- Foreign investment remains subdued amid the global economic slowdown and rising geopolitical tensions.

- Insufficient funding hampers efforts to achieve the 2030 Agenda, urging policy action to keep up sustainable finance.

- Business facilitation and digital government solutions can facilitate an environment to address low investment.

In 2023, global foreign direct investment (FDI) decreased by 2% to $1.3 trillion, according to the latest World Investment Report released by UN Trade and Development (UNCTAD) on 20 June.

When excluding the impact of a few exceptions, the report reveals a sharper decline of over 10% in global foreign investments for the second consecutive year. This decline is driven by increasing trade and geopolitical tensions in a slowing global economy.

While the prospects for FDI remain challenging in 2024, the report says that “modest growth for the full year appears possible”, citing the easing of financial conditions and concerted efforts towards investment facilitation – a prominent feature of national policies and international agreements.

With the global push to attract and retain financial flows, online information portals and single windows have proliferated to foster a conducive business and investment climate.

For developing countries, digitalization not only provides a technical solution, but also a stepping stone for wider digital government implementation to address underlying weaknesses in governance and institutions which often hinder investment.

“Investment is not just about capital flows; it is about human potential, environmental stewardship and the enduring pursuit of a more equitable and sustainable world,” says UN Trade and Development Secretary-General Rebeca Grynspan.

Foreign investments declined moderately in most regions

FDI flows to developing countries fell by 7% to $867 billion last year, reflecting an 8% decrease in developing Asia (Learn more).

This figure dipped by 3% in Africa (learn more) and by 1% in Latin America and the Caribbean (learn more).

On the other hand, flows to developed countries were strongly affected by financial transactions of multinational enterprises, partly due to efforts to implement a global minimum tax rate on the profits of these corporations.

Inflows to most parts of Europe and North America were down by 14% and 5%, respectively.

Figure 1: Foreign direct investments declined moderately in most regions

Data visualization: https://www.datawrapper.de/_/HVJwB/?v=2

Foreign investments in structurally weak and vulnerable economies bucked the trend, increasing slightly across least developed countries, landlocked developing countries, and small island developing states.

Insufficient investment slows sustainable development

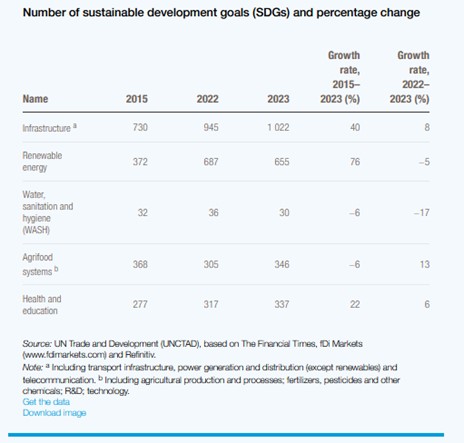

With tight financing conditions in 2023, the number of international project finance deals - crucial for funding infrastructure and public services such as power and renewable energy - fell by a quarter. This triggered a 10% reduction in investment in sectors linked to the Sustainable Development Goals (SDGs), most notably impacting agrifood systems, and water and sanitation. These sectors registered fewer internationally financed projects in 2023 than in 2015, when the goals were adopted.

Figure 2: Developing countries: investment in sectors relevant to the sustainable development goals

Data visualization: https://www.datawrapper.de/_/EcV5s/?v=2

On the other hand, greenfield project announcements grew in developing countries by more than 1,000, but highly concentrated in Asia.

Efforts needed to bolster sustainable finance

Meanwhile, the mobilization of funds for SDG investment through sustainable finance products in global capital markets is slowing down.

Sustainable bonds showed marginal growth in 2023, whereas new inflows in sustainable investment funds dropped by 60%.

In this context, UN Trade and Development finds that greenwashing concerns related to misleading sustainability claims are increasingly affecting investor demand and calls for more systematic efforts to bring more clarity and credibility to the sustainable fund market. These include well-defined product standards, robust sustainability disclosures, external auditing, and third-party ratings.

Global push for investment facilitation

Business and investment facilitation is central to both private sector development and FDI attraction in developing countries.

The World Investment Report shows that in 2023, 86% of the investment policy measures adopted by these economies were favourable to investors.

Given the need for information access, transparency of rules and regulations, and the streamlining of administrative procedures, digital tools have become key to effective implementation.

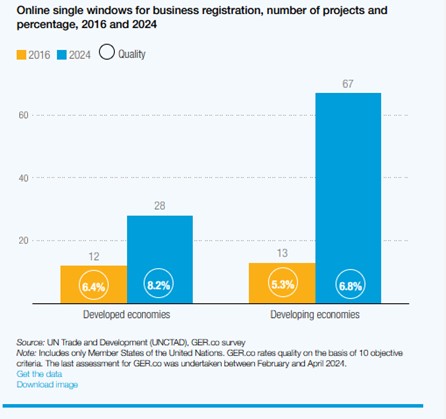

Since UN Trade and Development launched its global action menu for investment facilitation in 2016, the number of online single windows in developing countries has almost quadrupled from 13 to 67. In developed economies, the number more than doubled from 12 to 28.

Figure 3: Investment online single windows are growing in number and quality

Data visualization: https://www.datawrapper.de/_/lPugz/

Similarly, information portals for business and investor registration in developing countries expanded from 82 in 2016 to 124 in 2024, while developed nations saw an uptick from 43 to 48.

Figure 4: Investment facilitation portals are growing in number and quality

Data visualization: https://www.datawrapper.de/_/XwI7T/

Bottom-up, cost-effective approach to digital government

Additionally, facilitating business and investment supports the expansion of digital government services, complementing traditional top-down approaches.

By starting with basic services for business and gradually expanding to more institutions, countries can achieve economies of scale and scope with digital government tools, benefitting all businesses – both foreign and domestic, large and small.

Developing nations, in particular, can benefit from this bottom-up approach, which adds immediate value to users and revenue-generating potential for governments without needing major legislative changes.

To access country fact sheets, please click here https://unctad.org/wir

----------------------------------

**About UN Trade and Development: **

UN Trade and Development (formerly known as UNCTAD) is dedicated to promoting inclusive and sustainable development through trade and investment. With a diverse membership, it empowers countries to harness trade for prosperity.

Note to Editors: High-resolution images of the new logo and branding materials are available upon request. Additional background information and quotes can be provided upon request.

---------------------------------