Africa saw an increase in the productivity of investment in the first decade of the twenty-first century compared to the 1990s, UNCTAD says in the Economic Development in Africa Report 20141, although this fact has been disguised in the general story of Africa’s recent economic growth.

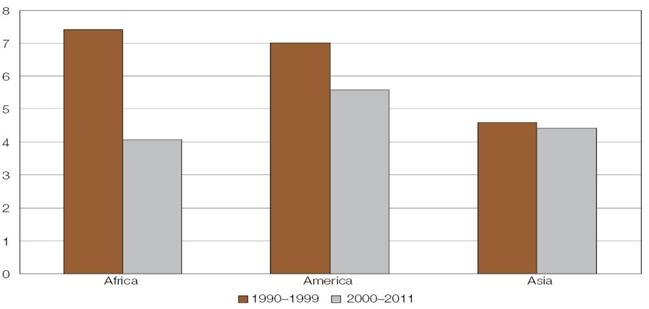

Subtitled Catalysing Investment for Transformative Growth in Africa, the report shows that from 1990 to 1999 the incremental capital–output ratio – which measures the degree of inefficiency in the use of capital – was about 7.4 in Africa, while from 2000 to 2011 (the latest date for which figures are available) it fell to 4.1 (figure 1).

This means that producing an additional unit of output in Africa required $4.1 in 2000–2011 compared to $7.4 of capital in 1990–1999 – a reduction of almost half.

Factors that have contributed to productivity increases in Africa over the past decade include improvements in infrastructure, relatively better access to technology and policy reforms that reduced the transaction costs linked to production, trade and investment.

Increases in the productivity of capital in Africa are important because they are an important source of growth, as well as being a major determinant of competitiveness. Such increases enhance Africa’s ability to compete and integrate into the global economy.

Compared to other developing-country groups, from 2000 to 2011, the productivity of capital was much higher in Africa than in America and slightly higher than in Asia. This is a big change from the 1990s when the productivity of capital was lower in Africa than in the other developing-country groups.

African countries that have made significant progress in enhancing the productivity of capital in the last two decades include Angola, the Congo, Guinea-Bissau, Liberia, Sao Tome and Principe and Zambia.

In the last decade (2000 to 2011), countries where capital had very high productivity included Angola, Equatorial Guinea, Ethiopia, Liberia, Mozambique, Nigeria, Rwanda, Sierra Leone and the Sudan.

Despite this encouraging trend, it should be noted that there were 22 countries in the continent for which the productivity of investment either did not change or declined between the periods of 1990–1999 and 2000–2011. In addition, the increase in productivity of total investment masks the fact that the productivity of public investment is low in sub-Saharan Africa.

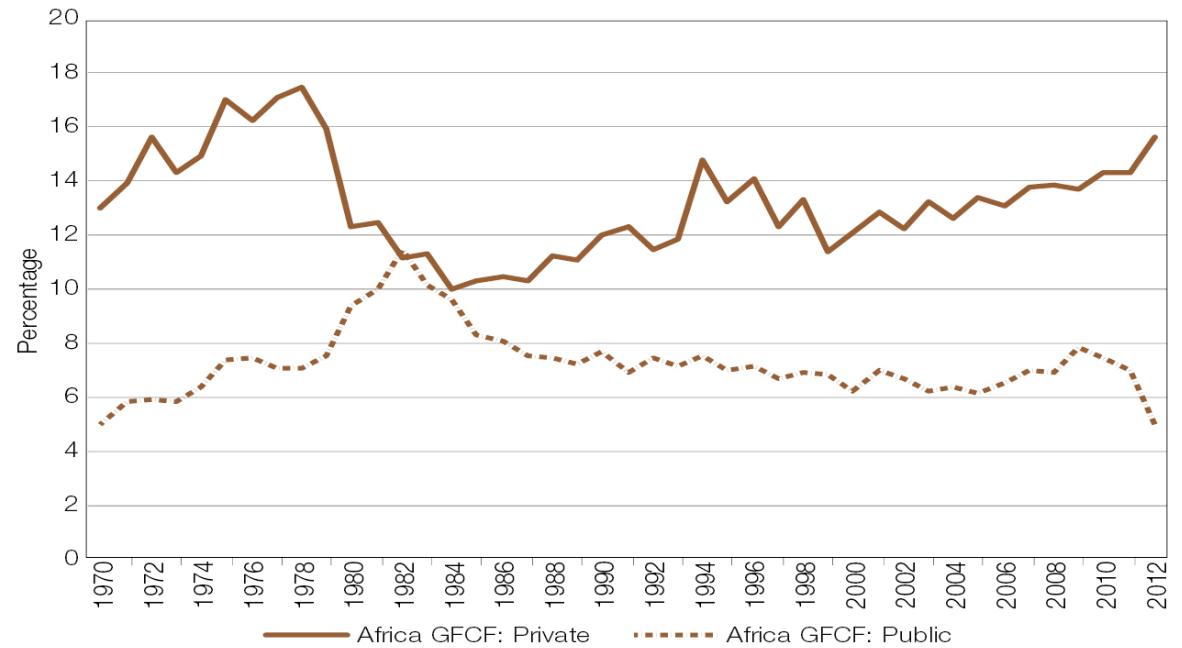

Private investment is important but should not be promoted at the expense of public investment, the report warns. There are important complementarities between public and private investment, the report highlights, calling for increased public investment in Africa. Public investment can crowd in private investment and increase the returns to private capital.

Despite the crucial and catalytic role of public investment in the development process, the report argues, there has been a decline in public investment rates in at least 23 countries over the past two decades, with the most dramatic declines observed in the following countries: Cape Verde (from 18.1 per cent to 13 per cent); Egypt (from 14.5 per cent to 8.2 per cent); Eritrea (from 17.6 per cent to 13.4 per cent); and Lesotho (from 18.2 per cent to 9.1 per cent). Aggregated figures for Africa are shown in figure 2.

African Governments can stimulate public investment, strengthen linkages between public and private capital and also ensure coherence in their overall investment promotion policies, the report argues. For example, foreign direct investment should not be promoted at the expense of local investment.

African governments offer generous incentives to foreign investors that put local investors at a disadvantage and go against efforts to promote domestic entrepreneurship and investment. The report argues for the need for coherence between policies promoting foreign direct investment and those aimed at developing local entrepreneurship.

The report argues that more can be done to increase the impact of investment on growth in Africa.

The productivity of private investment can be enhanced and sustained by developing workforce skills, providing better infrastructure, improving access to affordable credit and reducing the high costs of factor inputs, the report says.

Meanwhile, the report adds, the productivity of public investment, particularly in infrastructure, can be enhanced through the better selection and delivery of projects, getting more value out of existing infrastructure through maintenance of assets and refocusing public investment in areas such as energy and transport.

The report argues that investment is one of the main drivers of long-term growth on the continent but that investment rates are low relative to what is required to achieve national development goals.

Over the past two decades, the average investment rate in Africa has hovered at around 18 per cent, which is well below the 25 per cent threshold deemed necessary to make significant progress in reducing poverty. The report points out that low investment rates in Africa account in part for the region’s slow progress in realizing its development goals over the past decade.

While the report stresses the need to boost investment rates, it also argues that Governments in Africa should strengthen efforts to improve the productivity of existing and new investments and also ensure that investment goes into strategic and priority sectors that are crucial for sustained growth and the transformation of African economies (such as agribusiness and manufacturing activities).

Figure 1. Incremental capital–output ratios across developing-country groups

Source: UNCTAD.

Figure 2. Gross fixed capital formation in Africa – private and public

(As a percentage of gross domestic product)

Abbreviation: GFCF, gross fixed capital formation.

Source: World Development Indicators.

Press Release

For use of information media - Not an official record

UNCTAD/PRESS/PR/2014/029

Geneva, Switzerland, 3 July 2014