Climate change impacts are increasing in intensity and frequency; highlighting the need for more investment in climate resilient and low-carbon infrastructure.

Date: 1 November 2021

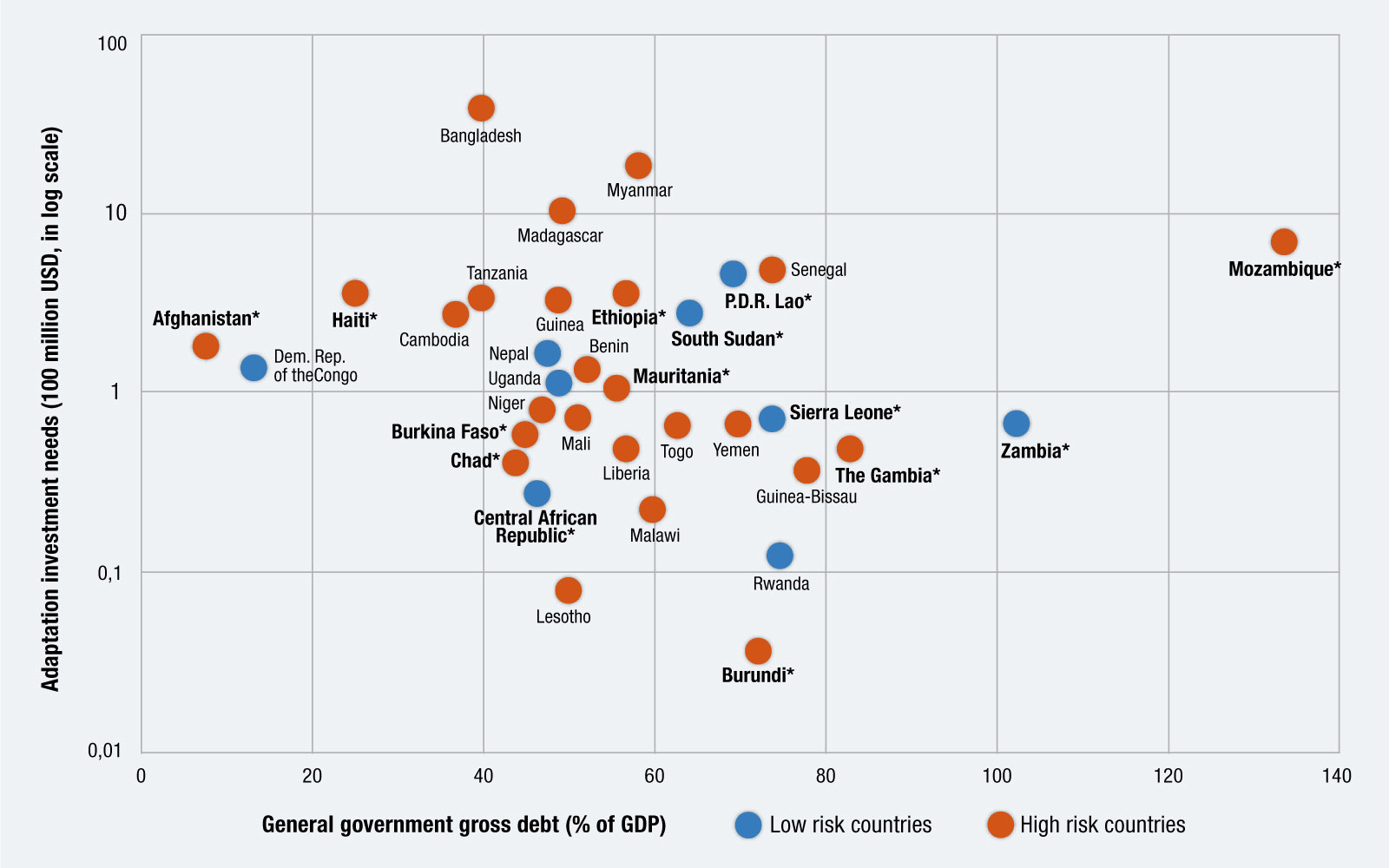

Sources: UNCTAD staff calculations based on the IMF Fiscal Monitor (October 2020, October 2021) and the IMF low-income countries' debt sustainability analysis database. Countries in debt distress or high risk of debt distress are displayed with an asterisk following the country name.

Note: The United Nations University Institute for Environment and Human Security World Risk Index for 2018 is used to measure natural disaster risk. The threshold suggested by the World Risk Report 2018 for the high- and the very high-risk group, at 7.14%, is used to differentiate countries into high- and low-risk categories. Data for outliers - Eritrea and Sudan - has been removed to improve chart readability.

At the UN climate conference (COP15) in 2009, developed countries pledged to mobilize $100 billion per year by 2020 to support developing countries to mitigate and adapt to the impacts of climate change. This commitment was reaffirmed in the Paris Agreement adopted at COP21 in 2015, where countries agreed to set a new collective goal by 2025, using $100 billion as a floor.

The COVID-19 pandemic has significantly worsened the context for international climate finance, stretching public budgets, deteriorating debt sustainability outlooks, and making the mid- to long-term prospects of climate finance uncertain. Nowhere is this more evident than in least developed countries (LDCs), where the risks of a divergent recovery continue to loom. The crisis has taken a toll on already limited fiscal space and raised debt vulnerabilities, at a time when LDCs urgently need to scale up investment.

The above chart shows that many LDCs that are vulnerable to climate impacts and need resources to build resilience and adapt to climate change are simultaneously heavily indebted (about 42% are at high risk of or are already in debt distress) and have limited fiscal space to borrow money.

The public investment needs for adaptation for 36 LDCs for which data is available amounted to about $12 billion, as per the IMF’s 2020 assessment, a figure likely to be higher if all LDCs are considered.

Although climate finance flows for all developing countries increased to $80 billion in 2019 (driven mostly by significant increases in the share of both concessional and non-concessional public loans), developed countries continue to fall short of meeting the annual $100 billion climate finance goal.

More climate finance is vital for a resilient future in LDCs

Public climate finance, including adaptation finance, for LDCs more than doubled to $15.4 billion in 2019 up from $6 billion in 2016. While this is a trend in the right direction, it’s still insufficient. This global climate financing gap inhibits LDCs from implementing adaptation activities and blocks efforts to address ongoing climate-related losses and damages.

Moreover, there are several key shortfalls in the quality and composition of climate finance flows; first, they have predominantly taken the form of loans rather than grants; second, they have prioritized mitigation over adaptation efforts; and third, many LDCs, as well as other developing countries, face considerable obstacles in accessing climate finance owing to onerous requirements.

The international community’s support will be paramount in securing adequate climate finance for LDCs, both in terms of quantity and quality/composition, and charting the path towards a more inclusive and sustainable recovery.

Therefore, stepped-up financial support from development partners, targeting resilience building as called for by UN Secretary-General António Guterres, and bolstering coping mechanisms are high on LDCs’ agenda for COP26.

Private finance is by far the biggest and largely untapped pool of capital. Closing the gap in adaptation investment will therefore inevitably require crowding in private finance. Also, productive capacity development remains of paramount importance in building the resilience of LDCs and mobilizing domestic resources for climate change adaptation.

It will also be critical to tackle debt distress and excessive debt overhang in climate vulnerable LDCs. A more comprehensive approach and strong international support are thus needed to scale up capacity development efforts, enable LDCs to access low cost finance and to mobilize adequate resources while ensuring alignment with their national development plans.

Downloads:

- The Least Developed Countries Report 2021: The least developed countries in the post-COVID world: Learning from 50 years of experience.

- The Least Developed Countries Report 2019: The Present and Future of External Development Finance - Old Dependence, New Challenges.

- Climate Finance Provided and Mobilised by Developed Countries: Aggregate Trends Updated with 2019 Data, Climate Finance and the USD 100 Billion Goal (OECD 2021)

- Delivering on the $100 Billion Climate Finance Commitment and Transforming Climate Finance (Independent Expert Group on Climate Finance, 2020)