The Sustainable Development Goals (SDGs), which are currently being formulated by the United Nations and a wide range of stakeholders, will require a step-change in both public and private investment in developing countries, if an estimated annual $2.5 trillion funding gap is to be filled, UNCTAD's World Investment Report 20141 argues. The report, which is subtitled Investing in the SDGs: An Action Plan, offers a bold framework to understand and enhance the role of private sector contributions to the pursuit of positive economic, social and environmental outcomes in developing countries.

Private sector contributions – through both good governance in business practices and investment in sustainable development – will be critical to the realization of the SDGs, the report says. Public sector contributions will remain indispensable, but may be insufficient to meet demands across all SDG-related sectors. Nevertheless, increasing private sector contributions poses challenges and policy dilemmas which must be addressed.

Key findings of the report:

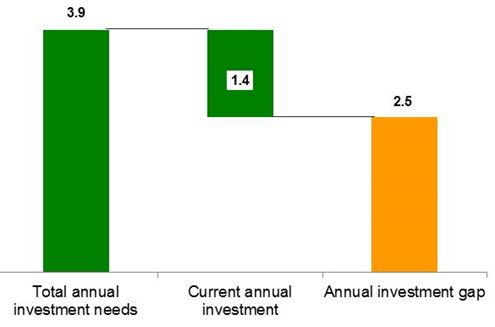

At current levels of investment in SDG-relevant sectors, developing countries face an annual gap of $2.5 trillion (figure 1). Estimates for total investment needs in developing countries alone range from $3.3 trillion to $4.5 trillion per year, for basic infrastructure (roads, rail and ports; power stations; water and sanitation), food security (agriculture and rural development), climate change mitigation and adaptation, health, and education. At today’s level of investment – public and private – in SDG-related sectors in developing countries, an average annual funding shortfall over 2015-2030 of some $2.5 trillion remains. Bridging such a gap may seem a daunting task, but it is achievable. The potential for increased private sector investment contributions is significant, especially in infrastructure, food security and climate change mitigation sectors. Structurally weak economies need special attention; UNCTAD estimates that a doubling of the growth rate of private investment in the least developed countries (LDCs) is required.

Increasing the involvement of private investors in SDG-related sectors, many of which are sensitive or of a public service nature, leads to policy dilemmas. Guiding principles are needed. UNCTAD identifies four key policy dilemmas: risks of increased private sector participation in sensitive sectors; the need to maintain quality services affordable and accessible to all; the respective roles of public and private investment; and the apparent conflict between the particularly acute funding needs in structurally weak economies, especially LDCs, and the fact that especially these countries face the greatest difficulty in attracting such investment. A common set of principles for investment in SDGs can help establish a collective sense of direction and purpose. The following broad principles could provide a framework.

• Balancing liberalization and the right to regulate

• Balancing the need for attractive risk-return rates with the need for accessible and affordable services

• Balancing a push for private investment with the push for public investment.

• Balancing the global scope of the SDGs with the need to make a special effort in LDCs

UNCTAD proposes a Strategic Framework for Private Investment in the SDGs

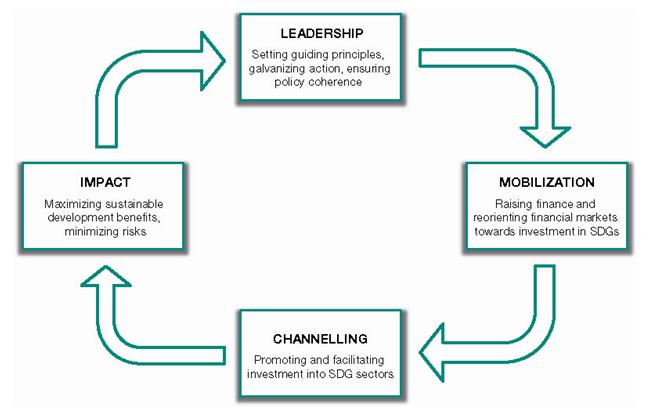

A Strategic Framework for Private Investment in the SDGs addresses key policy challenges and solutions, related to (figure 2):

Increasing private investment in SDGs will require leadership at the global level, as well as from national policymakers to provide guiding principles for dealing with policy dilemmas, and also to set investment targets, ensure policy coherence and create synergies, establish a global multi-stakeholder platform on investing in the SDGs, and create a multi-agency technical assistance facility for investment in the SDGs.

Challenges to mobilizing funds in financial markets must be overcome. Such challenges include market failures and a lack of transparency on environmental, social and governance performance, misaligned incentives for market participants, and start-up and scaling problems for innovative financing solutions. Policy responses that build a more SDG-conducive financial system might include creating fertile soil for innovative SDG-financing approaches, building or improving pricing mechanisms for externalities, promoting Sustainable Stock Exchanges, and introducing financial market reforms in order to favour investment in SDGs.

Once mobilized, funds need to be channelled to SDG sectors and projects, which present a different set of challenges. Key constraints to channelling funds into SDG sectors include entry barriers, inadequate risk-return ratios for SDG investments, a lack of information and effective packaging and promotion of projects, and a lack of investor expertise. Effective policy responses may include: reducing entry barriers, with safeguards; expanding the use of risk-sharing tools for SDG investments; establishing new incentives schemes and a new generation of investment promotion institutions; and building SDG investment partnerships.

Finally, private investment must maximize its positive impact on sustainable development, while minimizing the associated risks. Key challenges in maximizing the positive impact and minimizing the risks and drawbacks of private investment in SDG sectors include weak absorptive capacity in some developing countries, social and environmental impact risks, and the need for stakeholder engagement and effective impact monitoring. Policy responses could include increasing absorptive capacity, establishing effective regulatory frameworks and standards, good governance, strong institutions, stakeholder engagement, and implementing SDG impact assessment systems.

UNCTAD’s Action Plan for Private Investment in the SDGs contains a range of policy options for responding to mobilization, channelling and impact challenges. However, concerted effort by the international community and by policymakers at national levels needs to focus on a few priority actions – or packages (figure 3). Such a focused set of action packages can help shape a big push for private investment in sustainable development:

• A new generation of investment promotion strategies and institutions

• SDG-oriented investment incentives

• Regional SDG Investment Compacts

• New forms of partnership for SDG investments

• Enabling innovative financing mechanisms and a reorientation of financial markets

• Changing the global business mindset and developing SDG investment expertise

Figure 1. Estimated annual investment needs in key SDG sectors, 2015–2030

(trillions of dollars, annual average)

Source: UNCTAD, World Investment Report 2014

Figure 2. Strategic framework for private investment in the SDGs

Source: UNCTAD, World Investment Report 2014

Figure 3. A big push for private investment in the SDGs: action packages

Source: UNCTAD, World Investment Report 2014

Full Report: http://unctad.org/en/PublicationsLibrary/wir2014_en.pdf

Overview: http://unctad.org/en/PublicationsLibrary/wir2014_overview_en.pdf