Global Trade Update (July 2025): Global trade endures policy changes and geoeconomic risks

Policy insights: Highly concentrated digital markets put competition and consumers at risk

This edition of the Global Trade Update presents key trade trends for the first half of 2025 and offers an outlook for the months ahead.

It also examines the growing concentration in digital markets, underscoring the urgent need for stronger, more coordinated enforcement of competition law, alongside investment in infrastructure, skills and start-up ecosystems.

Global trade: Key trends

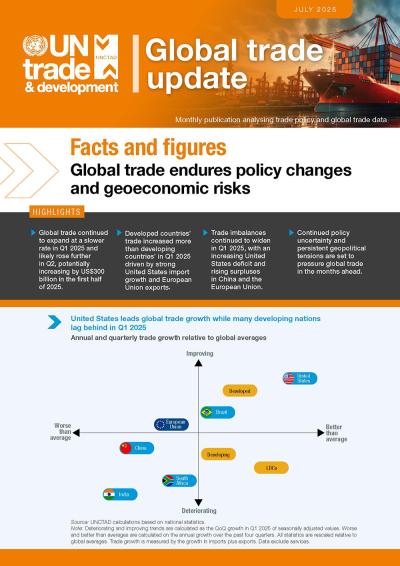

- Global trade expanded by an estimated $300 billion in the first half of 2025, growing at an estimated 1.5% in the first quarter and projections showing 2% growth in the second.

- Price increases contributed to the overall rise in trade value. Prices for traded goods edged up in the first quarter and likely continued to rise in the second, while trade volumes grew by just 1%.

- Developed economies outpaced developing countries in the first quarter of 2025, reversing recent trends that had favoured the Global South. The shift was driven by a 14% surge in United States imports and a 6% jump in European Union exports.

- Trade imbalances widened during the last four quarters, with the US posting a larger deficit, while China and the European Union recorded growing surpluses.

- Global trade faces mounting headwinds in the second half of 2025, amid persistent policy uncertainty, geopolitical tensions and signs of slowing global growth.

Digital market concentration: Key takeaways

- Digital markets have become increasingly concentrated. The top five digital multinational enterprises now account for 48% of global sales, up from 21% in 2017.

- Seven of the world’s ten most valuable companies are now digital giants, spanning everything from cloud services and e-commerce to artificial intelligence (AI) and online advertising.

- The rapid expansion of generative AI adds to growing concerns, with Big Tech companies such as Microsoft and Google dominating the value chain and consolidating their leading positions by partnering with start-ups like OpenAI.

- Governments are responding. Since 2020, the number of global competition interventions has risen from 14 to 153, but enforcement remains uneven, especially in Africa and Latin America.

- UNCTAD calls for stronger, more coordinated competition law enforcement, along with investment in infrastructure, skills and startup support, to build digital economies that work for all.

Global Trade Update (July 2025): Global trade endures policy changes and geoeconomic risks (UNCTAD/DITC/INF/2025/5)

8 Jul 2025