Nations Secretary-General appointed him Co-Chair of the Group of Experts to Promote Policy Solutions for Resolving the Debt Crisis. He is also a nonresident Distinguished Fellow at the Brookings Institution.

Previously, he served as Prime Minister of Italy (2016–2018), Minister of Foreign Affairs and International Cooperation (2014–2016), and Minister of Communications (2006–2008).

From 2001 to 2019, Gentiloni was a member of the Italian Parliament, where he served as Chairman of the Broadcasting Services Watchdog Committee (2005–2006) and as a Member of the Foreign Affairs Committee (2013–2014).

Earlier in his career, he worked as a professional journalist and served as a Councillor for the City of Rome (1993–2000).

He was also one of the 45 founding members of the Democratic Party (Partito Democratico – PD) and led the party as its President from 2018 to 2019.

Born in 1954, he graduated in Political Science from La Sapienza University in Rome. His most recent book is La sfida impopulista (The (Un)populist Challenge, Rizzoli).

Penelope Hawkins is the Officer-in-Charge of the Debt and Development Finance Branch within UN Trade and Development (UNCTAD), a branch that includes the Debt and Development Finance Research Unit as well as the Debt Management and Financial Analysis System (DMFAS) Programme, which currently facilitates the debt recording and management in over 60 developing countries.

In her current position, Ms. Hawkins researches and engages with member country representatives and the broader civil and academic society on sustainable sovereign debt, financing for development, and the nexus between debt and climate finance. She represents UNCTAD at the G20 International Financial Architecture Working Group meetings and is the G20 Finance Deputy to UNCTAD Secretary-General Rebeca Grynspan. She also represents UNCTAD in several fora, including most recently at the Fourth International Finance for Development Conference (FFD4), G24 meetings in Washington DC and BRICS meetings.

Previously, as the founder and Managing Director of Feasibility (Pty) Ltd, Ms. Hawkins undertook leading research projects in the financial sector in Southern Africa, commissioned by regulators, policy makers and the private sector.

Her expertise in the financial sector stems from her published work. She holds a PhD in economics from the University of Stirling, Scotland, and an M.A. in economics (cum laude) from the University of South Africa.

Allison Holland leads the Debt Policy Division of the Strategy, Policy, and Review Department of the International Monetary Fund since July 2023.

She has been with the IMF for over 18 years in a variety of roles including Mission Chief for Zambia and Somalia, supporting them through complex debt relief operations, as well as for Oman; overseeing the Regional Economic Outlook for the Middle East and Central Asia; and as a public debt management expert in the Monetary and Capital Markets Department.

Prior to joining the IMF, Ms. Holland worked for almost 12 years in the UK public sector—including the Bank of England, and senior roles at the Ministry of Finance and UK Debt Management Office.

Dr. Patrick Ndzana Olomo is Economist, Acting Director Economic Development, Integration and Trade Directorate and Head of Economic Policy and Sustainable Development Division and Coordinator of the Productive Transformation and Regional Value Chain Initiatives at the African Union Commission (AUC) in Addis Ababa, Ethiopia.

His work includes contributing to Africa’s economic transformation through regional value chains, industrialization, financial Sector Development and Regional Integration in Africa.

Before joining the Commission, he served as Lecturer, at Omar Bongo University (ENSET-Gabon) and International Consultant at the United Nations Development Programme (UNDP), the African Development Bank and the Economic Community of Central African States (ECCAS), where he successfully applied economic principles to produce rigorous analytical work and policy orientations in private sector development, macroeconomic and financial situation Central African Countries for economic and social transformation.

Dr. NDZANA's research interests include: international economics, investment, private sector, regulation, institutions, and policy evaluation. In addition, Dr. NDZANA is the Editor of the African Integration and Development Review of the AUC. He holds a PhD in Economics from Dschang University (Cameroon).

Dr. Patrick Njoroge served as the ninth Governor of the Central Bank of Kenya from June 2015 to June 2023, after a 20-year career at the International Monetary Fund.

He is currently a member of the Advisory Boards of the Yale Program on Financial Stability and the Global Finance and Technology Network, and Co-Chair of the Debt Relief for Green and Inclusive Recovery Project.

He has received several awards and recognition, including four awards for Africa’s Central Banker of the Year, and recognition in 2023 as a Top 25 African Finance Leader.

He holds a PhD in Economics from Yale University.

Guilherme de Aguiar Patriota as Permanent Representative of Brazil to the World Trade Organization and other economic organizations based in Geneva.

He was previously the Consul General of Brazil in Tokyo (2021-2023) and Consul General of Brazil in Mumbai (2019-2021). Mr. Patriota served as the Special Representative of Brazil to the Conference on Disarmament in Geneva (2018-2019), and before that the Deputy Permanent Representative of Brazil to the United Nations and other International Organizations in Geneva (2015-2018). A career diplomat since 1983, he has been a delegate of Brazil accredited to the Organization of American States in Washington from 1990 to 1994, the Latin American Integration Association, in Montevideo from 1994 to 1997, the Embassy of Brazil in New Zealand from 1997 to 2000, the Delegation of Brazil to the WTO and the World Intellectual Property Organization, in Geneva from 2005 to 2008, and was twice posted at the Permanent Mission of Brazil to the United Nations in New York from 2008 to 10 and from 2013 to 2015. He was International Advisor to the Brazilian Minister for Science and Technology from 2003 to 2004 and Deputy Foreign Policy Advisor to the President of the Republic from 2010 to 2013.

Yuefen Li is currently Special Advisor on Economics and Development Finance at the South Centre, Geneva, and Independent Expert on the effects of foreign debt and other related international financial obligations of States on the full enjoyment of all human rights to the UN Human Rights Council.

She worked at the United Nations Conference on Trade and Development (UNCTAD) from 1990 to 2014 where she last was Head of the Debt and Development Finance Branch in the Division on Globalization and Development Strategies. She was also guest professor at Tsinghua University and two other universities in China. She has published books, papers and articles in professional journals and newspapers, and contributed extensively to UNCTAD and South Centre publications and documents.

She received her Bachelor's degree from the University of Foreign Studies of China and Master's degree from the American Graduate School of International Management in the United States.

Dr. Mahmoud Mohieldin is an economist with more than 30 years of experience in international finance and development. He currently serves as the United Nations Special Envoy on Financing the 2030 Sustainable Development Agenda. Recently, he served as the UN High-Level Climate Champion for Egypt, and as Executive Director at the International Monetary Fund representing the Arab States and The Maldives. Previously, Dr. Mohieldin was the Minister of Investment of Egypt from 2004-2010, and afterwards served as the World Bank Group Senior Vice President for the 2030 Development Agenda, United Nations Relations and Partnerships.

Dr. Mohieldin held seats on several advisory and executive boards in the banking, research, academic and corporate sectors among others, including his role as chairman of the Africa chapter for the Glasgow Financial Alliance on Net Zero (GFANZ). He was a member of the Commission on Growth and Development and was selected a Young Global Leader of the World Economic Forum in 2005. Dr. Mohieldin is a Professor of Economics and Finance at the Faculty of Economics and Political Science in Cairo University and has been a member of its faculty for almost 30 years. In addition to that, he has held posts as a visiting Professor at several renowned Universities in Egypt, Korea, the UAE, the UK and the US.

Dr. Mohieldin holds a PhD in Economics from the University of Warwick, United Kingdom; an M.Sc. in Economics and Social Policy Analysis from the University of York, United Kingdom; a Diploma of Development Economics from the University of Warwick; and a B.Sc. in Economics from Cairo University. He has authored numerous publications and articles in leading journals in the fields of economics, finance, and sustainable development.

Ambassador Mabhongo has served in several senior diplomatic positions both in South Africa and abroad.

Ambassador Xolisa Mabhongo serves as Non-Executive Director to the NECSA Board, representing the Department of International Relations and Cooperation (DIRCO).

In April 2024, Ambassador Mabhongo was appointed as South Africa’s BRICS Sherpa. He also serves as the country’s G20 Sous-Sherpa.

He became Deputy Director-General (DDG) of Branch: Global Governance and Continental Agenda at South Africa’s Department of International Relations and Cooperation in August 2023. In this capacity, Ambassador Mabhongo serves as the Personal Representative (Sherpa) of the South African President on issues related to the African Union’s New Partnership for Africa’s Development (NEPAD) and the African Peer Review Mechanism (APRM).

Ambassador Mabhongo holds a Master’s Degree in Public Administration from Columbia University in New York, a Post Graduate Certificate in Diplomatic Studies from Oxford University in the United Kingdom and a Bachelor of Arts Degree from Rhodes University in South Africa.

For more than 25 years, Eric LeCompte has led religious groups to win policies that alleviate poverty, address global conflict and promote human rights. He is the Executive Director of Jubilee USA Network, a development coalition of more than 750 religious groups and organizations. LeCompte advised a United Nations General Assembly process on global sovereign bankruptcy structures to alleviate poverty.

He is a member of expert working groups to the United Nations Conference on Trade and Development (UNCTAD) and the United Nations Human Rights Office of the High Commissioner.

LeCompte serves on boards of faith-based, development and financial transparency organizations. He is a member of the executive board of the Financial Accountability and Corporate Transparency (FACT) Coalition.

Anna Gelpern is a Scott K. Ginsburg Professor of Law and International Finance at Georgetown Law and a non-resident senior fellow at the Peterson Institute for International Economics.

She has published research on government debt, contracts, and regulation of financial institutions and markets. She co-directs the Sovereign Debt Forum (SDF), a collaboration with Queen Mary University of London and scholars from around the world, that most recently launched the #PublicDebtIsPublic initiative, a joint project with Georgetown's Massive Data Institute to create the first centrally collated web-based sovereign debt documentation and data commons.

Daniel Reichert-Facilides is an attorney in private practice admitted to the bar in Germany and in the State of New York. He spent most of his professional career as a partner at Freshfields, where he led the German project finance and export credit team.

He also regularly advises on financial restructurings and cross-border insolvency law. Besides his current roles as a Senior Counsel at Chatham Partners and as a faculty lecturer at the Institute for Law and Finance, he regularly contributes in different formats to the international debate on sovereign debt restructuring reform.

Sharon Almanza is a Career Executive Service Officer and currently the Treasurer of the Philippines of the Bureau of the Treasury, an attached agency of the Department of Finance.

Before assuming her current role, she served as the Officer-in-Charge of the Bureau of the Treasury. Preceding this position, she held the title of Deputy Treasurer of the Philippines wherein she headed the Accounting Service, Research and Regional Operations, and Asset Management Service.

he was seconded to the World Bank Group (WBG) from 2021 to 2023 as the Alternate Executive Director and Senior Advisor for the Constituency of Brazil, Colombia, Dominican Republic, Ecuador, Haiti, Panama, Philippines, Suriname, and Trinidad & Tobago.

She also held various positions at the Department of Finance as the Chief of the Debt and Risk Management Division (DRMD) of the International Finance Group and Officer-in-Charge of the Multilateral Assistance Division.

Natalia Turdyeva is the Head of the Regional and Industry Research Unit in the Department of Forecasting at the Bank of Russia, a position she has held since 2018.

Prior to this, she was a Leading Researcher at the Center for Economic and Financial Research at the New Economic School in Moscow. Ms. Turdyeva holds a Master of Computer Science degree from the Russian National University of Science and Technology MISiS and a Master of Arts in Economics from the New Economic School.

Her main areas of research include climate economics and trade policy. Ms. Turdyeva is among Russia's leading experts in computable general equilibrium (CGE) models and currently applies her expertise in CGE modeling as part of the Bank of Russia's climate stress-testing initiatives.

Jill Dauchy is the founder and chief executive of Potomac Group LLC, a financial advisory firm based in Washington DC that specializes in advising governments on complex matters of the sovereign balance sheet.

Ms. Dauchy's career as a trusted advisor to governments and public entities spans more than twenty years and over a dozen countries throughout Europe, Asia, Africa, and Latin America. Prior to forming Potomac Group, Ms. Dauchy was Managing Director at Millstein & Co.

Ms. Dauchy is the host of Sovereign Debt, a podcast that is regularly downloaded in over 120 countries. In addition, Ms. Dauchy serves as an external expert to the IMF and is a member of the Institute of International Finance (IIF), where she regularly participates in the Principles Consultative Group, the Committee for Sovereign Risk Management, and the Committee for Debt Transparency.

Ms. Dauchy earned an M.B.A. from the Wharton School of Business and an M.A. in International Studies from the Lauder Institute, both of the University of Pennsylvania. She also received a B.A. in Soviet/Russian studies from Barnard College of Columbia University. She is fluent in French and Russian.

Nicole Kearse has a diverse career in law, finance, and consulting, with a focus on Africa's development. She began her legal career in 2003 at Curtis, Mallet-Prevost, later moving to Baker McKenzie and then Shearman & Sterling LLP as a finance associate.

In 2010, she became Deputy Managing Director at DaMina Advisors. By 2015, Ms. Kearse co-founded Krescent Consulting LLP and led Learning and Development at ILFA, also serving on its board. Her financial sector experience includes a secondment at Citibank's Latin America and Caribbean Division.

Since 2018, she has worked at the African Development Bank Group's African Legal Support Facility, currently heading the sovereign finance sector.

Ms. Kearse holds a JD from Georgetown, an MA from Columbia, and an MA (law and diplomacy) from the Fletcher School at Tufts. She is a Solicitor in England and Wales and admitted to the New York Bar.

Patricia Farah is the Coordinator of the Federal Council of Fiscal Responsibility of Argentina. Before that, she worked in the Ministry of Economy, in the National Senate, in Nación AFJP among other outstanding positions, and in private consulting, international organizations and international financial institutions.

She has worked in both the public and private sectors, with a solid development in the budgetary, fiscal and financial areas. She has extensive experience in consolidation and leadership of work teams, with experience in coordination of various topics and specialized in the evaluation of governmental fiscal management. She has several publications as co-author and research coordinator.

Patricia has a degree in Economics from the University of Buenos Aires, a Master's degree in Intégration Economique with a double degree from the Universities of Salvador and Sorbonne Paris, a Master's degree in Capital Markets from the University of Buenos Aires and the Argentinian Institute of Capital Markets, and is an Ontological Coach from the Di Tella University, among other postgraduate studies.

Mr. David Rebelo Athayde has been Undersecretary for Fiscal Policy Strategic Planning at the National Treasury Secretariat, Ministry of Finance of Brazil since September 2021.

Prior to that he was Head of Investor Relations Office and Undersecretary for Law and Economics in Economic Policy Secretariat; and National Treasury civil servant since 2005, with experiences in the IT and Federal Government Debt Management departments.

David graduated in Electrical Engineering at the Universidade de Brasilia, with master’s degree in public Sector Economics at the same university. M.Sc. in International, Money and Banking at the University of Birmingham (UK).

Mr. Jayant Sinha currently serves as Deputy Comptroller and Auditor General in the Supreme Audit Institution of India.

He has served in various positions within the SAI at Federal and State level. He has also worked in the Government of India in the Ministries of Finance, Defence and Information and Broadcasting.

Peter Schwendener has been Deputy Director of the Swiss Federal Finance Administration (FFA) within the Federal Department of Finance since 2019. Since 2015, he has been leading the Fiscal Policy, Fiscal Equalisation, Financial Statistics Division. Under his supervision, the division prepares the budgeting and financial planning for the federal government. Importantly, the division bears responsibility for all matters pertaining to the federal debt brake.

In addition, Peter Schwendener and his team are responsible for implementing and assessing national fiscal equalisation, and for compiling the financial statistics for all levels of government. Besides ensuring a reliable basis for fiscal-policy decisions, he has played an important role in various economic policy reforms.

Prior to joining the FFA, he was Head of the Statistical Office and Head of the Finance Administration of the Canton of Basel-Stadt. He obtained his doctorate in Economics from the University of Basel in 1990.

Mrs. Shanti Bobin is Deputy Director in charge of Multilateral Financial Affairs and Development Division at the French Treasury, and it also Vice-Chairperson of the Paris Club.

Previously, she covered European Affairs, as Deputy Director in charge of European Affairs (2021-23); Head of the French Treasury regional economic office in Madrid (2019-21); and Head of European bilateral affairs (2016-19).

She was also Head of official development aid unit (2013-16). She also covered emerging markets at the Treasury (2010-13). She started as head of mission on unemployment at ministry of Labour (2006-09).

Shanti holds a degree in Public Affairs from Sciences Po Paris and is an alumna from the Ecole nationale d'administration.

Luiz Vieira has over 25 years of senior management experience in international development, including 10 years collaborating with global economic, climate and human rights networks, academics and senior UN and government officials to critically analyse the international financial and aid architecture and its implications for international human rights obligations and the implementation of the UN’s Development Agenda.

Luiz coordinates the work of the Bretton Woods Project. Previously he served for eight years as the chief of mission for the International Organisation for Migration (IOM) in Timor Leste, where he worked with UN bodies, donors and IFIs on strategic development planning and received the Order of Timor-Leste, Medal of Merit for services to the people of Timor-Leste.

His past experience includes working with the IOM in Nauru, as well as with NGO Mercy Corps in a variety of emergency response situations, including in El Salvador, Kosovo and Macedonia, as well as on democratic governance in Angola. He served as a guest lecturer on conflict and development at the Columbia University School of International Public Affairs (SIPA). Luiz holds an LLM in International Law and a Masters in Development Economics from the School of Oriental and African Studies at the University of London, as well as a degree in political science from the State University of New York at Albany.

Mr. Malack Luhanga is Assistant Director in charge of the Debt Data Management Unit under the Debt Management Office (DMO) in the Ministry of Finance and National Planning, Zambia. He has been supervising the management of debt data with the use of DMFAS for the past seven (7) years.

With his vast experience in Programming and Databases, he has contributed to the enhancement of debt data transparency by regular production of a Debt Statistical Bulletin for Zambia which is published on the Ministry of Finance website. He has also provided support to the Front and Middle Offices of the DMO including during the debt restructuring process by maintaining an updated database.

Prior to that Mr. Luhanga was key in the development of the Budgeting software as well as the Funding Release system and provided technical support in managing and maintaining the systems for over 10 years as a Systems Analyst in the Budget Office of the Ministry of Finance, Zambia.

Vikas Pandey is a Business Analyst working in the Debt Management Unit of the Commonwealth Secretariat.

Mr. Pandey has over 25 years of experience with the debt management systems. He has assisted over 35 countries in Africa, Asia, Caribbean and the Pacific regions, in implementation of the debt systems, streamlining their debt management procedures and providing training.

Prior to joining the Commonwealth Secretariat, he worked with the Reserve Bank of India and played a key in setting up the Central Securities Depository.

Vikas has a Masters' degree in Statistics and a Post-Graduate diploma in Computer Applications.

Lilia Razlog is a Senior Debt Specialist in the Macroeconomics and Fiscal Management Global Practice of the World Bank.

Ms. Razlog is a seasoned debt management expert with vast international experience in sovereign debt management, debt restructurings, fiscal policy, inter-governmental fiscal relations, credit risk, sub-national debt and finance, and a broader range of public finance management.

She has more then 20 years of professional experience in the public sector reforms and regional experience from Europe, Asia, Latin America, Pacific and Africa regions.

Prior to joining the World Bank, Ms. Razlog was a Director of the Debt Department in Moldova, a member of the Board of Directors of the Black Sea Trade and Development Bank, an Alternate Governor representative at the IMF, WB, a Governor representative at IFAD and other international institutions.

Ms. Razlog holds an MA degree from University College of London, UK.

Ms. Carina Sugden is a Lead Governance Officer in the Governance and Economic Reforms Department at the African Development Bank Group (AfDB).

She is an experienced governance expert, leading policy dialogue, developing and implementing programs of support to African countries in the areas of economic management, public finance, domestic revenue mobilization, debt management, and combatting corruption.

She has been at the forefront of the AfDB's policy and strategy work on governance, leading the AfDB Strategy for Economic Governance in Africa and the Action Plan for the Management and Mitigation of Debt Distress in Africa.

Prior to joining the Bank, she worked for the United Nations in both development and humanitarian assistance. She has an M.SC degree in Economics from the University of Copenhagen.

Otavio Ladeira de Medeiros is the Chief of the Debt Management and Financial Analysis System (DMFAS) Programme of the UN Trade and Development.

Former National Treasury Secretary, he was appointed Head of the Brazilian Debt Management Office in May 2021 and held the position until January 2025, when he assumed his current role at UNCTAD as Head of the DMFAS Programme.

As head of the Brazilian DMO his responsibilities included managing Brazil's Federal Public Debt, ranging from defining the optimal debt composition and medium- and short-term strategies to executing domestic bond auctions and external operations.

He is also tasked with monitoring debt records and payments and managing institutional relations with financial institutions, investors, rating agencies, and multilateral organizations.

And while leading the DMFAS Programme, he leads a team dedicated to helping countries improve public debt management, primarily through the DMFAS System and capacity-building activities.

Mr. John P. Maketo is Programmes Manager, at the Zimbabwe Coalition on Debt and Development (ZIMCODD)

He is an experienced debt management practitioner, economic justice expert and public policy analyst in developmental, governance and human rights work in Zimbabwe and in the SADC region.

His areas of specialty and interest include governance, accountability, human rights advocacy, economic justice programming. He also has extensively worked national and regional organisations, such as National Association of NGOs (NANGO), Transparency International Zimbabwe, Southern Africa People's Solidarity Network (SAPSN), Fight Inequality Alliance (FIA) and Zimbabwe Coalition on Debt and Development (ZIMCODD).

Bruno Rocha is a Senior Economist of the Statistics Department at the IMF since 2017. Before that, he worked in the National Treasury of Brazil, where he established the Government Finance Statistics (GFS) Unit in 2008 and led it until 2015. He then became Director of Fiscal Affairs in the Brazilian Ministry of Finance (2016-2017).

He has extensive practice as a professor, and currently leads and designs different categories of trainings at the Statistics Department. He is also involved in substantial technical assistance in public sector debt statistics, including in fragile states. During 2017-2020 he worked as a GFS Advisor at the IMF's Regional Center in Central America and is based in Washington DC since 2020.

Mr. Rocha holds an MBA in Finances, a master's in Public Administration focused on Public Finances from the University of Brasilia, and studied Applied Linguistics at the University of California, Riverside. He is also a Project Management Professional, certificated by the PMI.

Mr. João Falcão Silva is a senior economist at the World Bank's Development Data Group, where he has been making significant contributions since October 2023. He currently leads the update of the World Bank's Debtor Reporting System Manual and reporting templates, as well as spearheading the compilation of external debt statistics.

With over 18 years of experience in external and monetary statistics from the Central Bank of Portugal, João held the position of Head of Unit for the Central Balance Sheet, Monetary and Financial Statistics, and External Statistics. In these roles, he was instrumental in data compilation, methodology development, innovation, and dissemination. Furthermore, João shared his expertise as a lecturer at the Nova School of Business and Economics.

He holds a PhD in International Economics, a master's degree in public economics, and an undergraduate degree in Economics.

Taichi Sakano is a senior advisor on public debt management and PFM at the Governance and Peacebuilding Department of Japan International Cooperation Agency (JICA), which he joined in 2016. He has been involved in various JICA projects related to debt management and PFM as an advisor, and has participated in several PEFA assessments as an assessor and peer reviewer.

Prior to joining JICA, he held a position of a senior analyst at a private think tank, where he conducted a number of policy studies for the World Bank, the ASEAN Secretariat, and the Japanese Ministry of Finance and Ministry of Economy, Trade and Industry. He has been a visiting professor at the Department of Economics, Yamaguchi University and Chuo University. His research interests focus on economic growth, debt management, public financial management, climate change and natural resources.

He holds an M.S. degree in Applied Economics from the University of Minnesota and an M.S. degree in Environmental Sciences from the University of Tsukuba.

Celine Tan is Professor of International Economic Law. She is also the Co-Director of the Centre for Law, Regulation and Governance of the Global Economy (GLOBE) based at Warwick Law School. Celine is a founding member of The IEL Collective, a community for scholars and practitioners interested in critical reflection of the interactions between law and the global economy.

Prior to Warwick, she was at the University of Birmingham. She completed her PhD at the University of Warwick where she held a Postgraduate Research Fellowship.

Mr. Niranjan Sarangi is the Leader of the Shared Economic Prosperity Cluster of the United Nations Economic and Social Commission for Western Asia (ESCWA)

He previously served as Senior Economic Affairs Officer and Lead Economist on Debt and Fiscal Policy at ESCWA, spearheading transformative initiatives to address critical economic challenges in the Arab region. His work in global and regional economic policy has made a significant contribution to the United Nations' strategies on debt solutions and sustainable financing for developing countries.

Mr. Sarangi's leadership extends to the production of flagship reports, research on public finance and the Sustainable Development Goals, and the implementation of projects and data-driven insights tailored to policymakers' needs.

Mr. Sarangi also served as an economist at the United Nations Development Programme Asia-Pacific Regional Centre from 2007 to 2012. Before joining the United Nations, he had a robust career in research and the private sector (2002-2007). Mr. Sarangi is of Indian nationality.

He holds a PhD in Development Economics from Jawaharlal Nehru University in Delhi, India.

Ms. Delphine Moretti is Lead of the Organization for Economic Cooperation and Development (OECD) Working Party on Public Financial Management and Reporting. As part of her functions, she works closely with OECD countries on developing innovative practices in PFM. She oversees the OECD's research work programme on fiscal risks management and digitalisation of public financial management.

Prior to this, Ms. Moretti served in the International Monetary Fund (IMF), where she held positions in headquarters and Southeast Asia. Ms. Moretti also previously held positions in the Ministry of Finance in France.

Hauke Maas leads the advisory work on multilateral debt policy in GIZ's Global Policy Group. In this capacity, he advises the German government's Federal Ministry for Economic Cooperation and Development on the global debt architecture and debt management capacity development. His portfolio also includes advising on the finances of International Financial Institutions.

Previously, Hauke was based in Nicaragua, where he was a researcher at a think tank and lecturer at Universidad Americana. He has been a consultant for the World Bank and ILO.

He graduated from LSE and SOAS, University of London.

H.E. Justice Abubaker Hussein Omar Alsaggaf is a Yemeni National born in 1965 was appointed by the President of the Republic of Yemen as President of the Central Organization for Control and Auditing, COCA in 2013. He has been in office since then. In this position, he has the duties and responsibilities as the Auditor General of the Republic of Yemen.

By law, he has a rank of state minister. And in financially and administratively managing COCA, he has the power of two ministers: Minister of Finance and Minister of Civil Services. As COCA, the Supreme Audit Institution of Yemen, is an autonomous body.

Justice Abubaker has the profession of a judge in the Courts of law. He obtained his Bachelor Degree in Law from Aden University, Republic of Yemen in 1989. Immediately after that, he assumed his duties as a Judge in the courts of law, progressed through, up to Chief of appeal court during the period: 1989-2009.

In 2009, he was selected by the President of the Republic to be a Board Member of High Authority for Tender Control: during the period: August 2009 -May 2013; That was all in recognition of his outstanding work in the courts of law and the ability to demonstrate high competency and high level of integrity.

Tina Leboussi is Deputy Director General of Debt at the Ministry of Finance of Gabon. She graduated from the Institute of Economy and Finance in 2003, she joined the Administration in 2004, where she spent her entire career.

Before becoming the Deputy Director General of Debt in October 2023, she successively held several strategic positions including, Officer at the Debt Pro Bureau in the Public Debt Directorate, Research Officer in the Public Debt Directorate, Deputy Director of the Directorate for Negotiation and Mobilization Monitoring, and later Director of the same Directorate.

Based on these experiences, enriched by specialized training, she developed in-depth expertise in public debt management, covering key competencies such as:

- Mastery of procedures of multilateral, bilateral, and commercial lenders,

- Analysis of financing offers,

- Conducting financial negotiations,

- Production and analysis of public debt statistics.

In parallel, she is actively involved in charitable associations.

H.E. Mr. João Augusto Ribeiro Nardes is currently minister and former president of the Federal Court of Auditors (TCU). For Rio Grande do Sul (a state in the South of Brazil), he was a federal deputy for three terms and a state deputy for two terms.

He has a degree in business administration, a postgraduate degree in development policy and a master's degree in development studies from the Institut Université d'Études in Geneva, Switzerland.

Mr. Jacob Mkandawire is an Economist with vast experience in economic and financial management. He is currently the Director, Sovereign Debt Management Programme at the Macroeconomic and Financial Management Institute of Eastern and Southern Africa (MEFMI), a regional institution owned by 15 member countries with headquarters in Harare, Zimbabwe.

In this role, he is overseeing the programme's capacity development and technical assistance on debt and public finance management to MEFMI member countries. In previous roles, he led the 'Investment and Debt Management' department at the Ministry of Finance in Zambia, where he oversaw the sovereign debt portfolio and supervised state-owned enterprises portfolio.

He has also previously served as an assistant director in Financial Markets department of the Bank of Zambia taking charge of domestic market operations, a key monetary policy implementation and fiscal agent role at the Bank. Earlier, he served as Assistant to the Governor of the Bank of Zambia, supporting the Governor in executing the central bank functions.

Passionate about debt, fiscal and macroeconomic stability to support sustainable growth and management of risks to public finances, he drives innovative solutions to sovereign debt challenges and developing courses for capacity building in the Countries.

Hakan Yavuz is a Senior Debt Specialist in the Global Debt Unit of the World Bank, with 23 years of experience in sovereign debt and risk management. Before joining the Bank, he held various managerial positions in the Turkish Treasury and worked as an economist at the European Commission.

Hakan holds a masters degree in Applied Economics and Finance from the University of California and is a certified Financial Risk Manager (FRM) by the Global Association of Risk Professionals.

Ms. Malty Dwarkasing has been Administrator-General at the Suriname Debt Management Office (SDMO) since January 2022.

Prior to that, she worked was the first female director of the Suriname Trade and Business Association. She has worked for the National Planning Office in the macro economic planning department for 8 years and at Administrator-General Suriname Debt Management Office (SDMO) as the manager Middle Office for 12 years.

Ms. Dwarkasing graduated from the Anton de Kom University of Suriname in Economics and subsequently completed several technical diploma courses in the field of "Development Planning Technique" at the Institute of Social Studies in The Hague, the Netherlands and at the Galilee College of Israel in the Development and management of SMEs.

In addition, she has followed many trainings and workshops at international organizations such as the IMF, World Bank, IADB in the field of macroeconomics and debt management.

Ms. Judith Nabaasa leads the Debt Management Office at Rwanda's Ministry of Finance and Economic Planning, overseeing debt strategy, sustainability assessments, and fiscal risk management.

With over seven years of experience in debt management and macroeconomic analysis, she focuses on optimizing debt structures and maintaining fiscal stability.

She holds a master's degree from the University of Kigali and a postgraduate certificate in capital markets from George Washington University.

David Rogelio Colmenares Páramo was elected Superior Auditor of the Federation of Mexico for the period 2018-2026 by the LXIII Legislature of the Honorable Chamber of Deputies. He is an economist graduated from the Faculty of Economics of the National Autonomous University of Mexico (UNAM), where he has been a professor for 30 years.

His career includes the assignment as Secretary of Finance of the State of Oaxaca; Delegate of the National Bank of Public Works and Services in the State of Oaxaca; Head of the Unit for Coordination with Federative Entities of the Ministry of Finance and Public Credit; Special Auditor of Federalized Spending in the Superior Audit of the Federation of Mexico and Internal Comptroller in the Federal Court of Fiscal and Administrative Justice.

Since 1978 he teaches courses on Economic Policy, State Finance, Fiscal Policy and Public Sector Economics, among others. He has been a member of the Governing Board of the University of the Americas (UDLA) and of the Committee for Evaluation of Study Plans and Programs of the Schools and Faculties of Economics in Mexico.

From 2000 to 2002 he was President of the National College of Economists, actually he is member of the Technical Committee of the National Conference of Municipalities of Mexico (CONAMM), of the Mexican Academy of Comprehensive and Performance Auditing, A.C., of the Tax Affairs Commissions of the Employers' Confederation of the Mexican Republic (COPARMEX) and of the Business Coordinating Council (CCE).

At the Latin American and Caribbean Organization of Supreme Audit Institutions (OLACEFS), he is Executive Secretary for the 2023-2028 period; in addition, in 2018, he served as president of the regional organization. Currently, he presides the Working Group on Disaster Management Supervision and is a member of the committees, commissions and working groups. In the Capacity Building Committee, he is in charge of the task force for the development of virtual courses.

At the Central American and Caribbean Organization of Supreme Audit Institutions (OCCEFS), he coordinates the Capacity Building Committee and the Task Force for monitoring the Sustainable Development Goals.

At the International Organization of Supreme Audit Institutions (INTOSAI), he presides the Value and Benefits of SAIs Working Group and also leads the Integrity Self-Assessment Tool (IntoSAINT). In addition, together with SAI of Peru, he is a full member of the INTOSAI Steering Committee, representing OLACEFS.

Ms. Lucia Marlene Correa Godoy was appointed Head of the External Public Debt Records Department at the Ministry of Economy and Finance, Paraguay in 2022.

Prior to that, she was Head of the Project Management and Control Department from 2015 to 2022.

Ms. Correa Godoy has has worked in the General Directorate of Credit and Public Debt of the Ministry of Economy and Finance since 2008. She has Master's degree in Government and Public Management.

Marcelo Tricarico is a Senior Debt Management Expert with over 25 years of experience in public administration, debt management, debt auditing, and related systems development. He has led numerous technical assistance missions with international organizations, including the World Bank, UNCTAD, the Inter-American Development Bank, the IMF, the U.S. Treasury's OTA, and INTOSAI.

At the DMFAS Programme, Marcelo worked from 2002 to 2012, initially serving as the User Representative for Latin America, then as the Leader of the IT team, and later as Deputy Chief of the Programme. During this period, he spearheaded the development and rollout of DMFAS 5.3 and DMFAS 6.

In his home country of Argentina, Marcelo has held key positions such as Senior Advisor at the National Internal Control Office, Director of the Debt Management Office at the Ministry of Finance, and Project Coordinator for the implementation of DMFAS and its integration with other Public Financial Management (PFM) components. He is also a professor at the National Technological University in Argentina and has authored several papers on Public Debt, Public Debt Management in Federal Countries, and Public Debt Management within the context of Public Financial Management.

Marcelo is also a member of the Panel of Experts for the Debt Management Facility (DMF).