Debt and development finance

Public debt can be a powerful tool for development, allowing governments to invest in their people and economies. But when debt grows too large or becomes too costly, it turns into a heavy burden.

This is especially for developing countries, whose public debt has grown twice as fast as that of advanced economies since 2010. They have also been borrowing at higher average rates than many advanced economies, making it harder to invest in schools, hospitals, infrastructure and other sectors critical for sustainable development.

Developing countries must not be forced to choose between servicing their debt or serving their people. There’s a pressing need to reform the international financial architecture to end the debt trap and unlock long-term investment and finance. We support countries in managing their public debt effectively.

Debt and development finance

Public debt can be a powerful tool for development, allowing governments to invest in their people and economies. But when debt grows too large or becomes too costly, it turns into a heavy burden.

This is especially for developing countries, whose public debt has grown twice as fast as that of advanced economies since 2010. They have also been borrowing at higher average rates than many advanced economies, making it harder to invest in schools, hospitals, infrastructure and other sectors critical for sustainable development.

Developing countries must not be forced to choose between servicing their debt or serving their people. There’s a pressing need to reform the international financial architecture to end the debt trap and unlock long-term investment and finance. We support countries in managing their public debt effectively.

Digital innovation for debt transparency: Strengthening public finances in Africa

In dozens of developing countries, digital innovation supported by UN Trade and Development is helping governments manage public debt more transparently, strengthening institutions and supporting long-term development planning.

News

Latest publications

Featured Series

External debt sustainability and development

Videos and podcasts

Related

Areas of work

- Debt and Debt Sustainability

- Responsible Sovereign Lending and Borrowing

- Sovereign Debt Restructuring

- Debt Management and Financial Analysis System

Projects

- Climate Finance for Development

- Financing green and sustainable development in small island developing States

- Mobilising financial resources for development in the time of Covid-19

Programmes

Meetings

7 – 9 December 2026

International Debt Management Conference, 15th session

Geneva, Switzerland

11 March 2026

Breaking the debt cycle: Digitalization and structural reforms as drivers of growth and debt reduction — The Greek experience

Palais des Nations, Geneva, Switzerland

19 December 2025

Regional workshop on external climate financing in Belize and St. Vincent and the Grenadines

Online

16 December 2025

Regional dialogue on external climate financing in Africa

Online

1 – 3 December 2025

Intergovernmental Group of Experts on Financing for Development, 9th session

Geneva, Switzerland

Documents

30 Jan 2026

Report of the Intergovernmental Group of Experts on Financing for Development on its ninth session [ADVANCE COPY]

English05 Jan 2026

All roads lead to reform: A financial system fit to mobilize $1.3 trillion for climate finance

English02 Dec 2025

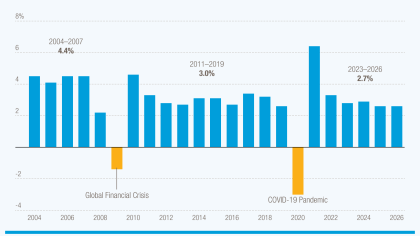

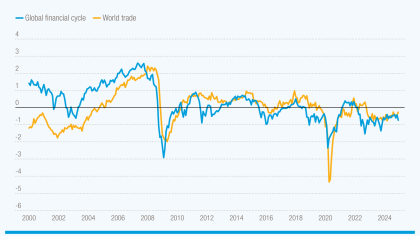

Trade and Development Report 2025: On the brink - trade, finance and the reshaping of the global economy

EnglishSecretary-General Statements

Contact

For further information on this topic, please contact us.