The alarming surge in global debt burden calls for urgent reforms to the international financial systems to safeguard a prosperous future for both people and the planet.

© Shutterstock/Boxed Lunch Productions | 769 million Africans live in countries where debt interest payments outweigh investments in either education or health – areas critical for human development.

In a new report released on 4 June, the United Nations sounded the alarm over the escalating debt burdens to global prosperity.

Titled ”A world of debt 2024: A growing burden to global prosperity”, the report highlights the unprecedented surge in public debt – comprising both domestic and external general government borrowing – which reached a historic peak of $97 trillion in 2023, up by a notable $5.6 trillion from the previous year.

Particularly in Africa, faltering economies in the wake of multiple global crises have resulted in a heavier debt burden. The number of African countries with debt-to-GDP rations above 60% has increased from 6 to 27 between 2013 and 2023.

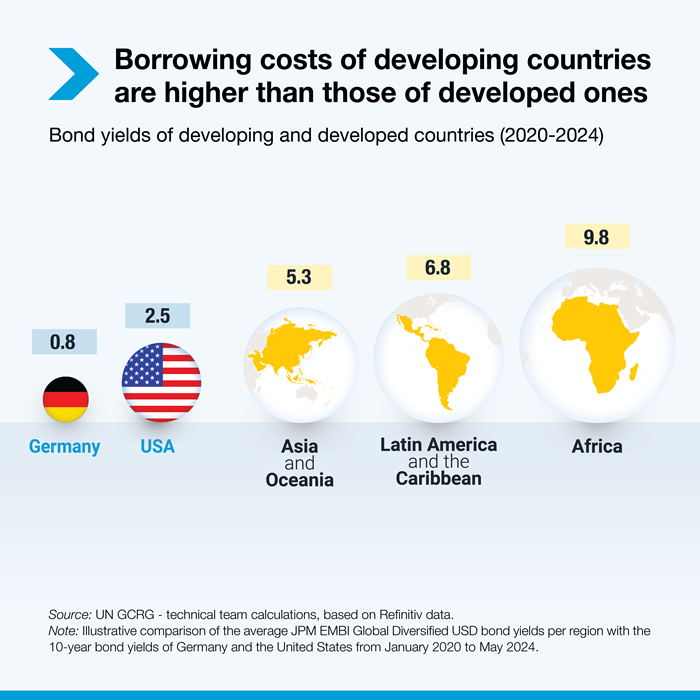

Meanwhile, repaying debt has become more costly, and this is hitting developing countries disproportionately.

In 2023, developing nations paid $847 billion in net interest, a 26% increase from 2021. They borrowed internationally at rates two to four times higher than the U.S. and six to 12 times higher than Germany.

The rapid rise in interest costs is limiting budgets in developing countries. Presently, half of them designate a minimum of 8% of government revenues to debt servicing, a number that has doubled in the last ten years.

Moreover, in 2023, a historic 54 developing nations, with almost half in Africa, dedicated a minimum of 10% of government funds to debt interest payments.

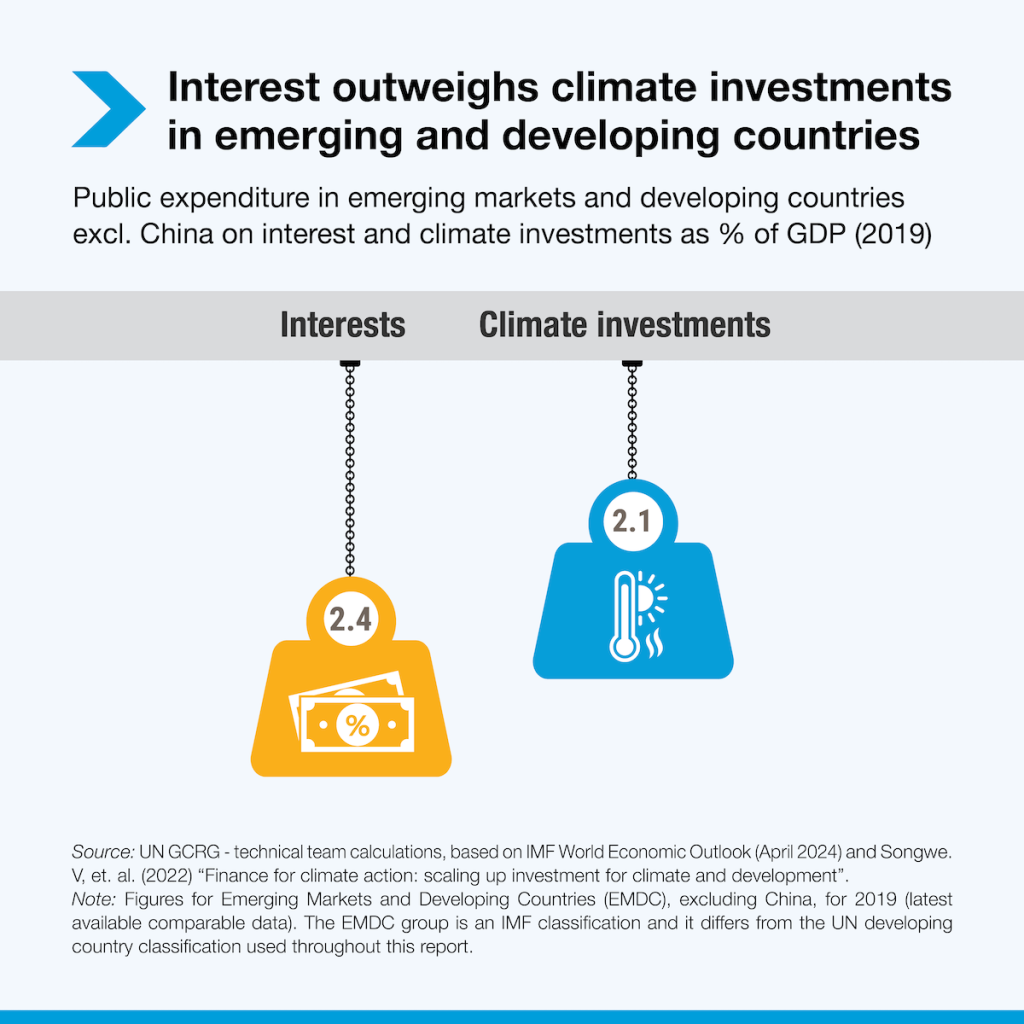

With the crisis intensifying, actions to limit global warming to 1.5°C become urgent. Despite this urgency, developing countries are currently allocating a larger proportion of their GDP to interest payments (2.4%), than to climate initiatives (2.1%). Debt is limiting their capacity to tackle climate change.

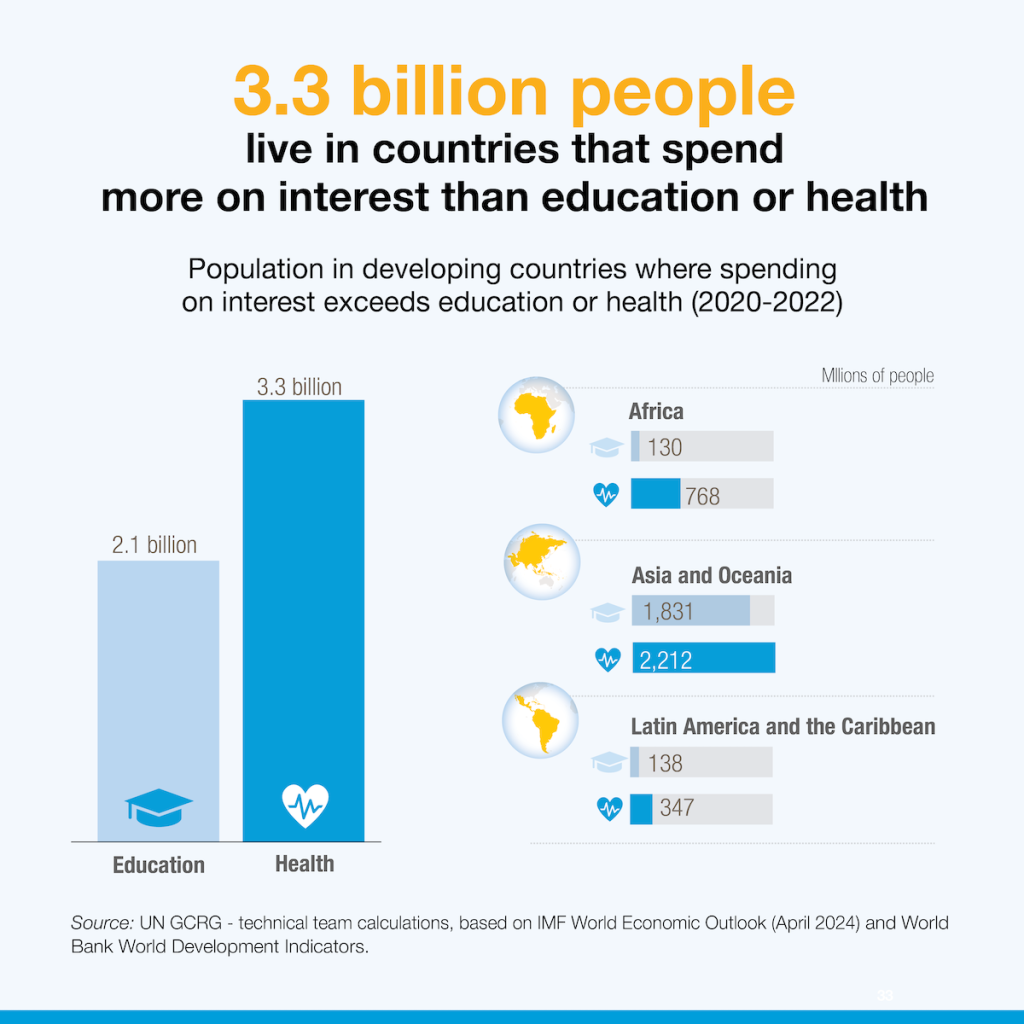

The report revealed that 3.3 billion individuals reside in nations where interest payments exceed spending on either education or health.

In Africa, the average person's spending on interest ($70) surpasses that of education ($60) and health ($39) per capita. A staggering 769 million Africans live in countries where interest payments outweigh investments in either education or health, accounting for nearly two-thirds of the entire population.

Call to action to finance sustainable development

The report proposed a plan to revamp the global financial system and boost the UN's Sustainable Development Goals (SDG) stimulus package to tackle the current debt crisis.

These will entail efforts to:

- Improve the effective participation of developing countries in the governance of global financial systems.

- Tackle the rising cost of debt and risk of debt distress through an effective debt workout mechanism.

- Expand contingency finance to provide greater liquidity in times of crisis, so that countries are not forced into debt as a last resort.

- Massively scale up affordable and long-term financing by mobilizing multilateral development banks and private resources.

The report “A world of debt: A growing burden to global prosperity” was prepared by the Global Crisis Response Group technical team at UN Trade and Development (UNCTAD) under the leadership of Secretary-General Rebeca Grynspan.

The report will inform the deliberations of the inaugural meeting of the SDG Stimulus Leaders Group convened by the United Nations on June 5.

The Leaders Group will advocate for actions to tackle the high cost of debt and rising risks of debt distress, scale up affordable long-term financing and expand contingency financing to countries facing short-term liquidity constraints.