A World of Debt 2025

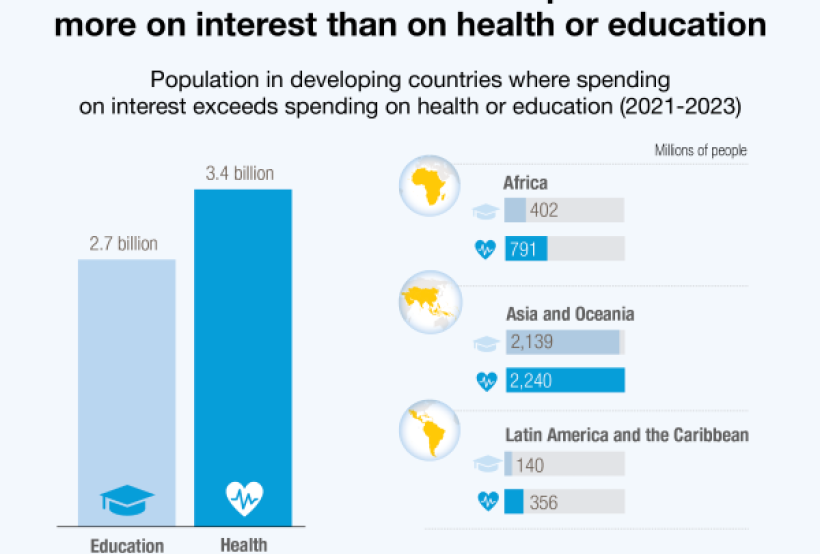

Public debt can be vital for development. Governments use it to finance expenditures, protect and invest in their people and pave the way to a better future. However, when public debt grows excessively or its costs outweigh its benefits, it becomes a heavy burden. This is precisely what is happening across the developing world today.

Developing countries must not be forced to choose between servicing their debt or serving their people. There is a pressing need to reform the international financial architecture, encompassing:

- Making the system more inclusive and development-oriented

- Enhancing the availability of liquidity in times of crisis

- Creating an effective debt workout mechanism that addresses current deficiencies

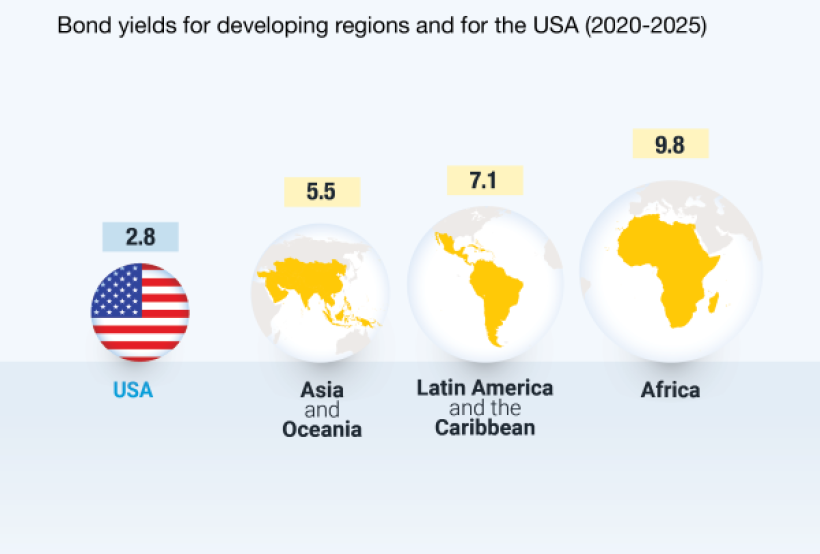

- Providing more and better concessional finance and technical assistance to support countries in tackling the high cost of debt

The world has long been talking about reform. It is time to move from conversation to action.

Developing countries must not be forced to choose between servicing their debt or serving their people. There is a pressing need to reform the international financial architecture, encompassing:

- Making the system more inclusive and development-oriented

- Enhancing the availability of liquidity in times of crisis

- Creating an effective debt workout mechanism that addresses current deficiencies

- Providing more and better concessional finance and technical assistance to support countries in tackling the high cost of debt

The world has long been talking about reform. It is time to move from conversation to action.