New data on global flows of foreign direct investment (FDI), published in the World Investment Report 2016, show regional variance but an overall picture of muted prospects. The report, subtitled Investor Nationality – Policy Challenges, revealed for example that developing Asia remained the region receiving the largest amount of FDI while flows declined steeply to countries transitioning to a market economy in South-East Europe and the Commonwealth of Independent States.

Africa

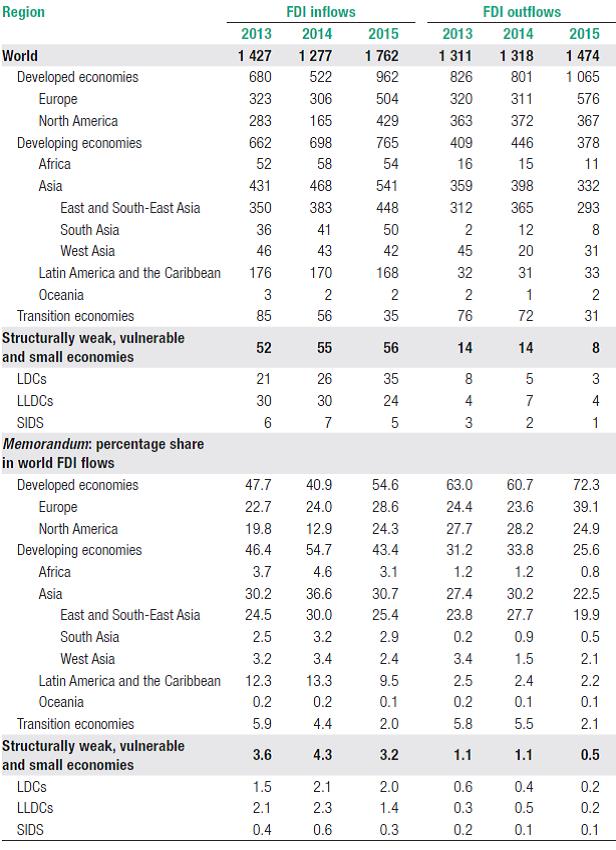

FDI flows to Africa fell to $54 billion in 2015, a decrease of 7 per cent over the previous year, according to the World Investment Report 2016 (see table). An upturn in investment into North Africa was more than offset by decreasing flows into sub-Saharan Africa, especially to West and Central Africa. In particular this was because low commodity prices depressed FDI inflows in economies based on natural resource.

Dynamic flows into Egypt boosted FDI to North Africa. FDI flows to Kenya reached a record level of $1.4 billion in 2015, resulting from renewed investor confidence in the country’s business climate and booming domestic consumer market. In Southern Africa, inflows to Angola reached $8.7 billion largely due to intracompany loans, while lacklustre economic performance pushed FDI in South Africa to $1.8 billion – the lowest level in 10 years.

In 2016, FDI inflows to Africa are expected to return to a growth path as a result of liberalization measures and planned privatizations of State-owned enterprises. This increase is already becoming apparent in announced greenfield projects in the first quarter of 2016.

Asia

Developing Asia, with FDI inflows reaching $541 billion – a 16 per cent increase – remained the largest FDI recipient region in the world (table 1). The growth was primarily driven by increased FDI in East and South Asian economies. In East Asia, FDI rose by 25 per cent to $322 billion, reflecting large equity investments related to a corporate restructuring in Hong Kong, China, and dynamic FDI flows to the services sector of China.

In South-East Asia, FDI to low-income economies such as Myanmar and Viet Nam soared, but this was offset by the lacklustre performance of higher-income countries, including Indonesia, Malaysia and Singapore. The FDI performance of India and Bangladesh pushed inflows to South Asia to $50 billion, an increase of 22 per cent from 2014. In West Asia, rising inflows to Turkey partly offset the negative impact of commodity prices and geopolitical tensions on FDI to oil-producing economies.

Hindered by the current global and regional economic slowdown, FDI inflows to developing Asia are expected to decline in 2016 by about 15 per cent, reverting to their 2014 level. Data on cross-border merger and acquisition sales and announced greenfield investment projects support the expected decline. However, flows to some Asian economies such as China, India, Myanmar and Viet Nam are likely to see a moderate increase in inflows in 2016.

Despite the decline in outflows from developing Asia by 17 per cent, to $332 billion, the region’s outward FDI in 2015 remained the third highest ever. Outward FDI from a number of Asian economies, including China and Thailand, increased. With outflows worth $128 billion, China remained the third largest investing country worldwide, after the United States of America and Japan.

Latin America and the Caribbean

FDI to Latin America and the Caribbean – excluding the Caribbean offshore financial centres – stayed flat in 2015 at $168 billion. There were contrasting performances in Central and South America, however. FDI flows to Central America rose by 14 per cent, to $42 billion, thanks to strong flows to Mexico and higher FDI in manufacturing across the subregion. FDI flows to South America, on the other hand, contracted by 6 per cent, to $121 billion, reflecting slowing domestic demand and worsening terms of trade caused by falling commodity prices. FDI flows to Brazil, the region’s principal recipient, fell 12 per cent to $65 billion. The decline in commodity prices also significantly affected flows to the Plurinational of State of Bolivia, Chile, Colombia and Peru.

FDI flows to the region may slow down further in 2016 as challenging macroeconomic conditions persist. In 2015, the value of announced greenfield projects dropped 17 per cent from their 2014 level, led by an 86 per cent decline in the extractive industry. Lower announced project values were also registered in the services sector. On the upside, national currency depreciation may motivate the acquisitions of assets. Cross-border mergers and acquisitions in the first quarter of 2016 were sharply up thanks to higher sales in Brazil, Chile and Colombia.

FDI outflows from the region rose by 5 per cent, to $33 billion in 2015. In Brazil, outward FDI expanded by a strong 38 per cent, an increase predominantly reflecting a significant reduction in reverse investment by Brazilian foreign affiliates. In Chile, outflows rose 31 per cent, to $16 billion.

Transition economies

FDI flows to countries transitioning from a planned to a market economy in South-East Europe and the Commonwealth of Independent States fell by 38 per cent, to $35 billion.

The FDI performance of transition economies differed by how they are grouped: in South-East Europe, FDI inflows increased by 6 per cent, to $4.8 billion, as better macroeconomic conditions and the European Union accession process continues to improve investors’ risk perception. In contrast, FDI flows to the Commonwealth of Independent States and Georgia declined by 42 per cent, to $30 billion, in a situation of low commodity prices, weakening domestic markets, regulatory changes and the direct and indirect impact of geopolitical tensions. Flows to the Russian Federation slumped to $9.8 billion as new FDI almost dried up due to the scaling back of operations and a string of divestment deals. The economic crisis and regulatory changes in the country have also reduced the scale and scope of round-tripping FDI.

After the significant decline recorded in 2015, FDI flows to transition economies are expected to increase modestly in 2016, excepting any further escalation of geopolitical tensions in the region. In the Commonwealth of Independent States, several countries, including Kazakhstan, the Russian Federation and Uzbekistan, have announced large privatization plans, which if realized will open new avenues for foreign investment.

Multinational enterprises from transition economies more than halved their FDI flows abroad. Geopolitical tensions, sharp currency depreciation and constraints in capital markets reduced outward FDI to $31 billion in 2015 – a value last recorded in 2005.

Developed countries

After three successive years of contraction, FDI inflows to developed countries bounced back sharply to the highest level since 2007. Exceptionally high cross-border merger and acquisition values among developed economies were the principal factor. Strategic considerations, but also tax optimization, drove acquisitions and corporate restructuring in sectors such as the pharmaceutical industry. Announced greenfield investment also remained high.

Inflows to Europe rose to $504 billion, accounting for 29 per cent of global inflows. This rebound was driven by large increases in Ireland, the Netherlands and Switzerland. Other major recipients were France and Germany, both of which recovered sharply from low points in 2014. Inflows into the United Kingdom of Great Britain and Northern Ireland fell to $40 billion but remained among the largest in Europe. In 2015, FDI inflows to North America reached $429 billion, surpassing the record high of 2000. In the United States, FDI almost quadrupled, albeit from a historically low level in 2014.

Barring another wave of cross-border merger and acquisition deals and corporate reconfigurations, the recovery of FDI activity recorded in 2015 is unlikely to be sustained at the same level in 2016. Recent regulatory measures meant to curb tax inversion deals are likely to discourage cross-border merger and acquisition deals and corporate reconfigurations. In addition, the economic growth momentum observed in some large developed economies weakened towards the end of 2015.

In 2015, multinational enterprises from developed economies invested $1.1 trillion abroad – a 33 per cent increase from the previous year. Europe became the world’s largest investing region owing to a strong rebound in their cross-border merger and acquisition purchases. Foreign investment by multinational enterprises from North America remained flat, with a significant increase in outflows from Canada being offset by a moderate decline of flows from the United States. Japanese multinational enterprises continued to seek growth opportunities abroad, investing more than $100 billion for the fifth consecutive year.

Least developed countries

FDI flows to structurally weak and vulnerable economies as a group increased moderately. Flows to the least developed countries (LDCs) jumped by one third to $35 billion; landlocked developing countries (LLDCs) and small island developing States (SIDS) saw a decrease in their FDI inflows of 18 per cent and 32 per cent, respectively.

FDI flows to LDCs rose by 33 per cent to a record high of $35 billion. In Asia, prospects of deeper economic integration in the Association of Southeast Asian Nations region spurred FDI in the Lao People’s Democratic Republic and Myanmar. FDI flows to Bangladesh hit a record high. Firms from China have become the largest holders of FDI stock in the LDCs, ahead of the United States. FDI to LDCs as a whole is expected to decrease in 2016, reflecting the continuing lull in FDI to a large number of African economies that rely heavily on natural resources.

Landlocked developing countries

FDI inflows to LLDCs fell for the fourth consecutive year to $24.5 billion – a drop of 18 per cent. Transition economy LLDCs accounted for the fall, particularly Kazakhstan, where flows halved. In spite of low commodity prices, Asian State-owned firms have been increasingly involved in Central Asia’s primary sector. Developing country investors, in particular from China, are holding an increasing share of FDI stock in LLDCs, as they do in LDC economies. FDI flows to LLDCs, in particular the transition economy subgroup, are expected to increase if large privatization plans materialize.

Small island developing States

FDI flows to SIDS dipped by 32 per cent to a five-year low of $4.8 billion. Reduced investment by energy firms contributed to a contraction in FDI flows to Trinidad and Tobago, the largest FDI host in the group. In Africa, FDI flows to Mauritius fell by 50 per cent, while in Asia and Oceania, the drop in FDI to Fiji and Maldives was less significant. Developing and transition economies now account for the majority of the top 10 investors in SIDS. FDI prospects in SIDS remain subdued, owing to the lack of large-scale investments in extractive industries and construction.

FDI flows by regions, 2013-2015

(Billions of dollar and percentage)

Report: http://unctad.org/en/PublicationsLibrary/wir2016_en.pdf

Press Release

For use of information media - Not an official record

UNCTAD/PRESS/PR/2016/014

Developing Asia attracts record levels, while inflows to 'transition' economies collapse

Geneva, Switzerland, 21 June 2016

Country Factsheets: http://unctad.org/en/Pages/DIAE/World%20Investment%20Report/WIR-2016-Country-Factsheets.aspx