The latest World Investment Report from UN Trade and Development (UNCTAD) highlights a significant rebound in foreign direct investment (FDI) inflows to Africa.

In 2024, foreign investment in the continent shot up by 75% to reach $97 billion, representing 6% of global FDI, compared to a 4% share the year before.

The surge was largely driven by an international project finance deal for urban development in Egypt. Net of this increase, FDI in Africa still rose 12% to about $62 billion, comprising 4% of global inflows.

Investment facilitation efforts continued to feature prominently in Africa, accounting for 36% of policy measures favourable to investors.

Liberalization also remained a key component of investment policymaking in Africa and Asia, making up one fifth of measures adopted in 2024.

The report shows that European investors hold the largest FDI stock in Africa, followed by the United States and China.

Investment from China, valued at $42 billion, is diversifying into sectors like pharmaceuticals and food processing.

One-third of projects linked to the Belt and Road Initiative, a global development initiative championed by the country, now focus on social infrastructure and renewable energy.

Foreign investment growth across Africa

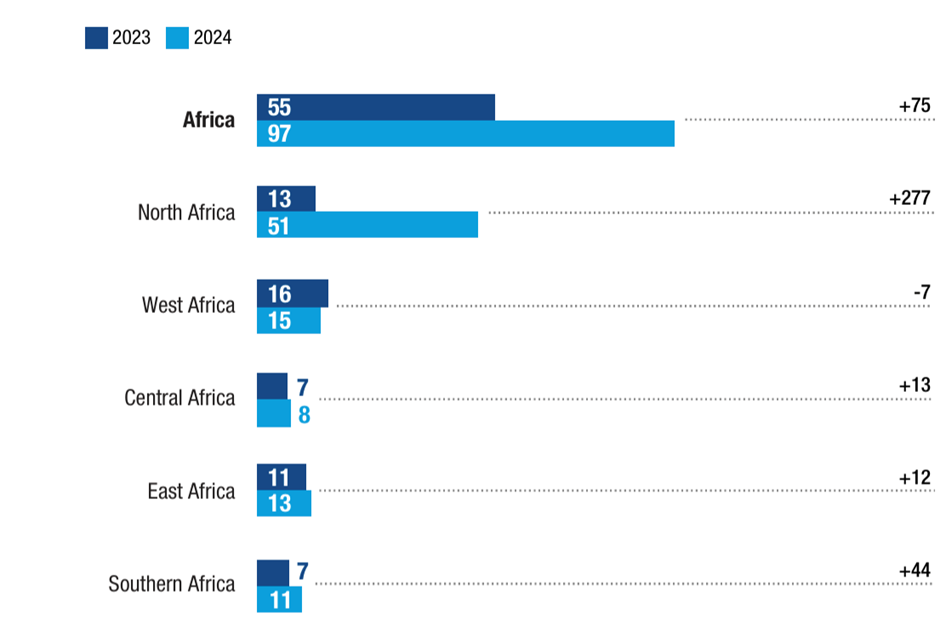

In 2024, foreign investment went up across most African regions, with North Africa leading the way.

Besides Egypt’s strong performance, FDI in Tunisia increased by 21% to $936 million and that of Morocco grew by 55% to $1.6 billion.

Figure: Foreign investment increased in most of Africa - Inflows by region and subregion

(Billions of dollars and percentage change)

Source: UNCTAD, FDI/MNE database (www.unctad.org/fdistatistics)

Across the continent, international project finance (IPF) deals rose 15% in value, fueled by large energy and transport infrastructure projects. In Egypt, IPF commitments more than doubled.

Project numbers, however, fell by 3%. Renewable energy was the only sector with notable growth, featuring seven major deals worth about $17 billion, including mainly offshore power cables and wind and solar plants in Egypt.

Other renewable energy projects occurred in Tunisia, Morocco and Namibia.

By contrast, greenfield investments declined in Africa, with announcements dropping 5% and value down 37% to $113 billion, compared with $178 billion in 2023.

Most countries saw fewer greenfield projects, except North Africa, where greenfield investments rose 12% to $76 billion, making up two thirds of the continent’s project capital expenditures.

Sector-wise, construction and metal products sectors saw the biggest increases in greenfield investment, while electricity and gas supply projects fell by $51 billion.

Cross-border mergers and acquisitions, typically around 15% of Africa’s FDI, turned negative.

----------------------------------

About UN Trade and Development:

UN Trade and Development (UNCTAD) is dedicated to promoting inclusive and sustainable development through trade and investment. With a diverse membership, it empowers countries to harness trade for prosperity.

Note to Editors: Additional background information and quotes can be provided upon request.

----------------------------------